FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

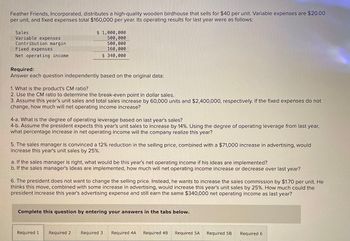

Transcribed Image Text:Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $40 per unit. Variable expenses are $20.00

per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Required:

$ 1,000,000

500,000

500,000

160,000

$ 340,000

Answer each question independently based on the original data:

1. What is the product's CM ratio?

2. Use the CM ratio to determine the break-even point in dollar sales.

3. Assume this year's unit sales and total sales increase by 60,000 units and $2,400,000, respectively. If the fixed expenses do not

change, how much will net operating income increase?

4-a. What is the degree of operating leverage based on last year's sales?

4-b. Assume the president expects this year's unit sales to increase by 14%. Using the degree of operating leverage from last year,

what percentage increase in net operating income will the company realize this year?

5. The sales manager is convinced a 12% reduction in the selling price, combined with a $71,000 increase in advertising, would

increase this year's unit sales by 25%.

a. If the sales manager is right, what would be this year's net operating income if his ideas are implemented?

b. If the sales manager's ideas are implemented, how much will net operating income increase or decrease over last year?

6. The president does not want to change the selling price. Instead, he wants to increase the sales commission by $1.70 per unit. He

thinks this move, combined with some increase in advertising, would increase this year's unit sales by 25%. How much could the

president increase this year's advertising expense and still earn the same $340,000 net operating income as last year?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3 Required 4A

Required 4B Required 5A

Required 5B

Required 6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $80 per unit. Variable expenses are $40.00 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 1,920,000 960,000 960,000 160,000 $ 800,000 Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year's unit sales and total sales increase by 42,000 units and $3,360,000, respectively. If the fixed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 11%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the…arrow_forwardFeather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $40 per unit. Variable expenses are $20.00 per unit, and fixed expenses total $200,000 per year. Its operating results for last year were as follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 1,000,000 500,000 500,000 200,000 $ 300,000 Required: Answer each question independently based on the original data: 1. What is the product's CM ratio?arrow_forwardFeather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $80 per unit. Variable expenses are $40.00 per unit, and fixed expenses total $200,000 per year. Its operating results for last year were as follows: Sales $ 2,160,000 Variable expenses 1,080,000 Contribution margin 1,080,000 Fixed expenses 200,000 Net operating income $ 880,000 Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. If this year's sales increase by $50,000 and fixed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's sales to increase by 18%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year? 5. The sales manager is…arrow_forward

- Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $120 per unit. Variable expenses are $60.00 per unit, and fixed expenses total $180,000 per year. Its operating results for last year were as follows: Sales $ 3,240,000 Variable expenses 1,620,000 Contribution margin 1,620,000 Fixed expenses 180,000 Net operating income $ 1,440,000 Required: Answer each question independently based on the original data: 1. The sales manager is convinced that a 12% reduction in the selling price, combined with a $71,000 increase in advertising, would increase this year's unit sales by 25%. a. If the sales manager is right, what would be this year's net operating income if his ideas are implemented? b. If the sales manager's ideas are implemented, how much will net operating income increase or decrease over last year? 2. The president does not want to change the selling price. Instead, he wants to increase the sales commission by $2.20 per unit. He…arrow_forwardFeather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $80 per unit. Variable expenses are $40.00 per unit, and fixed expenses total $180,000 per year. Its operating results for last year were as follows: Sales $ 2,160,000 Variable expenses 1,080,000 Contribution margin 1,080,000 Fixed expenses 180,000 Net operating income $ 900,000 Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year’s unit sales and total sales increase by 59,000 units and $4,720,000, respectively. If the fixed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 13%. Using the degree of operating leverage from last year, what percentage increase in net…arrow_forwardFeather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $80 per unit. Variable expenses are $40.00 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Sales $ 2,160,000 Variable expenses 1,080,000 Contribution margin 1,080,000 Fixed expenses 160,000 Net operating income $ 920,000 Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year’s unit sales and total sales increase by 44,000 units and $3,520,000, respectively. If the fixed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 14%. Using the degree of operating leverage from last year, what percentage increase in net operating…arrow_forward

- Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $80 per unit. Variable expenses are $40.00 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Sales $ 2,160,000 Variable expenses 1,080,000 Contribution margin 1,080,000 Fixed expenses 160,000 Net operating income $ 920,000 Required: Answer each question independently based on the original data: 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 14%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year? 5. The sales manager is convinced that a 11% reduction in the selling price, combined with a $72,000 increase in advertising, would increase this year's unit sales by 25%. a. If the sales manager is right, what would be this year's net operating income…arrow_forwardFeather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $40 per unit. Variable expenses are $20.00 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Sales Variable expenses Contribution margin Fixed expenses $ 1,040,000 520,000 520,000 160,000 Net operating income 360,000 Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year's unit sales and total sales increase by 48,000 units and $1,920,000, respectively. If the fixed expenses do not change, how much will net operating income increase? 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 14%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize…arrow_forwardA-7arrow_forward

- Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $20 per unit. Variable expenses are $12 per unit, and fixed expenses total $140,000 per year. Its operating results for last year were as follows: Sales (24,000 units) 480,000 Variable expenses 288,000 Contribution margin 192,000 Fixed expenses 140,000 Operating income 52,000 Required: Answer each question independently based on the original data: 1. What is the product's CM ratio?arrow_forwardHd.31. Feather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $25 per unit. Variable expenses are $8 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Sales $ 350,000 Variable expenses 112,000 Contribution margin 238,000 Fixed expenses 160,000 Net operating income $ 78,000 Required: Answer each question independently based on the original data: 1. What is the products CM ratio? 2. Use the CM ratio to determine the break-even point in sales dollars. 3. Assume this year's total sales increase by $40,000. If the fixed expenses do not change, how much will operating income increase? Assume that the operating results for last year were as in the question data. 4-a. Compute the degree of operating leverage based on last year's sales. 4-b. The president expects sales to increase by 16% next year. Using the degree of operating leverage from last year, what percentage increase in the operating income will the…arrow_forwardFeather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $120 per unit. Variable expenses are $60.00 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Sales $ 3,120,000 Variable expenses 1,560,000 Contribution margin 1,560,000 Fixed expenses 160,000 Net operating income $ 1,400,000 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's sales to increase by 17%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year? 5. The sales manager is convinced that a 11% reduction in the selling price, combined with a $66,000 increase in advertising, would increase this year's unit sales by 25%. a. If the sales manager is right, what would be this year's net operating income if his ideas are implemented? b. If the sales manager's ideas are…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education