ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

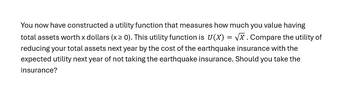

Transcribed Image Text:You now have constructed a utility function that measures how much you value having

total assets worth x dollars (x ≥ 0). This utility function is U(X)=√x. Compare the utility of

reducing your total assets next year by the cost of the earthquake insurance with the

expected utility next year of not taking the earthquake insurance. Should you take the

insurance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Describe the relationship between Expected Value, Expected Utility and Certain Equivalent (at least 150 words)arrow_forwardDonna just paid $800 for a new iPhone. Apple offers a two year extended warranty for $200 and Donna is considering purchasing it. She has utility given by U(X)=√X. Without the extended warranty, the iPhone becomes worthless if it breaks. What is the minimum probability, p, that the iPhone breaks in the next two years that will cause Donna to prefer to purchase the extended warranty? p= ✓the warranty. If the probability that her phone breaks is p=0.25, Donna will prefer toarrow_forwardConsider a person with the following utility function over wealth: u(w) = ew, where e is the exponential function (approximately equal to 2.7183) and w = wealth in hundreds of thousands of dollars. Suppose that this person has a 40% chance of wealth of $100,000 and a 60% chance of wealth of $2,000,000 as summarized by P(0.40, $100,000, $2,000,000). a. What is the expected value of wealth? b. Construct a graph of this utility function . c. Is this person risk averse, risk neutral, or a risk seeker? d. What is this person’s certainty equivalent for the prospect?arrow_forward

- The COVID-19 pandemic has caused an unprecedented increase in savings in many countries around the world. In the EU, the savings rate of households has jumped from 12.5% to 17%. In 2008-2009, it had moved from 12.5% to 14% (Dossche and Zlatanos 2020). Even if the source of 2020 surge in savings is different from the one of 2008, it is obvious that this increase does not result in more investment and growth. QUESTION: 1. Evaluate if and how increased savings in recession can influence consumption, export, and investmentarrow_forwardSuppose that you have a job paying $50,000 per year. With a 5% probability, next year your wage will be reduced to $20,000 for the year. (a) What is your expected income next year? (b) Suppose that you could insure yourself against the risk of reduced consumption next year. What would the actuarially fair insurance premium be?arrow_forwardRedo the problem in Question 2 under the assumption that the person has utility function u(c) = ln(c) (instead of u(c)=√C). The other parameters are the same as those used in Question 2. How the solution found in Question 2 will change? Q2: A person has wealth of $500,000. In case of a flood her wealth will be reduced to $50,000. The probability of flooding is 1/10. The person can buy flood insurance at a cost of $0.10 for each $1 worth of coverage. Suppose that the satisfaction she derives from c dollars of wealth (or consumption) is given by u(c) = √c. Let CF denote the contingent commodity dollars if there is a flood (horizontal axis) and CNF denote the contingent commodity dollars if there is no flood (vertical axis). Determine the contingent consumption plan if she does not buy insurance. 1 2 Assume that the person has von Neumann-Morgenstern utility function on the contingent consumption plans. Write down the expected utility U(CF, CNF) and derive the MRS. Solve for optimal (CF,…arrow_forward

- Suppose that you have a job paying $50,000 per year. With a probability of 5%, you will be injured and unable to work for part of the year reducing your wages to $20,000 next year. a. What is your expected income next year? b. Suppose that you could fully insure against the risk of reduced income next year. What would be the actuarially fair premium? c. If your utility function is U = VI where C is your income in any given period, what is your expected utility without insurance? d. If your utility function is U = VI where C is your income in any given period, what is your expected utility with insurance?arrow_forwardProspect X = ($4, 0.04 ; $15, 0.05 ; $24, 0.01 ; $38, p) What is the expected value of prospect X? (Hint 1: To answer this question, you'll need to first determine the value of "p"). (Hint 2: To determine "p", remember that probabilities sum to 1). (Note: The answer may not be a whole number; please round to the nearest hundredth) (Note: The numbers may change between questions, so read carefully)arrow_forwardConsider the Consumption and Savings model with random future income. The utility function of the individual is: u(C0, C1) = (C0) + (C1)1/2, where C0 is present consumption expenditure and C1 is future consumption. Let the present income be $5, the interest rate in the financial market r = 5%, and the probability distribution of future income Y1 = (1, 2; 1/2 , 1/2). Calculate the expected utility of saving $0 (consume $5 in the present) (use two decimals)arrow_forward

- "A financial investor has $31,000 to invest. The choices have been narrowed down to the following two options.-OPTION 1:Invest in a foreign bond that will mature in one year. This will entail an immediate brokerage fee of $100. For simplicity, assume that the bond will provide interest of $2,470, $2,130, or $1,527 over the one-year period and that the probabilities of these occurrences are assessed to be 0.29, 0.43, and 0.28, respectively.-OPTION 2:Invest in a $31,000 certificate with a savings-and-loan association. Assume that this certificate has an effective annual rate of 5.6%.Which form of the investment should the investor choose in order to maximize her expected financial gains? Enter the expected net gain (total return - initial investment - fee) of the preferred option."arrow_forwardDonna just paid $800 for a new iPhone. Apple offers a two year extended warranty for $200 and Donna is considering purchasing it. She has utility given by U(X)=√X. Without the extended warranty, the iPhone becomes worthless if it breaks. What is the minimum probability, p, that the iPhone breaks in the next two years that will cause Donna to prefer to purchase the extended warranty? p=_____________ If the probability that her phone breaks is p=0.25, will Donna will prefer to buy or not buy the warranty?arrow_forward2. You are deciding whether or not to purchase insurance. Your income is $100,000 and the chance of you getting sick is 30%. The insurance company is offering you a coinsurance rate of 0.15 and the utility that you get from your disposable income is U = VY. If you get sick, your medical bills add up to $80,000. Assume that the insurance company charges the actuarially fair premium, and assume that you would purchase the same amount of medical care whether you are insured or not (i.e. Mi = M¹ = M*). Economic theory predicts that you will purchase insurance if the expected gain in utility from receiving the insurance payout when you are sick is greater than the expected loss in utility from paying the premium and remaining healthy. a. Using an expected utility diagram, show your decision process regarding whether to buy insurance or not. Calculate and then show on the diagram the following: i. Disposable income if you remain healthy and do not purchase insurance ii. Disposable income if…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education