FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

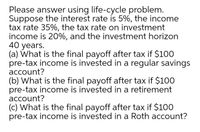

Transcribed Image Text:Please answer using life-cycle problem.

Suppose the interest rate is 5%, the income

tax rate 35%, the tax rate on investment

income is 20%, and the investment horizon

40 years.

(a) What is the final payoff after tax if $100

pre-tax income is invested in a regular savings

account?

(b) What is the final payoff after tax if $100

pre-tax income is invested in a retirement

account?

(c) What is the final payoff after tax if $100

pre-tax income is invested in a Roth account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If a person with a 24 percent tax bracket makes a deposit of $6,500 to a tax-deferred retirement account, what amount would be saved on current taxes? Current tax savingsarrow_forwardWhat type of defined contribution plan allows participants to contribute after-tax amounts to their retirement account? Select one: a. Roth 401(k) b. 403(b) c. 401(k) d. 457arrow_forwardIn a Traditional IRA or 401(k): O A. Contributions are tax deductible B. Withdrawals in retirement are taxable OC. Neither A nor B O D. Both A & Barrow_forward

- Scenario 1: Individual Retirement Accounts (IRAs) allow people to shelter some of their income from taxation. Suppose the maximum annual contribution to such accounts is $5,000 per person. Now suppose there is a decrease in the maximum contribution, from $5,000 to $3,000 per year. Shift the appropriate curve on the graph to reflect this change. This change in the tax treatment of interest income from saving causes the equilibrium interest rate in the market for loanable funds to and the level of investment spending to .arrow_forwardWhat is the tax rate range for Social Security benefits received? How is the deductible amount of personal property tax figured for personal vehicles? Remember, the tax must be calculated based on the vehicle’s value (not its weight) in order to be deducted. Are donations of time and services deductible? What types of state and local taxes are deductible as itemized deductions on Schedule A?arrow_forwardWhich of the toliowing types of interest is not taxable in the year it is posted to the taxpayer's account? Select one O a Interest on a savings account OD interest on an investment account Oc Imterest on an IRA O d. interest on ife insurance proceeds remaining with the insurance companyarrow_forward

- Which of the following are deducted from gross taxable income todetermine net taxable income? a - Severance payments b - Registered Retirement Savings Plan contributions c - Health carepremiums d - Charitable donationsarrow_forwardPayment of retirement benefits: A. Increases the PBO. B. Increases the ABO. C. Reduces the GBO. D. Reduces the PBOarrow_forwardImpact on Taxes. From question 24, if Lawrence had forgotten a $5000 tax credit (instead of a $5000 tax deduction), how would his taxes be affected?arrow_forward

- Unions dues, vacation account, 401k, insurance, subtracted from gross pay Options are: personal exemptions, tax deductions, adjusted gross income, social security tax, taxable wages, fit, net pay, personal deductions, Medicare tax, dependent, graduated income tax, and withholding allowances. Which one is it?arrow_forwardYou will earn money each year off your tax-deferred retirement accounts without having to pay taxes until the funds are withdrawn. True Falsearrow_forwardWhich of the following is a deductible expense for an individual taxpayer? A) Rent payments for personal use B) Mortgage interest on a vacation home C) Childcare expenses while working D) Personal clothing purchasesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education