ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:%24

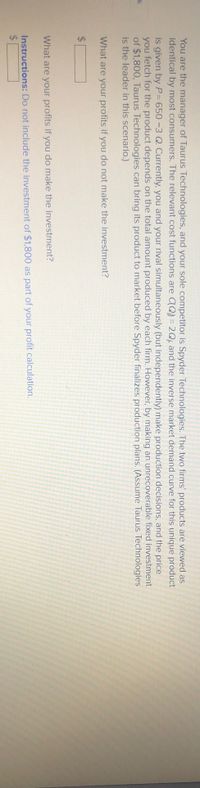

You are the manager of Taurus Technologies, and your sole competitor is Spyder Technologies. The two firms' products are viewed as

identical by most consumers. The relevant cost functions are CQ) = 2Q; and the inverse market demand curve for this unique product

is given by P= 650-3 Q. Currently, you and your rival simultaneously (but independently) make production decisions, and the price

you fetch for the product depends on the total amount produced by each firm.However, by making an unrecoverable fixed investment

of $1,800, Taurus Technologies can bring its product to market before Spyder finalizes production plans. (Assume Taurus Technologies

is the leader in this scenario.)

k

What are your profits if you do not make the investment?

%24

What are your profits if you do make the investment?

Instructions: Do not include the investment of $1,800 as part of your profit calculation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Can someone please explain how to answer this using piecewise function?arrow_forwardAssume that there are two firms in the market described by the inverse demand function P(q1,q2)=186 - (2/2)(q1+q2). Firm 1 has marginal costs of 51 and decides on first. Firm 2 has marginal costs of 62 and moves second. Both firms decide on quanties once. How much does firm 1 produce in equilibrium? (answer to 2 decimal places)arrow_forwardFirm 1 and firm 2 compete with each other by choosing quantities. The market demand is given by P(Q) = ( 300 − Q, if Q < 300) (0, otherwise), where Q = q1 + q2. Firm 1 has a cost function C1(q1) = 40q1, and firm 2 has a cost function C2(q2) = 50q2. Answer the following questions. 1. Assume the game lasts only one period. Compute the equilibrium price, quantities and profits for both firms. 2. If firm 1 becomes the monopolist on this market, what quantities will firm 1 choose to produce? Denote this quantity as QM. 3. One possible strategy is that each firm produces QM 2 . Would the resulting outcome be better for both firms (Pareto improvement)? Explain why this is not the equilibrium in the one period game. 4. Assume this game is infinitely repeated and the interest rate in this economy is r. For what values of r the strategy in (3) is sustainable by using a “Grim Trigger” strategy?arrow_forward

- Consider a duopoly with homogenous goods where Firm 1 has the following production function: Q1 = F1(L,K) = L1/2 K1/2, where Q and K are measured in units and L in hours. Firm 2 uses labour and capital as well but has a different production function, given by Q2 = F2(L,K) = L1/3 K2/3. You may assume that the market for labour and capital is perfectly competitive and the current wage rate is £40 and the rental rate on capital is £10. Both firms sell their products on the same market with inverse demand function P = 52 – (Q1 + Q2), where P is measured in pound sterling. Which production function(s) exhibit(s) decreasing returns to scale? Suppose Firm 1 wishes to produce 6 units. What is the cost minimising input mix for Firm 1? Suppose Firm 2 wishes to produce 4 units. What is the cost minimising input mix for Firm 2? Assume both firms now have the option to produce either 4 units or 6 units. We will consider the situation where both firms simultaneously, but independently,…arrow_forwardA manufacturer of fine pens produces in two plants. The total cost of producing in the first plant is given by TC1 = yi + 100. The total cost of producing in the second plant is given by TC2 + 200. 3 In these cost functions, y1 corresponds to the number of pens produced in the first plant, and y2 corresponds to the number of pens produced in the second plant. Suppose the firm's marginal cost is $256. If the firm is minimizing costs, the firm must be producing pens.arrow_forwardThere are two identical firms in an industry, 1 and 2, each with cost function , i = 1,2. The industry demand curve is P = 100 − 5X where industry output, X, is the sum of the two firms’ outputs (X1 + X2). (a) If each firm makes its output decisions on the assumption that the other will not react to its choices (the Cournot assumption), what is the equilibrium output for each firm? What is the equilibrium price? (b) Suppose that each firm takes it in turn to choose its level of output, on the assumption that the other’s output level is fixed. Would the process of adjustment be stable? (c) Suppose that firm 1 introduces a cost-saving innovation, so that its cost curve becomes C1 = 8X1. Firm 2’s cost curve and the industry demand curve are unchanged. What happens to the equilibrium quantity produced by each firm and to market price?arrow_forward

