SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Don't use ai given answer accounting questions

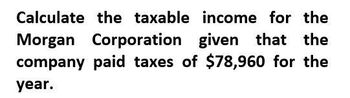

Transcribed Image Text:Calculate the taxable income for the

Morgan Corporation given that the

company paid taxes of $78,960 for the

year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bangura, Incorporated has regular taxable income of $932,500,000 and AFSI of $1,437,100,000. Required: Compute Bangura's regular tax liability, tentative minimum tax, AMT (if any) and total tax due. Regular tax liability Tentative minimum tax AMT Total tax duearrow_forwardPatriot Corporation reports the following results for the current year: View the current year results. Read the requirements. Requirement a. What are Patriot's taxable income and income tax liability for the current year? Begin by computing Patriot's taxable income. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Gross income Minus: Taxable income Requirements a. What are Patriot's taxable income and income tax liability for the current year? b. How would your answers to Part a change if Patriot's short-term capital loss is $12,000 instead of $2,000? Print Done - X Current Year Results Gross profits on sales Long-term capital gain Long-term capital loss Short-term capital gain Short-term capital loss Operating expenses Print $ 159,000 7,000 8,000 9,000 2,000 70,000 Done Xarrow_forwardThe income tax T owed in a certain state is a function of the taxable income I, both measured in dollars. The formula is given below. T = 0.13I − 300 a) Express using functional notation the tax owed on a taxable income of $12,000. T (_______) Calculate the tax owed on a taxable income of $12,000. $ (_______) b) If your taxable income increases from $12,000 to $15,000, by how much does your tax increase? $(_______) (c) If your taxable income increases from $15,000 to $18,000, by how much does your tax increase? $(_______)arrow_forward

- please Given answer accounting questionarrow_forwardDetermine taxable income in each of the following instances. Assume that the corporation is a C corporation and that book income is before any income tax expense. Required: a. Book income of $52,000 including capital gains of $1,500, a charitable contribution of $1,100, and meals expenses of $4,000. b. Book income of $94,000 including capital losses of $2,500, a charitable contribution of $13,000, and meals expenses of $1,100. c. Book income of $77,000 including municipal bond interest of $1,050, a charitable contribution of $4,100, and dividends of $1,200 from a 10% owned domestic corporation. The corporation also has an $6,100 charitable contribution carryover. d. Book income of $131,000 including municipal bond interest of $1,250, a charitable contribution of $3,550, and dividends of $5,600 from a 70% owned domestic corporation. The corporation has a capital loss carryover of $4,550 and a capital gain of $1,100 in the current year. Amount a. Taxable income b. Taxable income c.…arrow_forwardtaxable income of $299373 that includes $19309 in dividends has how much of a tax liabilityarrow_forward

- Barth James Inc. has the following deferred tax assets and liabilities: 12,000 noncurrent deferred tax asset, and 10,500 noncurrent deferred tax liability. Show how Barth James would report these deferred tax assets and liabilities on its balance sheet.arrow_forwardWhat are the tax rates for FICA Social Security and FICA Medicare? What are the maximum taxable earnings amounts for each of these taxes?arrow_forwardEight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts: ($ in millions) Temporary Differences Reported First on: The Income Statement The Tax Return Revenue Expense Revenue Expense 1. $40 2. $40 3. $40 4. $40 5. 35 40 6. 40 35 7. 35 40 30 8. 35 40 25 30 Required:For each situation, determine taxable income, assuming pretax accounting income is $300 million.arrow_forward

- Eight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts: 1. 2. 3. 4. 5. 6. 7. 8. ($ in millions) Temporary Differences Reported First on: The Income Statement The Tax Return Revenue $22 7 8 17 17 17 Expense $ 22 2222 Situations Taxable Income 1 $ 122 2 3 4 5 6 Revenue $22 17 7 Expense $22 Required: For each situation, determine taxable income, assuming pretax accounting income is $120 million. Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10). 12 12arrow_forwardA. Compute for the Net Taxable Income and Personal Income Tax. 1. A. Annual Basic Salary B. 13th Month Pay and Other Benefits C. Mandatory Contributions D. Annual Gross Income (A+B) E. Deductions and Exemptions (B+C) P 397,860.00 33,155.00 6,542.00 Net Taxable income (D-E) Personal Income Tax B. Compute for the 4 general deductions of the following employees: 1. A sales manager in Kopimo, Inc., a private company, earning P42,000 monthly with sales commission of P36,000 for the year. 2. A public school teacher earning P24,495 monthly with chalk allowance of P1,500, uniform allowance of P6,000 and performance bonus of P12,000. 3. An IT manager in Accentuate Corp., a private company, earning P55,000 monthly and laundry allowance of P15,000 for the whole year. C. Basic Applications. Solve for the following: 1. Conchita works as a service crew member in a fast-food chain in a mall. She has an hourly wage rate of P50. Her rest days are every Wednesday and Saturday. Consider the following…arrow_forwardEight Independent situations are described below. Each involves future deductible amounts and/or future taxable amounts: 1. 2. 3. 5. 6. 7. 2 The Income Statement Revenue 3 4 5 6 7 8 ($ in millions) Temporary Differences Reported First on: The Tax Return $24 19 19 19 Expense $24 Situations Taxable Income 1 24 24 24 24 Revenue $24 19 9 Expense Required: For each situation, determine taxable income, assuming pretax accounting income is $140 million. (Enter your answers in millions (I.e., 10,000,000 should be entered as 10).) $24 14 14arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you