FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

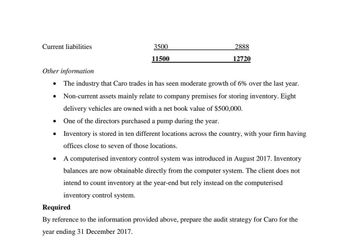

Transcribed Image Text:Current liabilities

3500

11500

2888

12720

Other information

•

•

The industry that Caro trades in has seen moderate growth of 6% over the last year.

Non-current assets mainly relate to company premises for storing inventory. Eight

delivery vehicles are owned with a net book value of $500,000.

One of the directors purchased a pump during the year.

Inventory is stored in ten different locations across the country, with your firm having

offices close to seven of those locations.

A computerised inventory control system was introduced in August 2017. Inventory

balances are now obtainable directly from the computer system. The client does not

intend to count inventory at the year-end but rely instead on the computerised

inventory control system.

Required

By reference to the information provided above, prepare the audit strategy for Caro for the

year ending 31 December 2017.

Transcribed Image Text:You are the audit manager in charge of the audit of Caro Ltd. The company's year-end is 31

December, and Caro has been a client for six years. The company purchases and resells

products for the energy industry including valves, fittings, pumps etc. Clients vary in size

from small operators to large companies. No manufacturing takes place in Caro.

Information on the company's financial performance is available as follows:

2017 Forecast

2016 Actual

$'000

$'000

Revenue

50,440

44,825

Cost of sales

(40.918)

(32.874)

Gross profit

9522

11951

Administration costs

(5194)

(4,952)

Distribution costs

(2,500)

(2.500)

Net profit

1828

4499

Non-current assets (at net book value) 4200

4900

Current assets

Inventory

250

1478

Receivables

6500

4552

Cash and bank

550

1790

Total assets

11500

12720

Capital and reserves

Share capital

1000

1000

Accumulated profits

5500

6574

Total shareholders' funds

6500

7574

Non-current liabilities

1500

2258

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- .arrow_forwardPlease help me to solve this questionarrow_forwardThe data shown were obtained from the financial records of Italian Exports, Inc., for March: Estimated Sales $540,000 Sales 567,932 Purchases 294,830 Ending Inventory* 10% Administrative Salaries 50,340 Marketing Expense** 5% Sales Commissions 2% Rent Expense 7,600 Depreciation Expense 900 Utilities 2,300 Taxes*** 15% *of next month's sales **of estimated sales ***of income before taxes Sales are expected to increase each month by 10%. Prepare a budgeted income statement. Round your answers to the nearest dollar. Italian Exports, Inc.Budgeted Income StatementFor the Month Ending Mar. 31, 2020 $Sales Cost of Goods Sold $Beginning Inventory Purchases $Cost of Goods Available for Sale Ending Inventory $Cost of Goods Sold Gross Profit Operating Expenses $Administrative Salaries Marketing Expenses Sales Commissions Rent Expense Depreciation Expense Utilities Total Operating…arrow_forward

- 11. Amina has a jewellery business in a well-established shop. Her most recent income statement shows the following key figures: This year Last year Sales 600,000 500,000 Cost of goods sold 350,000 300,000 Gross profit 250,000 200,000 A recent survey by the trade association shows that average sales in the sector increased by 17.3% from a year earlier and the average gross profit margin of firms in the sector was 38.3%. Which one of the following is TRUE? (A). Amina has a higher than average increase in sales, and a lower than average gross profit margin. (B). Amina has a lower than average increase in sales, and a higher than average gross profit margin. (C). Amina has a higher than average increase in sales and a higher than average gross profit margin. (D). Amina has a lower than average increase in sales, and a lower than average gross profit margin.arrow_forwardProvide Answer for this Questionarrow_forwardRotorua Products sells agricultural products in the burgeoning Asian market. The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows: Sales Cash Accounts receivable, net Inventory Total current assets Current liabilities Sales Current assets: Cash Accounts receivable, net Inventory Total current assets Current liabilities Year 11 Year 2 Year 3 Year 4 Year 5 $4,545,400 $4,737,850 $ 5,126,380 $5,421,900 $5,776,190 Year 1 $ 88,854 418,283 800,380 $ 1,307,517 $ 313,578 Required: 1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. Note: Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3). % % % % % % Year 2 $ 88,845 $ 77,057 435,833 587,279 $ 90,380 417,076 876,061 $1,383,517 $ 1,350,248 $ 1,466,414 $1,552,502 $ 346,822 $ 336,685 $ 335,107 $ 390,612 825,570 882,078 % % % % % % Year 3 % % % % Year 4 % % $ 80,928 569,984…arrow_forward