- Assume the inverse demand function in a market is given by P(Q) = 500 - Q where Q is the total industry output, that is the sum of the output of all firms in the market. There are two firms (indexed by i = 1,2) who both have a cost of producing the good given by c(qi) = 10 * qi The two firms are competing in the Cournot manner, that is they choose their quantities simultaneously in order to maximize profits.arrow_forwardConsider an industry with N firms that compete by setting the quantities of an identical product simultaneously. The resulting market price is given by: p = 1000 − 4Q. The total cost function of each firm is C(qi) = 50 + 20qi . (a) Derive the output reaction of firm i to the belief that its rivals are jointly producing a total output of Q-i . Assuming that every firm produces the same quantity in equilibrium, use your answer to compute that quantity. (b) Suppose firms would enter (exit) this industry if the existing firms were making a profit (loss). Write down a mathematical equation, the solution to which would give you the equilibrium number of firms in this industry. You don’t have to solve this equation.arrow_forwardYou are the manager of BlackSpot Computers, which competes directly with Condensed Computers to sell high-powered computers to businesses. From the two businesses’ perspectives, the two products are indistinguishable. The large investment required to build production facilities prohibits other firms from entering this market, and existing firms operate under the assumption that the rival will hold output constant. The inverse market demand for computers is P = 5,900 − Q, and both firms produce at a marginal cost of $800 per computer. Currently, BlackSpot earns revenues of $4.25 million and profits (net of investment, R&D, and other fixed costs) of $890,000. The engineering department at BlackSpot has been steadily working on developing an assembly method that would dramatically reduce the marginal cost of producing these high-powered computers and has found a process that allows it to manufacture each computer at a marginal cost of $500. How will this technological advance impact…arrow_forward

- There are only two driveway paving companies in a small town, Asphalt, Inc. and Blacktop Bros. The inverse demand curve for paving services is ?= 2040 ―20? where quantity is measured in pave jobs per month and price is measured in dollars per job. Assume Asphalt, Inc. has a marginal cost of $100 per driveway and Blacktop Bros. has a marginal cost of $150. Answer the following questions: Determine each firm’s reaction curve and graph it. How many paving jobs will each firm produce in Cournot equilibrium? What will the market price of a pave job be? How much profit does each firm earn?arrow_forwardKatie's Quilts is a small retailer of quilts and other bed linen products. Katie currently purchases quilts from a large producer for $100 each and sells them in her store at a price that does not change with the number of quilts that she sells. Katie is considering vertically integrating by making her own quilts. If the fixed cost of vertically integrating is $25,000 and she can produce quilts at Homework: Homework 7 (Lecture 6) Save Score: 0 of 1 pt 6 of 10 (8 complete) HW Score: 80%, 8 of 10 pts Text Question 4.2 Ques $50 per quilt, her total cost of producing quilts, q, herself is C=25,000+50q. How many quilts does Katie need to sell for vertical integration to be a profitable decision? For vertical integration to be profitable, Katie must sell at least nothing quilts. (Enter your response rounded to the nearest whole number.)arrow_forwardconsider a market with inverse demand P(Q) = 10 − Q and two firms with cost curves C1(q1) = 2q1 and C2(q2) = 2q2 (that is, they have the same marginal costs and no fixed costs). They compete by choosing quantities. Suppose that Firm 1 chooses quantity first and is able to credibly commit to this choice. Then firm 2 choose its quantity after observing firm 1’s quantity. In the SPNE of this game, what is the price faced by consumers?- p = 3- p = 4- p = 5- p = 6- p = 7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education