Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

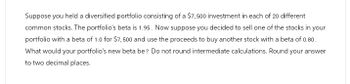

Transcribed Image Text:Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different

common stocks. The portfolio's beta is 1.95. Now suppose you decided to sell one of the stocks in your

portfolio with a beta of 1.0 for $7,500 and use the proceeds to buy another stock with a beta of 0.80.

What would your portfolio's new beta be? Do not round intermediate calculations. Round your answer

to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Your investment club has only two stocks in its portfolio. $30,000 is invested in a stock with a beta of 0.8, and $40,000 is invested in a stock with a beta of 2.1. What is the portfolio's beta? round your answer to two decimal places.arrow_forwardYou invest in a portfolio of 5 stocks with an equal investment in each one. The betas of the 5 stocks are as follows: 0.8, -1.3, 0.95, 1.2, and 1.4. The risk-free return is 3% and the market return is 7%. a. Compute the beta of the portfolio. b. Compute the required return of the portfolio.arrow_forwardData: So 101; X= 114; 1+r= 1.12. The two possibilities for sr are 143 and 85.arrow_forward

- You have a portfolio with a standard deviation of 23% and an expected return of 17%. You are considering adding one of the two stocks in the following table: If after adding the stock you will have 25% of your money in the new stock and 75% of your money in your existing portfolio, which one should you add? Standard deviation of the portfolio with stock A is%. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Stock A Stock B Expected Return 16% 16% Print Standard Deviation 23% 18% C... Done Correlation with Your Portfolio's Returns 0.3 0.8 - Xarrow_forwardYou buy a share of stock, write a 1-year call option with X = $55, and buy a 1-year put option with X = $55. Your net outlay to establish the entire portfolio is $54. The stock pays no dividends. a. What is the payoff of your portfolio? Payoff b. What must be the risk-free interest rate? (Round your answer to 2 decimal places.) Risk-free rate %arrow_forward8.2 An individual has $20,000 invested in a stock with a beta of 0.8 and another $55,000 invested in a stock with a beta of 1.8. If these are the only two investments in her portfolio, what is her portfolio's beta? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- You have a portfolio with a beta of 1.59. What will be the new portfolio beta if you keep 86 percent of your money in the old portfolio and 14 percent in a stock with a beta of 0.58? (Round your answer to 2 decimal places.) New portfolio beta: ___.__%arrow_forwardRanking investments by expected returns What makes for a good investment? Use the approximate yield formula or a financial calculator to rank the following investments according to their expected returns. Round the answers to two decimal places. Do not round intermediate calculations. Buy a stock for $45 a share, hold it for 3 years, then sell it for $75 a share (the stock pays annual dividends of $3 a share). % Buy a security for $25, hold it for 2 years, then sell it for $60 (current income on this security is zero). Do not round intermediate calculations. % Buy a 1-year, 12 percent note for $950 (assume that the note has a $1,000 par value and that it will be held to maturity). Do not round intermediate calculations. %arrow_forwardYou own a portfolio that has $2,045 invested in Stock A and $4,096 invested in Stock B. If the expected returns on these stocks are 14 percent and 8 percent, respectively, what is the expected return (in percent) on the portfolio? Answer to two decimals.arrow_forward

- You own a portfolio equally invested in a risk-free asset and two stocks. One of the stocks has a beta of 1.27 and the total portfolio is equally as risky as the market. What must the beta be for the other stock in your portfolio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Betaarrow_forwardSuppose you hold a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio beta is equal to 1.12. Now, suppose you have decide to sell one of the stocks in your portfolio with a beta equal to 1.0 for 7,500 and to use these proceeds to buy another stocks for your portfolio. Assume the new stocks beta to 1.75. Calculate your portfolios new beta.arrow_forwardYour portfolio is comprised of 30 percent of Stock X, 20 percent of Stock Y, and 50 percent of Stock Z. Stock X has a beta of 1.05, Stock Y has a beta of 0.80, and Stock Z has a beta of 1.43. What is the beta of your portfolio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education