Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

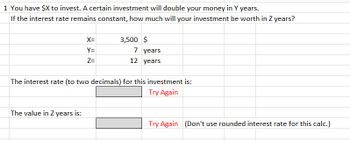

Transcribed Image Text:1 You have $X to invest. A certain investment will double your money in Y years.

If the interest rate remains constant, how much will your investment be worth in Z years?

X=

Y=

Z=

The value in Z years is:

3,500 $

7 years

12 years

The interest rate (to two decimals) for this investment is:

Try Again

Try Again (Don't use rounded interest rate for this calc.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Find the present worth sum of money that would be equivalent to the future amounts of $5000 in year 6 and $7000 in year 8 if the real interest rate is 10% per year and the inflation rate is 5% per year. Solve using the factors and their equations with (a) an inflation-adjusted rate, and (b) the real interest rate. Solve manually pleasearrow_forwardربو Suppose an investor will receive payments at the end of the next six years in the amounts shown in the table. 6 248 Ycar 1 5 4 2 3 Payment 465 233 632 365 334 If the interest rate is 3.5% compounded semiannually, what is the present value of the investment?. [Assume the first payment will arrive one year from now].arrow_forwardDetermine the present value P you must invest to have the future value A at simple interest rate r after time t. A = $19,000, r = 11.5%, t = 4 years The present value that must be invested to get $19,000 after 4 years at an interest rate of 11.5% is $. (Round up to the nearest cent.)arrow_forward

- 9 Suppose you invested $500 in a local credit union and: f(t) gives the future value of the investment in t years, if the APR is 2% and interest is compounded quarterly. • g(t) gives the future value of the investment in t years, if the APR is 2% and interest is compounded monthly. h(t) gives the future value of the investment in f years, if the APR is 2% and interest is compounded continuously. a. Write a function rule for f(t). For g(t). For h(t). Then describe how the rules are similar and how they are different. b. Based on your understanding of exponential growth, describe how the graphs of f(t), g(t), and h(t) are similar, and how they are different. c. On the same coordinate grid, use algebraic reasoning to sketch graphs of the three functions. .arrow_forwardSuppose you just bought an annuity with 10 annual payments of $16,500 at a discount rate of 13.75 percent per year. a. What is the value of the investment at the current interest rate of 13.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What happens to the value of your investment if interest rates suddenly drop to 8.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What happens to the value of your investment if interest rates suddenly rise to 18.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardDetermine the present value, P, you must invest to have the future value, A, at simple interest rate r after time t. Round answer to the nearest dollar. A=$5,000, r=8.2%, t=5 yearsarrow_forward

- Using the Rule of 72, approximately how many years are needed to double a $100 investment when interest rates are 5.25 percent per year? (Round your answer to 2 declmal places.) Period years < Prev o of 10 e here to search Eゴ ( F4 F5 F7 F10 F11 F12 76 #arrow_forwardProblem 1: You can choose between two different investments: (A) an annuity that pays $10,000 each year for the next 6 years; (B) a perpetuity that pays $10,000 forever, starting 11 years from now. 1. Which investment do you choose, A or B, if the interest rate is 5%? What if it is 10%? Explain in words the reason behind your choices.arrow_forwardSubject:- financearrow_forward

- Suppose the term structure of risk-free interest rates is as shown here: a. Calculate the present value of an investment that pays $1,000 in 2 years and $4,000 in 5 years for certain. b. Calculate the present value of receiving $900 per year, with certainty, at the end of the next 5 years. To find the rates for the missing years in the table, linearly interpolate between the years for which you do know the rates. (For example, the rate in year 4 would be the average rate in year 3 and year 5.) c. Calculate the present value of receiving $2,700 per year, with certainty, for the next 20 years. Infer rates for the missing years using linear interpolation. (Hint: Use a spreadsheet.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) 2 years 3 years 5 years 7 years 1 year 2.06 2.44 2.64 3.22 3.74 Term Rate (EAR, %) Print Done 10 years 4.25 20 years 5.09 I X t cent.)arrow_forwardYou are required to find how long it will take a sum of money (or anything else) to grow to some specified amount with a certain compound interest rate. Specifically, if a company’s investment has a real rate of return of 4% per year and the inflation rate is 6% per year, approximately how long will it take for the investment to triple?arrow_forwardDetermine the present value P you must invest to have the future value A at simple interest rate r after time t. A = $14,000, r = 7.5%, t = 8 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education