Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

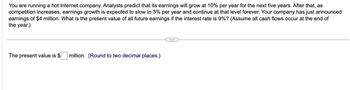

Transcribed Image Text:You are running a hot Internet company. Analysts predict that its earnings will grow at 10% per year for the next five years. After that, as

competition increases, earnings growth is expected to slow to 3% per year and continue at that level forever. Your company has just announced

earnings of $4 million. What is the present value of all future earnings if the interest rate is 9%? (Assume all cash flows occur at the end of

the year.)

The present value is $ million. (Round to two decimal places.)

...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You are building a free cash flow to the firm model. You expect sales to grow from $2 billion for the year that just ended to $2.2 billion five years from now. Assume that the company will not become any more or less efficient in the future. Assume that the company will grow at a constant rate for 5 years, and then at a constant rate of 1.424488% for year 6 and onward after that. Use the following information to calculate the value of the equity on a per-share basis. a. Assume that the company currently has $660 million of net PP&E. b. The company currently has $220 million of net working capital. c. The company has operating margins of 12 percent and has an effective tax rate of 28 percent. d. The company has a weighted average cost of capital of 10 percent. This is based on a capital structure of two-thirds equity and one-third debt. e. The firm has 2 million shares outstanding. A Do not round intermediate calculations. Round your answer to the nearest centarrow_forwardYou are valuing your business ready for its initial public offering. You have determined the most recent annual (2021) cash-flow to the firm, was $30 million. You expect that these cash-flows will increase at an 10% annual rate (g1) over the next two years. At the end of two years (the end of 2023), the cash-flow growth rate will drop to 5% per year (g2) in perpetuity. The firm’s WACC is 15%. Calculate the expected value of your firm.arrow_forwardYour firm currently has net working capital of $115,000 that it expects to grow at a rate of 4.0% per year forever. You are considering some suggestions that could slow that growth to 3.0% per year. If your discount rate is 16.0%, how would these changes impact the value of your firm? Firm value would increase by $ (Give answer to nearest dollar) Checkarrow_forward

- Assume that the economy can experience high growth, normal growth, or recession. Under these conditions you expect the following stock market returns for the coming year: State of the Economy High Growth Normal Growth Recession. Probabilities 0.2 0.7 0.1 Return +30% +12% -15% 1. Compute the expected value of a $2000 investment over the coming year. If you invest $2,000 today, how much money do you expect to have next year? 2. Compute the standard deviation of the percentage return over the coming year.arrow_forwardYou are valuing a firm that is expected to earn cash flows that grow at 10% for the first five years and at 5% in perpetuity thereafter. The forecasted cash flow next period is $100m (which includes the 10% growth) and you estimate a discount rate of 11%. What is the present value of these cash flows?arrow_forwardToday the Gamma Corporation has just paid an annual dividend of $2 per share. You expect the annual dividends to grow at a constant rate of 3% forever. Find the present value of the all future cash dividends if the appropriate required rate of return per year is 13%.arrow_forward

- You are investing $500 per month in an account where you expect a long term growth rate of 6% compounded monthly. If you do this for seven years, what will your account balance be at the end of seven years? $54,352 $52,037 $51,459 $52,797arrow_forwardXYZ, Inc. has been growing at 10% per year. You believe this rate will continue for 4 more years, and then will increase to 15% per year and remain indefinitely. If the most recent dividend paid was $3 (D0) and the required return is 10%, then what is the value of the stock today? create an excel filearrow_forward2.Your expected income will grow at 6% per year for the next five years. After that your incomegrowth is expected to slow to 3% per year and continue at that level forever. Your currentincome is AED 500,000. What is the present value of all future earnings if the interestrate is 8%? (Assume all cash flows occur at the end of the year.)arrow_forward

- Emerald City Corporation (ECC) is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect ECC to begin paying a dividend of $2.00 three years from today. The dividend should grow rapidly: at a rate of 30% per year during years 4 and 5. After Year 5, growth should be a constant 5% per year forever. If the required return on ECC is 9%, what is the value of the stock today?arrow_forwardLaurel Enterprises pays annual dividends, and the next dividend is expected to be in one year. Laurel expects earnings next year of $3.58 per share and has a 50% retention rate, which it plans to keep constant. Its equity cost of capital is 11%, which is also its expected return on new investment; this is expected to continue forever. What do you estimate the firm's current stock price to be? (Hint: its next dividend is due in one year.) C The current stock price will be $ (Round to the nearest cent.)arrow_forwardSmart tech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Smart tech to begin paying dividends, beginning with a dividend of $0.50 coming 3 years from today. The dividend should grow rapidly - at a rate of 20% per year - during Years 4 and 5, but after Year 5, growth should be a constant 10% per year. If the required return on Smart tech is 14%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education