Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

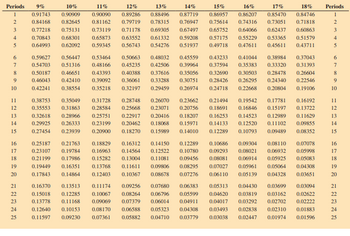

You wish to have $23,000 in 10 years. Use Table 11-2 to create a new table factor, and then find how much you should invest now (in $) at 6% interest, compounded quarterly in order to have $23,000, 10 years from now. (Round your answer to the nearest cent.)

Transcribed Image Text:Periods 9%

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

10%

11%

14%

12% 13%

15%

0.89286 0.88496 0.87719 0.86957

0.90909

0.91743

0.90090

0.84168 0.82645 0.81162

0.73119

0.79719

0.71178

0.78315 0.76947 0.75614

0.69305 0.67497 0.65752

0.77218 0.75131

0.70843

0.68301

0.65873

0.63552

0.64993

0.62092

0.59345 0.56743

21

22

23

24

25

0.38753 0.35049 0.31728 0.28748

0.35553 0.31863 0.28584

0.32618 0.28966

0.29925

0.26333

0.27454

0.23939

0.59627 0.56447

0.53464 0.50663

0.48032 0.45559

0.54703 0.51316 0.48166 0.45235 0.42506 0.39964

0.50187 0.46651 0.43393 0.40388 0.37616 0.35056

0.46043 0.42410 0.39092 0.36061 0.33288 0.30751

0.35218 0.32197 0.29459 0.26974

0.42241

0.38554

0.26070

0.25668 0.23071

0.20416

0.20462 0.18068

0.15989

0.25751 0.22917

0.23199

0.20900 0.18270

0.61332

0.54276

0.25187

0.21763 0.18829

0.16312

0.23107

0.19784 0.16963 0.14564

0.21199

0.17986

0.15282

0.13004

0.19449 0.16351

0.13768

0.17843 0.14864

0.12403

0.11611

0.10367

16%

17%

0.86207 0.85470

0.74316 0.73051

0.64066 0.62437

0.59208 0.57175 0.55229 0.53365

0.51937 0.49718 0.47611 0.45611

0.14150

0.12522

0.11081

0.09806

0.08678

0.23662

0.20756

0.18207

0.15971

0.14010

18%

0.84746

0.71818

0.60863

0.51579

0.43711

0.43233 0.41044 0.38984 0.37043

0.37594 0.35383 0.33320 0.31393

0.32690 0.30503 0.28478 0.26604

0.28426 0.26295 0.24340 0.22546

0.24718 0.22668 0.20804 0.19106

0.12289

0.10780

0.09456 0.08081 0.06914

0.08295

0.07276

0.21494 0.19542 0.17781

0.18691 0.16846 0.15197

0.16253

0.14523 0.12989 0.11629

0.14133 0.12520 0.11102 0.09855

0.12289 0.10793 0.09489 0.08352

0.16192

0.13722

0.10686 0.09304 0.08110 0.07078

0.09293 0.08021

0.06932 0.05998

0.05925

0.05083

0.04308

0.07027 0.05961 0.05064

0.06110 0.05139 0.04328

0.03651

0.13513

0.16370

0.15018 0.12285

0.11174 0.09256 0.07680 0.06383 0.05313 0.04430 0.03699 0.03094

0.10067 0.08264 0.06796 0.05599 0.04620 0.03819 0.03162 0.02622

0.13778 0.11168 0.09069 0.07379 0.06014 0.04911 0.04017 0.03292 0.02702 0.02222

0.12640 0.10153 0.08170 0.06588 0.05323 0.04308 0.03493 0.02838 0.02310 0.01883

0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 0.03038

0.01596

0.02447 0.01974

Periods

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I'm not sure why, but that is not the correct solution to the question.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I'm not sure why, but that is not the correct solution to the question.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the future value of a constant income stream of $20,000 per year in 6 years from now given a continuous interest rate of 3.5% per annum? Give your answer to the nearest dollar and show working. уearsarrow_forwardWhat is the present value of $6,000 paid at the end of each of the next 87 years if the interest rate is 6% per year? The present value is $ View an example (Round to the nearest cent.) Get more help - Clear allarrow_forwardHow much will $3,000 invested at the end of each year grow to in 4 years, assuming an interest rate of 11% compounded annually? Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, and PVA of $1). Multiple Choice $13,663 $14,129 О $12,729 $13,200arrow_forward

- Determine the annual rate of interest, to the nearest tenth of a percent, given that the investment of $34 500 is compounded monthly and after 6 years is worth $49 750. use tvm solver or graphing calculator N= 1%= PV= PMT= FV= P/Y= C/Y= PMT: END BEGINarrow_forwardCalculate what $890 would grow to at 7.5% per year compounded daily for 6 years. (Use the Table 12.2.) Note: Round your final answer to the nearest cent. Amountarrow_forwardSuppose you wish to have $17,250 in 5 years. Use the present value formula to find how much you should invest now at 5% interest, compounded semiannually in order to have $17,250, 5 years from now. Then calculate the amount of interest. O $3,774.33 $4,312.50 $12,937.50 $13,475.67arrow_forward

- i need the answer quicklyarrow_forwardYou have $76,000 in your account that you want to grow to triple that amount in 25 years. What annual rate of return is necessary to reach your goal? (Note: Enter your answer is a decimal, not a percentage. For example, enter .0452 instead of 4.52%) Your Answer: Answerarrow_forwardAssume today is January 1 and you plan to invest $4,000 today in an account earning interest of 6% compounded semi-annually. You would like to calculate the amount your investment will grow to three years from now.Question: What should be the correct "n" and "i" to use for factor table purposes in order to answer your question?arrow_forward

- Suppose that $30,000 is invested at 9% interest. Find the amount of money in the account after 7 years if the interest is compounded annually. If interest is compounded annually, what is the amount of money after t = 7 years? $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardConsider a dollar amount of $750 today, along with a nominal interest rate of 15.00%. You are interested in calculating the future value of this amount after 5 years. For all future value calculations, enter -$750 (with the negative sign) for PV and 0 for PMT. When calculating the future value of $750, compounded annually for 5 years, you would enter a value of 15 for 1/Y. Using the keystrokes you just identified on your financial calculator, the future value of $750, compounded annually for 5 at the given nominal interest rate, yields a future value of approximately $1,508.52. When calculating the future value of $750, compounded semi-annually (twice per year) for 5 years, you would enter a value of 10 for N, a value of 7.50% for I/Y. 5 for N, a value of Using the keystrokes you just identified on your financial calculator, the future value of $750, compounded semi-annually for 5 at the given nominal interest rate, yields a future value of $1,545.77. When calculating the future value…arrow_forwardSuppose that $70,000 is invested at 7% interest. Find the amount of money in the account after 7 years if the interest is compounded annually. If interest is compounded annually, what is the amount of money after t = 7 years? $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education