- [The following information applies to the questions displayed below.] Mears and Company has been operating for five years as an electronics component manufacturer specializing in cellular phone components. During this period, it has experienced rapid growth in sales revenue and in inventory. Mr. Mears and his associates have hired you as Mears's first corporate controller. You have put into place new purchasing and manufacturing procedures that are expected to reduce inventories by approximately one-third by year-end. You have gathered the following data related to the changes: Inventory (dollars in thousands) Beginning of Year $585,700 End of Year (projected) $392,310 Current Year Cost of goods sold P7-7 Part 1 (projected) $7,018,984 Required: 1. Compute the inventory turnover ratio based on two different assumptions: Note: Round your answers to 1 decimal place. a. Those presented in the above table (a decrease in the balance in inventory). b. No change from the beginning-of-the-year…arrow_forwardConn Man's Shops, a national clothing chain, had sales of $340 million last year. The business has a steady net profit margin of 8 percent and a dividend payout ratio of 35 percent. The balance sheet for the end of last year is shown. Cash Accounts receivable Inventory Plant and equipment Total assets Assets Balance Sheet End of Year (in $ millions) $ 24 39 81 $145 $289 Required new funds Liabilities and Stockholders' Equity Accounts payable Accrued expenses Other payables Common stock Retained earnings Total liabilities and stockholders' equity $ 63 20 36 48 122 $289 The firm's marketing staff has told the president that in the coming year there will be a large increase in the demand for overcoats and wool slacks. A sales increase of 10 percent is forecast for the company. All balance sheet items are expected to maintain the same percent-of-sales relationships as last year,* except for common stock and retained earnings. No change is scheduled in the number of common stock shares…arrow_forwardThe grocery industry has an annual inventory turnover of about 13 times. Organic Grocers, Inc., had a cost of goods sold last year of $11,310,000; its average inventory was $993,980. What was Organic Grocers' inventory turnover, and how does that performance compare with that of the industry? a) What was Organic Grocers' inventory turnover? times per year (round your response to two decimal places).arrow_forward

- A firm has an average account payable of of $75,000 and beginning inventory of $30,000.ending inventory is 80,000 The firm's cost of good sold is are $500,000 and Sales is 900,000 The firm's payable turnover isarrow_forwardAdams Furniture has a quick ratio of 2.00x, $37,575 in cash, $20,875 in accounts receivable, some inventory, total current assets of $83,500, and total current liabilities of $29,225. The company reported annual sales of $100,000 in the most recent annual report. Additionally, the company’s cost of goods sold is 75% of sales. Over the past year, how often did Adams Furniture sell and replace its inventory? 8.01x 3.29x 2.86x 2.99xarrow_forwardA company's total sales in a year were $2,710,000. The cost price of goods sold was $2,040,000. Given below are the overheads paid during the year. Item Wages Amount $198,500 Electricity and gas 15,300 Telephone 1,790 Rent of premises 41,090 Office expenses 17,030 At the end of the year, the company expanded by issuing new shares in the business. It planned to raise $2,450,000 through the issue of 70,00 shares. Calculate the price per share.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education