Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

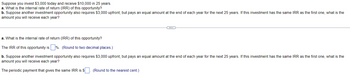

Transcribed Image Text:Suppose you invest $3,000 today and receive $10,000 in 25 years.

a. What is the internal rate of return (IRR) of this opportunity?

b. Suppose another investment opportunity also requires $3,000 upfront, but pays an equal amount at the end of each year for the next 25 years. If this investment has the same IRR as the first one, what is the

amount you will receive each year?

a. What is the internal rate of return (IRR) of this opportunity?

The IRR of this opportunity is%. (Round to two decimal places.)

b. Suppose another investment opportunity also requires $3,000 upfront, but pays an equal amount at the end of each year for the next 25 years. If this investment has the same IRR as the first one, what is the

amount you will receive each year?

The periodic payment that gives the same IRR is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10.15 million. Investment A will generate $2.15 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.58 million at the end of the first year, and its revenues will grow at 2.5% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 5.6%? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? a. Which investment has the higher IRR? The IRR of investment A is%. (Round to two decimal places.)arrow_forwardf you insulate your office for $29,000, you will save $2,900 a year in heating expenses. These savings will last forever. a. What is the NPV of the investment when the cost of capital is 5%? 10%? b. What is the IRR of the investment? (Enter your answer as a whole percent.) c. What is the payback period on this investment?arrow_forwardYou have been offered a unique investment opportunity. If you invest $10,400 today, you will receive $520 one year from now, $1,560 two years from now, and $10,400 ten years from now. What is the NPV of the opportunity if the cost of capital is 6.5% per year?arrow_forward

- (Payback period, net present value, profitability index, and internal rate of return calculations) You are considering a project with an initial cash outlay of $72,000 and expected cash flows of $20,880 at the end of each year for six years. The discount rate for this project is 10.8 percent. a. What are the project's payback and discounted payback periods? b. What is the project's NPV? c. What is the project's PI? d. What is the project's IRR? a. The payback period of the project is years. (Round to two decimal places.)arrow_forwardAn investment will pay $100 at the end of each of the next 3 years, $200 at the end of Year 4, $400 at the end of Year 5, and $600 at the end of Year 6. If other investments of equal risk earn 8% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent. Present value: $ Future value: $arrow_forwardIf you invest $5,000 today, you will receive $1,000 in a year, $1,500 each in year 2 and year 3, and $2,000 each in year 4 and year 5. If you require a 10% annual return, should you take the investment.arrow_forward

- You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $9.6 million. Investment A will generate $1.86 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.55 million at the end of the first year, and its revenues will grow at 2.2% per year for every year after that. Which investment has the higher IRR? (Round to the nearestinteger.) Which investment has the higher NPV when the cost of capital is 7.8%? In this case, for what values of the cost of capital does picking the higher IRR give the correct answer as to which investment is the best opportunity?arrow_forwardIf a particular investment will pay $500, 5 months from now, and an additional $500, 9 months from now, what is the largest amount that an investor should be willing to invest today, assuming money earns a rate of return of 7%? Assume that the investment has no money left after the two withdrawals.arrow_forwardAn investment opportunity requires a payment of $910 for 12 years, starting a year from today. If your required rate of return is 6.5 percent, what is the value of the investment to you today? (Round factor values to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25.)arrow_forward

- Please answer the question. The details of the question are attached in the image below.arrow_forwardSuppose that you are planning to buy a boat in in 28 years [cell B3] for $100,000 [cell B2], and you deposit into your account the amount of $26,000 CAD [cell B1]. (a) What average annually compounding rate of return (as a percentage, correct to 2 decimals) should you earn so you can accumulate the lump sum needed to achieve your goal [cell B5]? Use the RATE function.(Note: You might have to modify the format of cell B5 so that it shows 2 decimals.) (b) What is the correct formula (using 18 characters or less) that should be placed in cell B5?Note: There are to be NO numbers in the function call (apart from a 0 if appropriate), only cell references, or negative cell references where appropriate. In excel pls.arrow_forwardCalculating Rates of Return Suppose an investment offers to quadruple your money in12 months (don’t believe it). What rate of return per quarter are you being offered?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education