Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

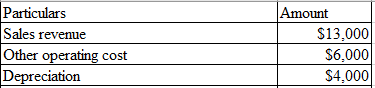

You have just landed an internship in the CFO's office of Hawkesworth Inc. Your first task is to estimate the Year 1 cash flow for a project with the following data. What is the Year 1 cash flow?

| Sales revenues | $13,000 |

| $4,000 | |

| Other operating costs | $6,000 |

| Tax rate | 25.0% |

|

|||

|

|||

|

|||

|

|||

|

Expert Solution

arrow_forward

Step 1

Given:

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Romanos Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Laura Berenstein, staff analyst at Romanos, is preparing an analysis of the three projects under consideration by Chester Romanos, the company's owner. Data Table A B C D 1 Project A Project B Project C 2 Projected cash outflow 3 Net initial investment $3,000,000 $2,100,000 $3,000,000 4 Projected cash inflows 5 Year 1 $1,200,000 $1,200,000 $1,700,000 6 Year 2 1,200,000 600,000 1,700,000 7 Year 3 1,200,000 500,000 200,000 8 Year 4 1,200,000 100,000 9 Required rate of return 10% 10% 10% 1. Because the company's cash is limited, Romanos thinks the payback method should be used to choose between the capital budgeting projects. a. What are the…arrow_forwardVishalarrow_forwardHalls Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Laura Bentley, staff analyst at Halls, is preparing an analysis of the three projects under consideration by Caden Halls, the company's owner. Data Table A B C D 1 Project A Project B Project C 2 Projected cash outflow 3 Net initial investment $3,000,000 $2,100,000 $3,000,000 4 Projected cash inflows 5 Year 1 $1,200,000 $1,200,000 $1,700,000 6 Year 2 1,200,000 600,000 1,700,000 7 Year 3 1,200,000 500,000 200,000 8 Year 4 1,200,000 100,000 9 Required rate of return 6% 6% 6 1.. Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Halls choose?. Ignore income taxes. (Round your answers to…arrow_forward

- You work for an outdoor play structure manufacturing company and are trying to decide between the following two projects: (Click on the following icon in order to copy its contents into a spreadsheet.) Year-End Cash Flows ($ thousands) 1 19 39 Project Playhouse Fort You can undertake only one project. If your cost of capital is 8%, use the incremental IRR rule to make the correct decision. 0 - 27 - 78 2 20 50 IRR 28.2% 8.9% The incremental IRR is %. (Round to two decimal places.) With the incremental IRR at - 1.23% and the cost of capital of 8%, you should undertake the ▼ (Select from the drop-down menu.)arrow_forwardYou work for an outdoor play structure manufacturing company and are trying to decide between the following two projects: (Click on the following icon in order to copy its contents into a spreadsheet.) Project Playhouse Fort Year-End Cash Flows ($ thousands) 1 2 18 IRR 33.8% 13.2% 52 You can undertake only one project. If your cost of capital is 7%, use the incremental IRR rule to make the correct decision. 0 -25 -75 The incremental IRR is%. (Round to two decimal places.) 20 39 Save OLarrow_forwardRevenues generated by a new fad product are forecast as follows: Year Revenues 1 $50,000 2 35,000 3 30,000 4 20,000 Thereafter 0 Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $60,000 in plant and equipment. a. What is the initial investment in the product? Remember working capital. b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm’s tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is the project IRR?arrow_forward

- As assistant to the CFO of Boulder Inc., you must estimate the Year 1 cash flow for a project with the following data. What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number. Sales revenues $11,900 Operating costs $5,430 Tax rate 20.0%arrow_forwardFinancearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education