Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

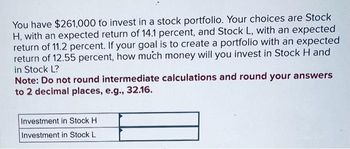

Transcribed Image Text:You have $261,000 to invest in a stock portfolio. Your choices are Stock

H, with an expected return of 14.1 percent, and Stock L, with an expected

return of 11.2 percent. If your goal is to create a portfolio with an expected

return of 12.55 percent, how much money will you invest in Stock H and

in Stock L?

Note: Do not round intermediate calculations and round your answers

to 2 decimal places, e.g., 32.16.

Investment in Stock H

Investment in Stock L

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have a portfolio with the following: Stock Number of Shares Price Expected Return W 1,000 $ 57 14% X 900 34 18 Y 650 70 16 Z 875 55 17 What is the expected return of your portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardSuppose you are thinking of purchasing the SunStar’s common stock today. If you expect SunStar to pay $0.80 dividend at the end of year one and $1.6 dividend at the end of year two and you believe that you can sell the stock for $15 at that time. If you required return on this investment is 10%, how much will you be willing to pay for the stock? a. $13.95 b. $14.44 c. 14.19 d. $15.51arrow_forwardSuppose you are thinking of purchasing the Luna Co.’s common stock today. If you expect Luna to pay $2.5, $2.625, $2.73, and $2.81 dividends at the end of year one, two, three, and four respectively and you believe that you can sell the stock for $40.97 at the end of year four. If you required return on this investment is 9%, how much will you be willing to pay for the stock today?arrow_forward

- Tom O'Brien has a 2-stock portfolio with a total value of $100,000. $55,000 is invested in Stock A with a beta of 0.75 and the remainder is invested in Stock B with a beta of 1.79. What is his portfolio's beta? Do not round your intermediate calculations. Round your final answer to 2 decimal places. Group of answer choices 0.87 1.01 1.05 1.22 1.19arrow_forwardWhat are the portfolio weights for a portfolio that has 125 shares of Stock A that sell for $82 per share and 100 shares of Stock B that sell for $74 per share? (Do not round intermediate calculations and round your answers to 4 decimal places, e.g., .1616.) Stock A: Stock B:arrow_forwardDear Bartleby, I need help calculating the dividend yield e. If Wiper's stock had a price/earnings ratio of 14 at the end of 2020, what was the market price of the stock? (Round intermediate calculations and final answer to 2 decimal places.)f. Calculate the cash dividend per share for 2020 and the dividend yield based on the market price calculated in part e. (Round intermediate calculations and final answers to 2 decimal places. Presented here are summarized data from the balance sheets and income statements of Wiper Inc.: WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 2019 2018 Current assets $ 650 $ 900 $ 700 Other assets 2,750 2,050 1,750 Total assets $ 3,400 $ 2,950 $ 2,450 Current liabilities $ 500 $ 800 $ 700 Long-term liabilities 1,500 1,000 800 Stockholders' equity 1,400 1,150 950 Total liabilities and stockholders' equity $ 3,400 $ 2,950 $ 2,450…arrow_forward

- Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio's beta is 1.95. Now suppose you decided to sell one of the stocks in your portfolio with a beta of 1.0 for $7,500 and use the proceeds to buy another stock with a beta of 0.80. What would your portfolio's new beta be? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward8.2 An individual has $20,000 invested in a stock with a beta of 0.8 and another $55,000 invested in a stock with a beta of 1.8. If these are the only two investments in her portfolio, what is her portfolio's beta? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardRanking investments by expected returns What makes for a good investment? Use the approximate yield formula or a financial calculator to rank the following investments according to their expected returns. Round the answers to two decimal places. Do not round intermediate calculations. Buy a stock for $45 a share, hold it for 3 years, then sell it for $75 a share (the stock pays annual dividends of $3 a share). % Buy a security for $25, hold it for 2 years, then sell it for $60 (current income on this security is zero). Do not round intermediate calculations. % Buy a 1-year, 12 percent note for $950 (assume that the note has a $1,000 par value and that it will be held to maturity). Do not round intermediate calculations. %arrow_forward

- a) Assume that you bought 200 stock B in your portfolio for total investment of $1200, now the market price of the stock is $75, the dividend paid for this stock is $2 each year. How much is the capital gain of this stock? b) Assume that the following data available for the portfolio, calculate the expected return, variance and standard deviation of the portfolio given stock A accounts for 45% and stock B accounts for 55% of your portfolio? A B Expected return 12.50% 18.50% Standard Deviation of return 15% 20% Correlation of coefficient (p) 0.4arrow_forwardGive typing answer with explanation and conclusionarrow_forwardAn individual has $15,000 invested in a stock with a beta of 0.3 and another $65,000 invested in a stock with a beta of 1.7. If these are the only two investments in her portfolio, what is her portfolio's beta? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education