Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

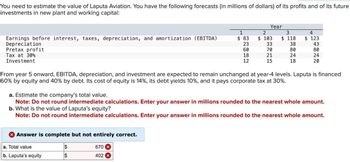

Transcribed Image Text:You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future

investments in new plant and working capital:

Year

1

2

3

4

Earnings before interest, taxes, depreciation, and amortization (EBITDA)

Depreciation

$ 83

$ 103

$ 118

$ 123

23

33

38

43

Pretax profit

60

70

80

80

Tax at 30%

18

21

24

24

Investment

12

15

18

20

From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed

60% by equity and 40% by debt. Its cost of equity is 14%, its debt yields 10%, and it pays corporate tax at 30%.

a. Estimate the company's total value.

Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.

b. What is the value of Laputa's equity?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.

> Answer is complete but not entirely correct.

a. Total value

$

670 ×

b. Laputa's equity

$

402 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment 1 $85 25 60 a. Total value i b. Laputa's equity 18 14 Year 2 $ 105 35 70 21 17 3 $ 120 40 se 24 20 4 $ 125 45 80 24 22 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 50% by equity and 50% by debt. Its cost of equity is 16%, its debt yields 7%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations, Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.arrow_forwardVijayarrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital Earnings before interest, taxes, depreciation, amortion (EBITDA) Depreciation Pretax profit Tax at 30% Investment $ 78 38 40 12 14 Year a. Total value b. Laputa's equity 2 $98 48 50 15 17 $ 113 53 60 18 20 $118 58 60 18 22 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year 4 levels. Laputa is financed 40% by equity and 60% by debt. Its cost of equity is 13%, its debt yields 9%, and it pays corporate tax at 30% a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.arrow_forward

- Vijayarrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment $ 87 DARIK a. Total value b. Laputa's equity 17 70 21 16 Year 2 $107 27 86 24 19 $122 32 27 22 4 $127 37 90 27 24 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 40% by equity and 60% by debt. Its cost of equity is 18%, its debt yields 9%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. (11arrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Year 1 2 3 4 Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation $ 82 $ 102 $ 117 $ 122 12 22 27 32 Pretax profit 70 80 90 90 21 24 27 27 Tax at 30% Investment 11 14 17 19 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 50% by equity and 50% by debt. Its cost of equity is 13%, its debt yields 9%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. a. Total value $ b. Laputa's equity 431arrow_forward

- You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment 1 $ 87 17 70 21 16 a. Total value b. Laputa's equity Year 2 $ 107 27 80 24 19 3 $ 122 238NN ONN 32 90 27 22 4 $ 127 37 90 27 24 558 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 40% by equity and 60% by debt. Its cost of equity is 18%, its debt yields 9%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.arrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Year 1 2 3 4 Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation $ 90 $ 110 $ 125 $ 130 10 20 25 30 Pretax profit 80 90 100 100 Tax at 30% Investment 24 27 30 30 19 22 25 27 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 40% by equity and 60% by debt. Its cost of equity is 12%, its debt yields 7%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. Answer is complete but not entirely correct. a. Total value…arrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 40% Investment Total value million Laputa's equity $ Ask Jasper 1 DEBEH million 90 10 80 32 19 $ 2 129 3 N Year 110 20 90 36 22 $ 3 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 40% by equity and 60% by debt. Its cost of equity is 12%, its debt yields 7%, and it pays corporate tax at 40%. 125 25 100 40 25 a. Estimate the company's total value. (Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.) $ 4 130 30 100 40 27 b. What is the value of Laputa's equity? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.)arrow_forward

- You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Year 1 2 3 4 Earnings before interest, taxes, depreciation, and amortization (EBITDA) $ 85 $ 105 $ 120 $ 125 Depreciation 25 35 40 45 Pretax profit 60 70 80 80 Tax at 40% 24 28 32 32 Investment 14 17 20 22 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 50% by equity and 50% by debt. Its cost of equity is 16%, its debt yields 7%, and it pays corporate tax at 40%. a. Estimate the company’s total value. (Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.) b. What is the value of Laputa’s equity?arrow_forwardBhupatbhaiarrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment Answer is complete but not entirely correct. a. Total value b. Laputa's equity 1 $ 86 26 60 18 15 $ $ Year 629 x 377 2 $ 106 36 70 21 18 3 $ 121 41 80 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 60% by equity and 40 % by debt. Its cost of equity is 17%, its debt yields 8%, and it pays corporate tax at 30%. 24 21 a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College