Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

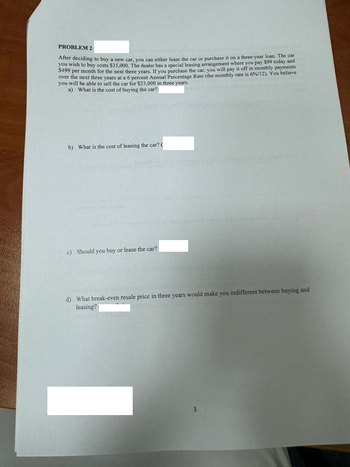

Transcribed Image Text:PROBLEM 2

After deciding to buy a new car, you can either lease the car or purchase it on a three-year loan. The car

you wish to buy costs $35,000. The dealer has a special leasing arrangement where you pay $99 today and

$499 per month for the next three years. If you purchase the car, you will pay it off in monthly payments

over the next three years at a 6 percent Annual Percentage Rate (the monthly rate is 6%/12). You believe

you will be able to sell the car for $23,000 in three years.

a) What is the cost of buying the car?

b) What is the cost of leasing the car? (

c) Should you buy or lease the car?

d) What break-even resale price in three years would make you indifferent between buying and

leasing?

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are considering the purchase of a $54,000 Ford F-150 Raptor. If you are financing the truck for 60 months and the auto loan annual rate is 3.5%, what is your monthly car payment? (Round your answer to the nearest hundredth; two decimal places) Your Answer: Answerarrow_forwardCreate an amortization table in Excel for a new car loan for 30,000 for six years at 5%. Determine the total amount of interest you will pay on this loan. Copy the table from Step 1, make an extra principal payment of $2,000 on the first day of year two. How does this change the total interest you will pay on this loan? Create an amortization table in Excel for a new car loan for 30,000 for three years at 5%. Determine the total amount of interest you will pay on this loan. Copy the table from Step 3, change the interest rate to 2%. How does this change the total interest that you will pay on the loan? What is the total amount you will pay for the car (principal and interest) in each of the steps 1, 2, 3 and 4.arrow_forwardAfter deciding to acquire a new car, you realize you can either lease the car or purchase it with a two-year loan. The car you want costs $34,000. The dealer has a leasing arrangement where you pay $97 today and $497 per month for the next two years. If you purchase the car, you will pay it off in monthly payments over the next two years at an APR of 6 percent. You believe that you will be able to sell the car for $22,000 in two years. What is the present value of purchasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of lease $ What is the present value of leasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of purchase $ What break-even resale price in two years would make you indifferent between buying and leasing? (Do not round intermediate calculations and round your answer to 2…arrow_forward

- You have decided to purchase a new car. The car costs $27,500. The dealer is offering to finance the car for 6 years at a rate 8.75%. How much would your monthly payment be? Question 3 options: $492 $495 $504 $518 $511arrow_forwardYou open a new business and need a new laptop computer. You decide on a Knox Computer Solutions for $1499 due to the business software that is included. If the sales tax is 4.25% of the purchase price and you finance the total cost, including sales tax, for 3 years at the annual interest rate of 8.4%, find the monthly payment amount.arrow_forwardYou want to purchase a new company car for employees to visit clients. If you purhcase the car for $60,000 with a loan that has an APR of 12% in which interest accrues monthly, what would you expect the monthly payments to be if the term of the loan is 5 years? $1,683 $572 $1,322 $1,000arrow_forward

- You are purchasing a new car for $27,600. The dealership offers you three options: 0% financing: 0 down and 0% financing for 48 months. Rebate: 0 down. If you choose the rebate, you will need to secure a loan for the balance at your local bank. Down payment: Make a down payment of 5% or more and get financing at 1.5% compounded monthly for 48 months. The rebate offer is $1900, and you can obtain a car loan at your local bank for the balance at 2.03% compounded monthly for 48 months. If you choose the rebate, what is your monthly payment? $ _______ . Round to the nearest dollar.arrow_forwardYou are purchasing a new car for $27,600. The dealership offers you three options: • 0% financing: 0 down and 0% financing for 48 months. • Rebate: 0 down. If you choose the rebate, you will need to secure a loan for the balance at your local bank. • Down payment: Make a down payment of 5% or more and get financing at 1.5% compounded monthly for 48 months:arrow_forwardNot sure where to start this one Suppose that you purchase a new home that costs $180,000. A local bank offers you a 3% fixed rate mortgage loan for 30 years. Also, you are required to make a 20% down payment immediately. a) Find your monthly payment. b) Find the interest amount and the principal amount in your first monthly payment. c) Find the total interest paid for 30 years.arrow_forward

- Calculating Loan Payments You want to buy a new sports coupe for $69,300, and the finance office at the dealership has quoted you a loan with an APR of 5.6 percent for 48 months to buy the car. What will your monthly payments be? What is the effective annual rate on this loan?arrow_forwardAfter starting your first full-time job out of college, you decide to buy a new car for $12,000. Using Excel, create a complete amortization table for this car-loan: You make 36 equal end- of-month payments. The discount rate is 7.25% compounded monthly. How much would you owe after the 15th payment is made? Use excel to solvearrow_forwardPlease answer with explanation. I will really upvotearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education