Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

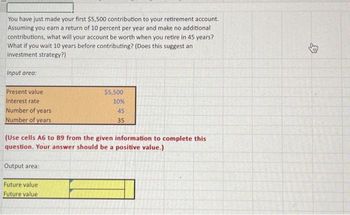

Transcribed Image Text:You have just made your first $5,500 contribution to your retirement account.

Assuming you earn a return of 10 percent per year and make no additional

contributions, what will your account be worth when you retire in 45 years?

What if you wait 10 years before contributing? (Does this suggest an

investment strategy?)

Input area:

Present value

Interest rate

Number of years

Number of years

(Use cells A6 to 89 from the given information to complete this

question. Your answer should be a positive value.)

Output area:

$5,500

10%

45

35

Future value

Future value

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- kaiarrow_forwardGive typed solution only If you put $200,000 into your investment account now for 10 year at 5% annual interest, what is the difference in interest income between simple interest calculation and compound interest calculation?arrow_forwardSuppose you are offered an investment opportunity that will pay $2,500 in five years if you invest $2,000 today. What is the implied rate of return? A) 4.56% B) 4.00% C) 5.00% D) 3.62% E)25.00%arrow_forward

- Problem 1: You can choose between two different investments: (A) an annuity that pays $10,000 each year for the next 6 years; (B) a perpetuity that pays $10,000 forever, starting 11 years from now. 1. Which investment do you choose, A or B, if the interest rate is 5%? What if it is 10%? Explain in words the reason behind your choices.arrow_forwardIn planning for your retirement, you would like to withdraw $50,000 per year for 17 years. The first withdrawal will occur 20 years from today. Click here to access the TVM Factor Table Calculator Part a Your answer is incorrect. What amount must you invest today if your return is 10% per year? $ Round entry to the nearest dollar. Tolerance is 14. IIarrow_forwardFuture Value. How much will you have in 48 months if you invest $105 a month at 12% annual interest? In 48 months, you will have S (Round to the nearest cent) (Use your financial calculator or you may use the Financial Tables in Appendix C in computing your answer)arrow_forward

- You plan to invest $13223 into an investment that you hope will earn a return of 10.28 % . You will withdraw your money in 24 years. How much will you withdraw?arrow_forwardshow all excel formulas/ work answering the following: Saving For Retirement You are offered the opportunity to put some money away for retirement. You will receive five annual payments of $25,000 each beginning in 40 years. How much would you be willing to invest today if you desire an interest rate of 12%?arrow_forwardBy using formula please;;arrow_forward

- You plan to invest $12,000 per year into a retirement account. If you earn a compound annual rate of return of 11%, how many years will it take you to reach a balance of $1,500,000? Question 2 options: 22.83 25.79 24.24 21.09 26.76arrow_forward1. You want to have an income of $50,000 per year in retirement, and you think you will be alive for 30 years in retirement. How much do you need to have invested the day you retire, in real dollars, assuming a 3% real rate of return?arrow_forwardPlease answer using life-cycle problem. Suppose the interest rate is 5%, the income tax rate 35%, the tax rate on investment income is 20%, and the investment horizon 40 years. (a) What is the final payoff after tax if $100 pre-tax income is invested in a regular savings account? (b) What is the final payoff after tax if $100 pre-tax income is invested in a retirement account? (c) What is the final payoff after tax if $100 pre-tax income is invested in a Roth account?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education