FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

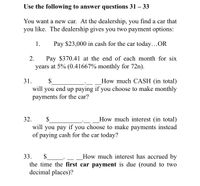

Transcribed Image Text:Use the following to answer questions 31 – 33

You want a new car. At the dealership, you find a car that

you like. The dealership gives you two payment options:

1.

Pay $23,000 in cash for the car today...OR

Pay $370.41 at the end of each month for six

years at 5% (0.41667% monthly for 72n).

2.

How much CASH (in total)

up paying if you choose to make monthly

31.

$

will

you

end

payments for the car?

32.

How much interest (in total)

$

will you pay if you choose to make payments instead

of paying cash for the car today?

33.

$

How much interest has accrued by

the time the first car payment is due (round to two

decimal places)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You purchase a new TV with a store credit card for $800. You have a year to pay off the TV, but interest accrues. The nominal rate is 12% compounded weekly. You pay back the full amount plus interest in one year, How much do you owe? O a. 866.51 O b. 832.59 O c. 901.87 O d. 896arrow_forwardAfter starting your full-time job out of college, you decide to buy a new car for $85,000. Create a complete amortization table in excel for this car loan: You make 84 equal end-of-month payments. The discount rate is 6.5 percent compounded quarterly. How much would you owe after the 75 th payment? Please show both regualr and formula format of the spreadsheet.arrow_forwardYou are purchasing a new car for $27,600. The dealership offers you three options: 0% financing: 0 down and 0% financing for 48 months. Rebate: 0 down. If you choose the rebate, you will need to secure a loan for the balance at your local bank. Down payment: Make a down payment of 5% or more and get financing at 1.5% compounded monthly for 48 months: Use this information for the questions below. Use the Buying a Car information above to answer this question. You want to make monthly payments of $449, but you don't want a car loan over your head for more than 48 months, so you decide to go with the down payment option. How much of a down payment do you need to make? $_____ . Round to the nearest dollararrow_forward

- You are looking to buy a car. You can afford $370 in monthly payments for four years. In addition to the loan, you can make a $1,800 down payment. If interest rates are 9.00 percent APR, what price of car can you afford (loan plus down payment)? Note: Do not round intermediate calculations and round your final answer to 2 decimal places.arrow_forwardYou want to buy a car and you want your payments to be $500 per month. You can finance the car for 1.5% interest for 6 years. How much are you able to borrow for the loan? Assume monthly compounding. Do not enter the negative sign from your calculator (if there is one) or the dollar sign. Round to two decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education