FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:+

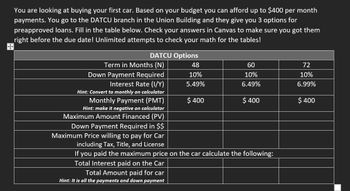

You are looking at buying your first car. Based on your budget you can afford up to $400 per month

payments. You go to the DATCU branch in the Union Building and they give you 3 options for

preapproved loans. Fill in the table below. Check your answers in Canvas to make sure you got them

right before the due date! Unlimited attempts to check your math for the tables!

DATCU Options

Term in Months (N)

Down Payment Required

48

60

72

10%

10%

10%

Interest Rate (I/Y)

5.49%

6.49%

6.99%

Hint: Convert to monthly on calculator

$ 400

$ 400

$ 400

Monthly Payment (PMT)

Hint: make it negative on calculator

Maximum Amount Financed (PV)

Down Payment Required in $$

Maximum Price willing to pay for Car

including Tax, Title, and License

If you paid the maximum price on the car calculate the following:

Total Interest paid on the Car

Total Amount paid for car

Hint: It is all the payments and down payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Pls help me get the answer correctly thanks a lotarrow_forwardFast pls solve this question correctly in 5 min pls I will give u like for sure Savitr Prudencia has to make two payments of 2,000 each, within 6 and 9 months, to deal with some extraordinary repairs from the community of neighbors. Calculate how much money Doña Prudencia must place today in an account that offers 6% annual interest, to meet these payments.arrow_forwardI need answer typing clear urjent no chatgpt used i will give 5 upvotesarrow_forward

- Vijay shiyalarrow_forwardCapital One is advertising a 60-month, 5.99% APR motorcycle loan. If you need to borrow $8,000 to purchase your dream Harley Davidson, what will your monthly payment be? Question content area bottom Part 1 Your monthly payment will be $enter your response here. (Round to the nearest cent.)arrow_forwardHow much will Molly’s monthly payment be?arrow_forward

- You want to buy a $13,000 car. The company is offering a 3.46% monthly interest rate for 60 months (5 years). What will your monthly payments be? Question Help: D Video 1 D Video 2 D Video 3 Submit Questionarrow_forwardHey! I need help with #29, thank you!arrow_forwardUse the following to answer questions 31 – 33 You want a new car. At the dealership, you find a car that you like. The dealership gives you two payment options: 1. Pay $23,000 in cash for the car today...OR Pay $370.41 at the end of each month for six years at 5% (0.41667% monthly for 72n). 2. How much CASH (in total) up paying if you choose to make monthly 31. $ will you end payments for the car? 32. How much interest (in total) $ will you pay if you choose to make payments instead of paying cash for the car today? 33. $ How much interest has accrued by the time the first car payment is due (round to two decimal places)?arrow_forward

- a and b pleasearrow_forwardP/Y = 12 PV C/Y = 12 PMT = $200.61 PMT: END BEGIN Monthly payment would be $ 200.61 After making payments for 19 months, Natasha decides to repay the loan in full. Use this information and the monthly payment, found above, to calculate her payoff amount (PV) on the loan. How many payments does Natasha have left (Use this as N in the TVM Solver below)? Calculate the payoff amount (PV). N C/Y = FV = 1% = P/Y = PV = N = 5 years PMT = FV = 10,500 PMT: END BEGIN 1% = 5.51%arrow_forwardPls solve this question correctly in 5 min i will give u like for surearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education