ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

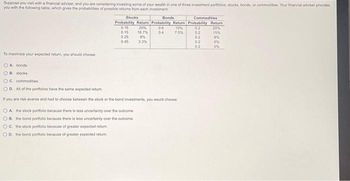

Transcribed Image Text:Suppose you visit with a financial adviser, and you are considering investing some of your wealth in one of three investment portfolios stocks, bonds, or commodities. Your financial adviser provides

you with the following table, which gives the probabilities of possible returns from each investment

To maximize your expected return, you should choose:

Stocks

Bonds

Probability Return Probability Return

0.15 20%

0.15 16.7%

06

10%

T

04

7.5%

0.25

8%

0.45 3.3%

OA bonds

OB stocks

OC. commodities

OD. All of the portfolios have the same expected return.

If you are risk-averse and had to choose between the stock or the bond investments, you would choose

OA the stock portfolio because there is less uncertainty over the outcome

OB. the bond portfolio because there is less uncertainty over the outcome.

OC. the stock portfolio because of greater expected return.

OD. the bond portfolio because of greater expected return.

Commodities

Probability Return

02

20%

0.2

15%

0.2

8%

02

02

5%

0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 10. Which one of the following measures may be used to measure the risk of an investment on its own? a) Expected return of the investment. b) Expected utility of the investment for an investor. c) Standard deviation of the possible outcomes of the investment. d) The Bernoullian utility function's value of a good investment outcome.arrow_forwardIf the risk-free rate is 3 percent and the risk premium is 5 percent, what is the required return?arrow_forward1. Which of the following is INCORRECT? a All of a stock's risk could be unsystematic. b. A negative beta stock has an expected return less than the risk-free rate. c. Anticipated returns on any given stock are always greater than 0. d. Two assets with a correlation of -1 could be combined to create a portfolio with a standard deviation of zero (no risk). 2. Which of the following measures the total risk of a portfolio? a. Beta b. Standard Deviation c. Correlation Coefficient d. Alpha 3. Which of the following stocks have the highest systematic risk? a A stock with high correlation to the market and high returm volatility. b. A stock with low correlation to the market and a high return volatility. c A stock with high correlation to the market and a low return volatility. d. A stock with low correlation to the market and a low return volatility. 4. Which of the following companics have the lowest systematic risk? a A company that sells soups (Campbells), beta=0.60 b. A coffee company…arrow_forward

- Suppose that there is a 45 percent change that George's coffee shop will make $10000 in profits in January and a 45 percent chance it will make 0 profits and a 10 percent chance that it will make -$1000 in profits (i.e., it will lose $1000). Calculate the coffee shop's expected profitsarrow_forward(a) Calculate the risk-premium on this portfolio and provide a brief interpretation of it (b) Calculate the minimum sale price of the capital assets for the average investor.arrow_forward16. The market consists of only two assets, A and B, with normally distributed re- turns. Asset A's returns have a mean of 18% and a standard deviation of 14% and Asset B's returns have a mean of 15% and a standard deviation of 18%. In such a scenario a risk-averse investor would always want to invest all of her money in Asset A. 17. A call option offers the purchaser limited downside loss as given by the option premium paid, combined with limited upside potential. 18. The return earned on a risk free portfolio must be equal to the risk free interest rate. 19. CAPM assumes that all investors' optimal portfolio has a fraction invested in the risk-free asset and the remaining in the minimum variance portfolio. 20. For any frontier portfolio p, except the minimum variance portfolio, there exists a unique frontier portfolio with which p has zero covariance. 21. The market portfolio of all available assets is the supply of risky assets. 22. An arbitrage opportunity is an…arrow_forward

- 3. The risk free rate is 3%. The optimal risky portfolio has an expected return of 9% and standard deviation of 20%. Answer the following questions. (a) Assume the utility function of an investor is U = E(r) − 0.5Aσ2. What is condition of A to make the investors prefer the optimal risky portfolio than the risk free asset? (b) Assume the utility function of an investor is U = E(r) − 2.5σ2. What is the expected return and standard deviation of the investor’s optimal complete portfolio?arrow_forwardRequired Return If the risk-free rate is 3 percent and the risk premium is 5 percent, what is the required return?arrow_forwardQuestion 11 The beta of an active portfolio is 1.45. The standard deviation of the returns on the market index is 22%. The nonsystematic variance of the active portfolio is 3%. The standard deviation of the returns on the active portfolio is a) 36.30%. b) 5.84%. c) 19.60%. d) 24.17%. e) 26.0%.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education