Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

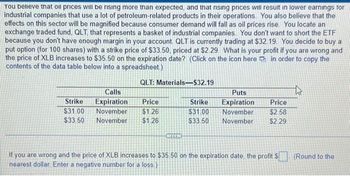

Transcribed Image Text:You believe that oil prices will be rising more than expected, and that nsing prices will result in lower earnings for

industrial companies that use a lot of petroleum-related products in their operations. You also believe that the

effects on this sector will be magnified because consumer demand will fall as oil prices rise. You locate an

exchange traded fund, QLT, that represents a basket of industrial companies. You don't want to short the ETF

because you don't have enough margin in your account. QLT is currently trading at $32.19. You decide to buy a

put option (for 100 shares) with a strike price of $33.50, priced at $2.29. What is your profit if you are wrong and

the price of XLB increases to $35.50 on the expiration date? (Click on the icon here in order to copy the

contents of the data table below into a spreadsheet)

QLT: Materials-$32.19

Strike

$31.00

$33.50

Calls

Expiration

Price

$1.26

November

November $1.26

Puts

Expiration

Price

November $2.58

$2,29

Strike

$31.00

$33.50 November

If you are wrong and the price of XLB increases to $35.50 on the expiration date, the profit S

nearest dollar. Enter a negative number for a loss.);

h

(Round to the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In the short-run macro model, if aggregate expenditure is less than GDP, output in the future will a. decline as firms cut production to stop the buildup of inventories b. increase as firms cut their prices to try to stop depletion of inventories c. remain unchanged indefinitely unless government takes action d. decline as firms increase their prices to stop the buildup of inventories e. increase as firms increase production to try to stop depletion of inventoriesarrow_forwardThe government will be decreasingincome taxes. To an entity producingluxury bags, it would: A. Expect lower economic growth and may plan to produce less of these bags.B. Expect higher economic growth and may plan to produce more of these bags.C. Expect lower economic growth and may plan to produce more of these bags.D. Expect higher economic growth and may plan to produce less of these bags.arrow_forwardCompanies go global for various reasons. Although becoming a multinational corporation provides prospects for high returns and diversification, it makes financial management more complicated for financial executives and managers. Based on your understanding of the factors that complicate financial management in multinational firms, complete the following statement: Compared to domestic corporations, multinational corporations have (increased or reduced) risk from exchange rate fluctuations.arrow_forward

- You are an Acquisition Offer for an Investment Bank. You work in the High- Tech Investment Division of the Investment Bank. You understand high tech companies come and go very quickly. You also understand that the technology changes so quickly that a long-term forecast can be worthless very quickly. It is a changing market. You have been offered the opportunity to acquire a Silicon Valley based high tech company. You must decide if you recommend making the acquisition. You have been told that you must operate with a 6.0% WACC. You have decided that you will make your recommendation based upon a four-year forecast. The Company: The company, MERCO, makes processing chips for Intel. MERCO has signed two contracts with Intel. The first expires in two years and pays the company an annual amount of $1,924,261 and $2,212,900 for each year. The second contract was signed because Intel was happy with the work MERCO had done for it. The…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardInvestment advisors recommend risk reduction through international diversification. International investing allows you to take advantage of the potential for growth in foreign economies, particularly in emerging markets. Janice Wong is considering investment in either Europe or Asia. She has studied these markets and believes that both markets will be influenced by the U.S. economy, which has a 21% chance for being good, a 52% chance for being fair, and a 27% chance for being poor. Probability distributions of the returns for these markets are given in the accompanying table. Return Rates in Europe: Good, 10%; Fair, 4%; Poor, -3% Return Rates in Asia: Good, 24%; Fair, 4%; Poor, -18% a. Find the expected value and the standard deviation of returns in Europe and Asia. (Round intermediate calculations to at least 4 decimal places and final answers to 2 decimal places.)arrow_forward

- QuickBank has decided to lower the interest rate it charges on business loans in order to attract more business. It has succeeded in boosting the number of loan applications, but it finds that many of the applicants turn out to be very poor credit risks. This illustrates the problem known as adverse selection moral hazard the principal-agent porblem diversificationarrow_forwardM4arrow_forwardYou recently found out that when the market is in recession, ALL assets seem to suffer from some degree of liquidity problems as there are less trades than usual, and thus it is hard to sell an asset without losing some of its fair value. So, you concluded that at least some portion of liquidity risk must be systematic in nature and therefore it must be compensated by the market. To verify this, you cut the market portfolio in half by the illiquidity measure developed by Amihud (2002) [So that you have one relatively liquid portfolio and one relatively illiquid portfolio. Assume that this measure is reliable.] and calculated the market liquidity risk premium as follows: Market liquidity risk premium = Expected return on the illiquid portfolio - Expected return on the liquid portfolio = [E(RIL) - E(RL)] Then you formed 5 portfolios from the entire market based on liquidity (Amihud measure) and estimate the factor loading β (called liquidity beta) of each portfolio using [RIL - RL] as…arrow_forward

- Which of the following limits the market from becoming a fully efficient market? New information takes time to process. Obtaining new information is costly. The existence of closed end investment companies. Both a. and b. are correct. All of the above answers are correct. None of the above answers is correct.arrow_forwardIf a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. Because the investment cost is increased, the project's expected rate of return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows: Cost of equity from new stock = r, D1 +8 Po(1-F) The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. The firm's current common stock price, Po, is $25.00. If it needs to issue…arrow_forwardWhat comment or conclusion can be made about this? Large amounts of national debt can lead to higher interest rates and lower stock prices. Stocks are a reflection of investor confidence. If those investors lose confidence in where those companies operate then their stock price will take a hit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education