Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

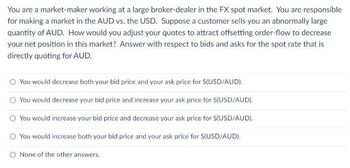

Transcribed Image Text:You are a market-maker working at a large broker-dealer in the FX spot market. You are responsible

for making a market in the AUD vs. the USD. Suppose a customer sells you an abnormally large

quantity of AUD. How would you adjust your quotes to attract offsetting order-flow to decrease

your net position in this market? Answer with respect to bids and asks for the spot rate that is

directly quoting for AUD.

You would decrease both your bid price and your ask price for S(USD/AUD).

O You would decrease your bid price and increase your ask price for S(USD/AUD).

You would increase your bid price and decrease your ask price for S(USD/AUD).

You would increase both your bid price and your ask price for S(USD/AUD).

O None of the other answers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please answer fast I will rate for you sure....arrow_forwardSelect all of the following statements that accurately compare or contrast forwards and options: Group of answer choices Taking naked long positions in either a call or forward will lead to an overall long position in the underlying security. Options and forwards always have identical payoffs if the spot price remains the same. Both options and forwards can be used to reduce exposure to foreign exchange risk. Going long a naked put option and going short a naked forward both cause unlimited liability. Both options and forwards require the payment of a premium at the initiation of the contract. Forward contracts impose obligations on both parties in the transaction. Options contracts only impose an obligation on one party.arrow_forwardThe ability to buy on margin is one advantage of futures. Another is the ease with which one can alter one’s holdings of the asset. This is especially important if one is dealing in commodities, for which the futures market is far more liquid than the spot market.arrow_forward

- Which of the following statements is most accurate? A stop-sell order is placed by a bullish investor above the current market price. A stop-buy order is placed by a bearish investor above the current market price. A stop-sell order is placed by a bearish investor below the current market price. A stop-sell order is placed by a bullish investor at the current market price. A stop-sell order is placed by a bearish investor at the current market price.arrow_forwardIn an efficient market, the price of a security will: Multiple Choice always rise immediately upon the release of new information with no further price adjustments related to that information. react to new information over a two-day period after which time no further price adjustments related to that information will occur. rise sharply when new information is first released and then decline to a new stable level by the following day. react immediately to new information with no further price adjustments related to that information.arrow_forwardWhat is correct option and incorrect option with explanation please without plagiarism please Introduction and explanation and final answer required pleasearrow_forward

- You recently found out that when the market is in recession, ALL assets seem to suffer from some degree of liquidity problems as there are less trades than usual, and thus it is hard to sell an asset without losing some of its fair value. So, you concluded that at least some portion of liquidity risk must be systematic in nature and therefore it must be compensated by the market. To verify this, you cut the market portfolio in half by the illiquidity measure developed by Amihud (2002) [So that you have one relatively liquid portfolio and one relatively illiquid portfolio. Assume that this measure is reliable.] and calculated the market liquidity risk premium as follows: Market liquidity risk premium = Expected return on the illiquid portfolio - Expected return on the liquid portfolio = [E(RIL) - E(RL)] Then you formed 5 portfolios from the entire market based on liquidity (Amihud measure) and estimate the factor loading β (called liquidity beta) of each portfolio using [RIL - RL] as…arrow_forwardBehavioural finance is arguably most useful in explaining asset prices when there are significant numbers of “noise traders” and limits to arbitrage. Why is this so?arrow_forwardMarkets are efficient when prices adjust rapidly to new information, continuous markets exist, and large dollar trades can be absorbed without large price movements. True or Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education