ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

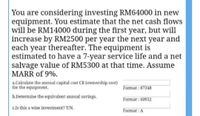

Transcribed Image Text:You are considering investing RM64000 in new

equipment. You estimate that the net cash flows

will be RM14000 during the first year, but will

increase by RM2500 per year the next year and

each year thereafter. The equipment is

estimated to have a 7-year service life and a net

salvage value of RM5300 at that time. Assume

MARR of 9%.

a.Calculate the annual capital cost CR (ownership cost)

for the equipment.

Format : 87348

b.Determine the equivalent annual savings.

Format: 60952

c.Is this a wise investment? Y/N.

Format: A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- not use ai pleasearrow_forwardThe cost of a fully installed new equipment is $ 15,000 and the service lifeat the end, the scrap value will be $ 2,000.If the useful life is 10 years and the annual compound interest is 6%What is the capitalized cost of the equipment?arrow_forwardYour firm is thinking about investing $200,000 in the overhaul of a manufacturing cell in a lean environment. Revenues are expected to be $36,000 in year one and then increasing by $12,000 more each year thereafter. Relevant expenses will be $5,000 in year one and will increase by $2,500 per year until the end of the cell's five-year life. Salvage recovery at the end of year five is estimated to be $8,000. What is the annual equivalent worth of the manufacturing cell if the MARR is 12% per year?arrow_forward

- You are being asked to evaluate the worthiness of an investment that requires you to spend $120,000 today in return for receiving $25,000 each year for seven years (starting one year from now). At the end of the seven year study period, the investment can be sold for $10,000. The MARR = 12% per year. Compute the AW of this investment. Round your answer to the nearest dollar. Answer should be -301arrow_forwardDraw cash flow as well !!arrow_forwardWhat is the capitalized cost of the machine with an initial cost of 250,000.00 maintenance cost of 10,000.00 and an infinite life? The effective interest rate is 10%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education