Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

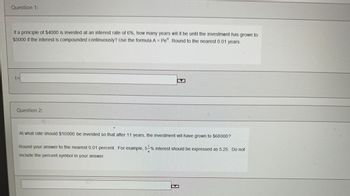

Transcribed Image Text:Question 1:

If a principle of $4000 is invested at an interest rate of 6%, how many years will it be until the investment has grown to

$5000 if the interest is compounded continuously? Use the formula A = Pet. Round to the nearest 0.01 years.

Question 2:

At what rate should $10000 be invested so that after 11 years, the investment will have grown to $68000?

Round your answer to the nearest 0.01 percent. For example, 5-% interest should be expressed as 5.25. Do not

include the percent symbol in your answer.

B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Determine the present value, P, you must invest to have the future value, A, at simple interest rate r after time t. Round answer to the nearest dollar. A=$5,000, r=8.2%, t=5 yearsarrow_forwardUsing the Rule of 72, approximately how many years are needed to double a $100 investment when interest rates are 5.25 percent per year? (Round your answer to 2 declmal places.) Period years < Prev o of 10 e here to search Eゴ ( F4 F5 F7 F10 F11 F12 76 #arrow_forwardProblem 1: You can choose between two different investments: (A) an annuity that pays $10,000 each year for the next 6 years; (B) a perpetuity that pays $10,000 forever, starting 11 years from now. 1. Which investment do you choose, A or B, if the interest rate is 5%? What if it is 10%? Explain in words the reason behind your choices.arrow_forward

- (Solving for n with nonannual periods) About how many years would it take for your investment to grow twofold if it were invested at an APR of 14 percent compounded weekly? If you invest $1 at an APR of 14 percent compounded weekly, about how many years would it take for your investment to grow twofold to $2? years (Round to the nearest whole number.)arrow_forward(Solving for n with nonannual periods) About how many years would it take for your investment to grow threefold if it were invested at an APR of 11 percent compounded annually? If you invest $1 at an APR of 11 percent compounded annually, about how many years would it take for your investment to grow threefold to S3? lyears (Round to the nearest whole number.)arrow_forwardSuppose the term structure of risk-free interest rates is as shown here: a. Calculate the present value of an investment that pays $1,000 in 2 years and $4,000 in 5 years for certain. b. Calculate the present value of receiving $900 per year, with certainty, at the end of the next 5 years. To find the rates for the missing years in the table, linearly interpolate between the years for which you do know the rates. (For example, the rate in year 4 would be the average rate in year 3 and year 5.) c. Calculate the present value of receiving $2,700 per year, with certainty, for the next 20 years. Infer rates for the missing years using linear interpolation. (Hint: Use a spreadsheet.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) 2 years 3 years 5 years 7 years 1 year 2.06 2.44 2.64 3.22 3.74 Term Rate (EAR, %) Print Done 10 years 4.25 20 years 5.09 I X t cent.)arrow_forward

- You are required to find how long it will take a sum of money (or anything else) to grow to some specified amount with a certain compound interest rate. Specifically, if a company’s investment has a real rate of return of 4% per year and the inflation rate is 6% per year, approximately how long will it take for the investment to triple?arrow_forwardDetermine the present value P you must invest to have the future value A at simple interest rate r after time t. A = $14,000, r = 7.5%, t = 8 yearsarrow_forwardThe interest rate required for a $2,050 investment to double in 5 years can be found from this equation: 4,100=2,050(1+r2)104,100=2,0501+r210 . Find the necessary rate. Your answer should be a decimal, but express it as a percentage to 2 decimal places: The rate is %arrow_forward

- can somebody help me? thanks K means compound k times a year.arrow_forwardPls help me stepwise. Thankssarrow_forward6. If the effective interest rate is i per period and you invest b dollars at time 0, then the value at time n is b(1 + i)”. For example, if at time 0 you invest $100 at an effective interest rate of 6% per year, then the value at time 1 is $100(1+0.06) = $106. dollars. At time 2, the value will be $100 (1 + 0.06)² = $112.36. Similarly, the present value (value at time 0) of $100 received 2 years from now would be $100(1+0.06)-²≈ $88.99. Sometimes it's convenient to define d = 1/(1 + i) so that we would have $100(1+i)n = $100d". If the interest rate per year is i compounded semiannually, then the effective annual interest rate is (¹ + 2)²³ - 1₁ 1. For example, if the interest rate is 6% per year compounded semiannually, the effective annual interest rate is 1 + .06 2 2 - 1 ≈ 6.09%. If the interest rate per year is i compounded quarterly, then the effective annual interest rate is 4 (¹ + 4) * - 1 1. (a) If the interest rate is 6% per year compounded quarterly, what is the effective…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education