ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

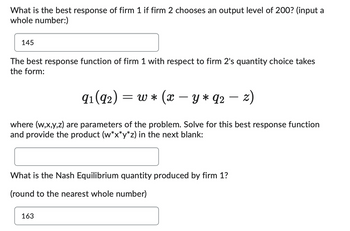

Transcribed Image Text:What is the best response of firm 1 if firm 2 chooses an output level of 200? (input a

whole number:)

145

The best response function of firm 1 with respect to firm 2's quantity choice takes

the form:

91 (92) = = w* (x

−

-Y * 92 − 2)

-

where (w,x,y,z) are parameters of the problem. Solve for this best response function

and provide the product (w*x*y*z) in the next blank:

What is the Nash Equilibrium quantity produced by firm 1?

(round to the nearest whole number)

163

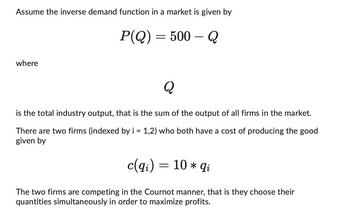

Transcribed Image Text:Assume the inverse demand function in a market is given by

P(Q) = 500 - Q

where

Q

is the total industry output, that is the sum of the output of all firms in the market.

There are two firms (indexed by i = 1,2) who both have a cost of producing the good

given by

c(qi)

=

10 * qi

The two firms are competing in the Cournot manner, that is they choose their

quantities simultaneously in order to maximize profits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- When the admission price for a baseball game was $4 per ticket, 50,000 tickets were sold. When the price was raised to $5, only 45,000 tickets were sold. Assume that the demand function is linear and that the variable and fixed costs for the ball park owners are $0.10 and $95,000 respectively. (a) Find the profit P as a function of x, the number of tickets sold. P(x) = (b) Select the graph of P. y 150000 y 150000 150 000 100 000 100 000 100 000 50 000 50 000 50 000 20000 40 000 60 00p 20000 40 000 60 000 20000 40 000 60 000 - 50 000 -50 000 -50 000 -100 000 100000 100000 The xy-coordinate plane is given. The curve starts at the approximate point (0, 3,000), goes up and right becoming less steep, and exits the window at the approximate point o-150000 O o-150000L O O (70,000, 69,000). 150000 100 000. 50 000- 20000 40 000 60 do0 - 50 000 100 000- o 150 000arrow_forwardThe business venture involves the sale of decorative jewelry cases. It costs the startup $280 to produce 40 decorative jewelry cases a week while it costs $320 to produce 60 decorative cases per week as well. you and your partners are told that the demand, x, for your product is given as a linear function of price, p, where p(x)=15−0.02x Use the information above, to answer the following questions: 1. Given that the break even points are 16 and 634, If the intention is to make at most 800 jewellery cases a week, what range of quantity demanded can the startup ensure a profit is made. 2. Determine the Maximum Profit that can be made by this new business venture.arrow_forwardleave answer in calculator ready formarrow_forward

- Suppose that Quality Widgets Limited is an efficient small firm with cost functionC(q)=q3 - 10q2+100q + 196 and suppose also that the maximum level of weekly production is L=10. Determine:(d) their breakeven point, (e) their supply set.arrow_forwardThis question deals with cost curves and isoprofit curves. Keep in mind that the formula for a firm's cost function is: TC = FC + C(Q) TC → Total Costs: FC → Fixed Costs: C(Q) → Cost of production*Quantity produced → also known as Variable Costs Q2: Firms A and B are two firms supplying products in two separate differentiated goods markets. Equations (1) and (2) give the total cost functions of the two firms: - Firm A: TC = 2Q --- Equation (1) %3D - Firm B: TC = 10 + 2Q --- Equation (2) Each firm has the ability to produce a maximum quantity of 80,000 units in ten batches of 8,000. The cost of production per unit for each firm is $2. Firm B has a fixed cost of $10. (a) Plot isoprofit curves valuing $34,000 and $60,000 for each of the two firms. Can you provide an explanation for any differences that may exist? (b) Use the information given about firms A and B and appropriate diagrams/figures to explain how the equilibrium for both firms will change if a rival company increases its…arrow_forwardSuppose the Sunglasses Hut Company has a profit function given by P(q) - 0.01q² + 5q - 40, = where q is the number of thousands of pairs of sunglasses sold and produced, and P(q) is the total profit, in thousands of dollars, from selling and producing a pairs of sunglasses. A) Find a simplified expression for the marginal profit function. (Be sure to use the proper variable in your answer.) Answer: MP(q) = B) How many pairs of sunglasses (in thousands) should be sold to maximize profits? (If necessary, round your answer to three decimal places.) Answer: thousand pairs of sunglasses need to be sold. C) What are the actual maximum profits (in thousands) that can be expected? (If necessary, round your answer to three decimal places.) Answer: thousand dollars of maximum profits can be expected.arrow_forward

- Suppose that the inverse demand for aloe juice in Greece is given by P = 100 – 2Q, where P is the price per bottle (1000ml) of aloe juice and Q is the total quantity, i.e., number of bottles, supplied in the market. There are two aloe juice manufacturers in Greece, Aloe Health and Aloe Wealth, operating under similar cost conditions. Each manufacturer's cost function is C(q) = 4qi, i =1,2, where q¡ is the manufacturer's individual quantity produced and Q = qı + q2. (a) Based on demand conditions every year, they decide, independently of each other, the quantity of aloe juice that will be supplied, letting the market determine the price per bottle. Find the equilibrium price and each firm's profit in this market. %3D (b) Consider that the above two manufacturers form a cartel, agreeing to fix their total quantity in such a way that the market maintains a collusive price. For simplicity, the eventual cartel directory will determine the target total-quantity and price pair, and each firm…arrow_forward1 1 Consider the following cost function: c(w₁, W₂, y) = (w₁ + w₂)¹ y² (a) Find the marginal cost function, the average cost function, the supply function, and the demand function for input 1. (b) Sketch the supply curve and the demand curve for input 1. (c) What is the effect of an increase in the price of input 2 on the supply curve and the demand curve for input 1? Illustrate your answer. Solution: (excluding graphs) 1 1 дс MC = = 2 (w² + w²₁) ³y ду 1 _c_ (w² +w² )*y² _ y AC = -=-=-=- y 1 Supply: p =MC ⇒p = 2(w₁ +w₂₁) ¹y 1 1 1 = (w₁² + w²) ³ y To get demand for input 1, we use Shephard's lemma: x₁ = Cw₁ (w, y) = 4 (w^² + w² ) ² (; w₁, ²³y²) = (w ² + w² ) ² (w,₁ ²,²)arrow_forwardPlease solve this problem? THANK YOUarrow_forward

- is profit maximisation seen as local minimum or maximum? Is part (b) the correct way of doing first derivative? There is image of the questions, another image of the answers of part (a) and (b).arrow_forwardConsider a computer hardware production firm with total cost function TC = 2200+480Q+20Q2, and market demand function Qd = 190 – 2P; Q is output and P is market price. (a) Determine the firm’s Total Cost when it produces 120 units of output. (b) Determine the firm’s Marginal Cost when it produces 120 units of output. (c) Determine the firm’s Average Cost when it produces 120 units of output. (d) Find the market price of the firm’s output when it sells 120 units of output. (e) Determine whether the firm makes profit, or loss, at 120 units of output.arrow_forwardProfit Function Suppose the demand function (in dollars) for a certain product is given by.. 50,000-g 25,000 for 0arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education