Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

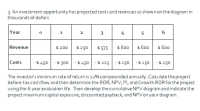

Transcribed Image Text:3. Aninvestment opportunity has projected costs and revenues as shown on the diagram in

thousands of dollars.

Year

2

3

4

Revenue

$ 200

$ 250

$ 575

$ 600

$ 600

$ 600

Costs

-$ 450

-$ 300 -$ 450 -$ 225 -$150 -$ 150 - $250

The investor's minimum rate of return is 12% compounded annually. Calculate the project

before-tax cash flow and then determine the ROR, NPV, PI, and Growth ROR forthe project

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Refer to two projects with the following cash flows: Year Project A Project B 0 -$110 -$110 1 45 55 2 45 55 3 45 55 4 45 If the opportunity cost of capital is 11%, what is the profitability index for each project?arrow_forwardCalculate the payback period, the discounted payback period and the NPV for the following project using a rate of 5%. Time Cash Flow 0 - $53,000 1 $ 21,000 2 $ 21,000 3 $ 21,000 NPV = Payback = Discounted Payback =arrow_forwardCalculate the payback period, the discounted payback period and the NPV for the following project using a rate of 5%. Time Cash Flow 0 - $63,000 $ 21,000 $ 21,000 $ 21,000 $ 21,000 Payback = Discounted Payback =arrow_forward

- Fernando Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.75% Year 0 1 2 3 Cash flows - $800 $510 $510 $510 a. 2.18 years b. 1.10 years c. 2.82 years d. 1.82 years e. 1.18 yearsarrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forward3) Consider the following two projects: Net Cash Flow Each Period Initial Outlay 1 2 3 4 Project A $4,000,000 $2,003,000 $2,003,000 $2,003,000 $2,003,000 Project B $4,000,000 0 0 0 $11,000,000 Calculate the net present value of each of the above projects, assuming a 14 percent discount rate. What is the internal rate of return for each of the above projects? Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above. If 14 percent is the required rate of return, and these projects are independent, what decision should be made? If 14 percent is the required rate of return, and the projects are mutually exclusive, what decision should be made?arrow_forward

- Talent Inc. is considering a project that has the following cash flow and WACC data.WACC: 7%Year 0 1 2 3Cash flows -$1,600 $500 $600 $700 (1) What is the project's NPV?(2) What is the project's IRR?(3) What is the project's Payback Period?(4) What is the project's Discounted Payback Period?arrow_forwardCompute the Internal Rate of Return for a project with the following cash flows: Year Cash Flow 0 ($2,000) 1 $500 2 $400 3 $400 4 $1,500 Question 7 options: 7% 40% 12% 8%arrow_forwardYou are given the following cash flows for a project. Assuming a cost of capital of 12.84 percent. determine the profitability index for this project. Year 0 1 2 3 4 5 O 14981 O 1.68/7 O1.7508 1.6245 1.5613 Cash Flow -$1,115.00 $554.00 $622.00 $648 00 $426.00 $216.00arrow_forward

- Redesign Inc. is considering a project that has the following cash flow data. What is the project's payback period and discounted payback period? Assume the cost of capital is 12%. Year 0 1 2 3 Cash flows -$500 $200 $200 $200arrow_forwardProblem 2 please.arrow_forwardInternal rate of return and modified internal rate of return. Quark Industries has three potential projects, all with an initial cost of $1,900,000. Given the discount rate and the future cash flow of each project, what are the IRRs and MIRRs of the three projects for Quark Industries? Cash Flow Project M Project N Project O Year 1 $500,000 $600,000 $1,000,000 Year 2 $500,000 $600,000 $800,000 Year 3 $500,000 $600,000 $600,000 Year 4 $500,000 $600,000 $400,000 Year 5 $500,000 $600,000 $200,000 Discount rate 9% 13% 16% What is the IRR for project M?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education