Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

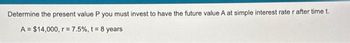

Transcribed Image Text:Determine the present value P you must invest to have the future value A at simple interest rate r after time t.

A = $14,000, r = 7.5%, t = 8 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following two investment alternatives. Determine the range of investment costs for Alternative B (i.e., min. value < Xarrow_forwardOutline the concept of present value. The interest rate is 7%. Use the concept of present value to compare the difference between €200 to be received in ten years time and €300 to be received in 20 years time. Problem 1: Assume the interest rate is 6%. In each of the following three cases, state which you would rather receive and briefly explain why: €200 today or €480 in two years? €205 today or €240 in one year? €1,000 in one year or €1,220 in two years? Problem 2: A company has an investment project that would cost €10 million today and yield a payoff of €15 million in four years. Should the firm undertake the project if the interest rate is 11%? 10%? 9%? 8%? Can you calculate the exact point at which the interest rate makes the difference between profitability and non-profitability? please make sure to fully explain the reasoning behindarrow_forwardDetermine the present value P you must invest to have the future value A at simple interest rate r after time t. A = $19,000, r = 11.5%, t = 4 years The present value that must be invested to get $19,000 after 4 years at an interest rate of 11.5% is $. (Round up to the nearest cent.)arrow_forwardFind the present value PV of the given future value. (Round your answer to the nearest cent.) Future value $8,300 at 9 1/2% simple interest for three yearsarrow_forwardPresent Value =PV Please see imagearrow_forwardj. Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 8%. Year 1 $100, Year 2 $200, Year 3 $400 Year Payment 1 100 2 200 3 400 Rate 8% To find the PV, use the NPV function: Pv= $581.59 Year Payment x (1+ I)^(N- t) = FV 1 100 2 200 3 400arrow_forward5. Present value To find the present value of a cash flow expected to be paid or received in the future, you will the future value cash flow by (1+1)N What is the value today of a $42, 000 cash flow expected to be received 17 years from now based on an annual interest rate of 7% ? $13,296 $10,637 $132, 670 $20, 609 Your broker called carfier today and offered you the opportunity to invest in a security. As a friend, he suggested that you compare the current, or present value, cost of the security and the discounted value of its expected future cash flows before deciding whether or not to invest. The decision rule that should be used to decide whether or not to invest should be. Everything else being equal, you should invest if the discounted value of the security's expected future cash flows is greater than or equal to the current cost of the security. Everything else being equal, you should invest if the current cost of the security is greater than the present value of the security's…arrow_forwardSolve the following problem using the present worth analysis for an interest rate of 8%. Alt. A Alt. B Alt. B Initial cost $1,700 $2,100$3,750 Benefit/year 1,000 |1,000 1,000 Life in years|2 3 6arrow_forwardFuture Value You invest $1,000 today and exect to sell the investment for $2,000 in 10 years. a. Is this a good deal if the investment rate is 6%? b. What if the interest rate is 10%? Why ? Show the calculations in Excel.arrow_forwardIf I invest £100 and get back £300, what is the percentage return over. a. 5years? b. 10years? with working pleasearrow_forwardConsider a dollar amount of $750 today, along with a nominal interest rate of 15.00%. You are interested in calculating the future value of this amount after 5 years. For all future value calculations, enter -$750 (with the negative sign) for PV and 0 for PMT. When calculating the future value of $750, compounded annually for 5 years, you would enter a value of 15 for 1/Y. Using the keystrokes you just identified on your financial calculator, the future value of $750, compounded annually for 5 at the given nominal interest rate, yields a future value of approximately $1,508.52. When calculating the future value of $750, compounded semi-annually (twice per year) for 5 years, you would enter a value of 10 for N, a value of 7.50% for I/Y. 5 for N, a value of Using the keystrokes you just identified on your financial calculator, the future value of $750, compounded semi-annually for 5 at the given nominal interest rate, yields a future value of $1,545.77. When calculating the future value…arrow_forwardcalculate future valuesarrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education