Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Pls solve this question correctly instantly in 5 min i will give u 3 like for sure

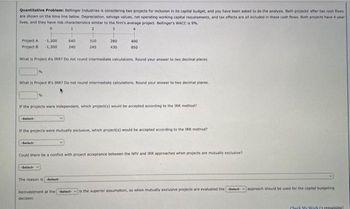

Transcribed Image Text:Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows

are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows, Both projects have 4-year

lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9%.

0

1

2

3

4

Project A

Project B

-Select-

-1,300

-1,300

%

What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places.

-Select-

640

240

310

245

What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places.

-Select-

280

430

If the projects were independent, which project(s) would be accepted according to the IRR method?

400

850

If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method?

The reason is -Select-

Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive?

Reinvestment at the -Select- is the superior assumption, so when mutually exclusive projects are evaluated the select

decision

approach should be used for the capital budgeting

Check My Work (3 remaining)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- My Drive - Google Drive X 4 My Drive - Google Drive Front Desk Operations 2020 - Go X + ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress%3Dfalse Tp Netflix 0z TVCC Email P My Math Lab Log In to Canvas X Mathway | Calculus.. N Netflix Cengage Login * Login Readin- Darby Company, operating at full capacity, sold 114,800 units at a price of $108 per unit during the current year. Its income statement is as follows: Sales $12,398,400 Cost of goods sold 4,392,000 Gross profit $8,006,400 Expenses: Selling expenses $2,196,000 Administrative expenses 1,332,000 Total expenses 3,528,000 Income from operations $4,478,400 The division of costs between variable and fixed is as follows: Variable Fixed Cost of goods sold 60% 40% Selling expenses 50% 50% Administrative 30% 70% expenses Management is considering a plant expansion program for the following year that will permit an increase of $972,000 in yearly sales. The expansion will increase fixed costs by…arrow_forwardAutoSave OFF Home Insert X Paste E36 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 A Ready D 2 - C Draw Page Layout Calibri (Body) V 11 B I U A. V V B UDENCRUIVIIVIIL & FRITCITOU. CONSOLIDATED BALANCE SHEETS Formulas V fx (In millions, except par value amounts) ASSETS CURRENT ASSETS: Cash and Equivalents Marketable Securities Receivables Inventories Other Current Assets TOTAL CURRENT ASSETS PROPERTY AND EQUIPMENT, NET OTHER ASSETS TOTAL ASSETS CURRENT LIABILITIES: Accounts Payable Other Liabilities and Accrued Expenses Income Taxes Payable TOTAL CURRENT LIABILITIES NONCURRENT LIABILITIES: Long-Term Debt Other Liabilities TOTAL NONCURRENT LIABILITIES STOCKHOLDERS' EQUITY: Class A Common Stock, $0.01 par value: 150,000 shares authorized and 103,300 shares issued Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Treasury Stock, at Average Cost - 17,662 and 16,054 at December…arrow_forward1 2 m 4n 07 9. White 9 A Talk S Aint Ia O ENG 10 O Annota S Annota SAnnota M Recibic I Downl ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 台☆* + Facebook 6 Student Center Bb Blackboard WhatsApp Ggrammarly unemployment > |国Readi Maps Zoom Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--. If an amount box does not require an entry, leave it blank. Page: POST. DATE DESCRIPTION…arrow_forward

- sf Your session h X sf Career Opport x x - ( xoqui Birdledon Writi x O Brussels Alrline x myAU Portal N X Fall 2021 Seme X to.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... seno TV erviews (Chapter 8) i Saved Help Save & Exit Which of the following service auditor reports provide evidence about the operating effectiveness of controls? Multiple Choice Type 1 report. Type 2 report. Comprehensive report. IT report. Next %24 < Prev 6. 9 jo Finacial Accounting... Finacial Account....pdf Finacial Account...pdf Finacial Account..pdf MacBook Airarrow_forward4Homework: Project Analysis As X 9 Question 2 - Homework: Projec X %3D heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... O * O Project Analysis Assignment i 1 Saved Help Save & Exit Submit Check my work A project currently generates sales of $18 million, variable costs equal 60% of sales, and fixed costs are $3.6 million. The firm's tax rate is 35%. Assume all sales and expenses are cash items. a. What are the effects on cash flow, if sales increase from $18 million to $19.8 million? (Input the amount as positive value. Enter your answer in dollars not in millions.) Cash flow increases by $ 47,000 b. What are the effects on cash flow, if variable costs increase to 70% of sales? (Input the amount as positive value. Enter your answer in dollars not in millions.) decreases | by s 2$ 117,000 Cash flowarrow_forwardFast pls solve this question correctly in 5 min pls I will give u like for sure Surbh You just opened a brokerage account, depositing $4,000. You expect the account to earn an interest rate of 10% annually. You also plan on depositing $1,500 at the end of years 4 through 10. What will be the value of the account at the end of year 10? a. $9,487 b. $20,606 c. $24,606 d. $8,908 e. $23,106arrow_forward

- Pls solve this question correctly instantly in 5 min i will give u 3 like for surearrow_forward120 SRBBARH ageNOWv2 | Online teach x + SOFTWARE UPDATE takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false macOS Big Sur 11.3.1 is available and w later tonight. еВook 4 Show Me How E Print Item eak-Even Point Radison Inc. sells a product for $75 per unit. The variable cost is $34 per unit, while fixed costs are $494,214. Determine (a) the break-even point in sales units and (b) the break-even point if the selling price were increased to $83 per unit. a. Break-even point in sales units units b. Break-even point if the selling price were increased to $83 per unit units Previous Next Check My Work Save and Exit Submit Assignment for Grading Email Instructor MacBook Airarrow_forwardI need typing clear urjent no chatgpt use i will give 5 upvotesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education