ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

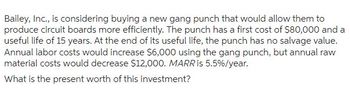

Transcribed Image Text:Bailey, Inc., is considering buying a new gang punch that would allow them to

produce circuit boards more efficiently. The punch has a first cost of $80,000 and a

useful life of 15 years. At the end of its useful life, the punch has no salvage value.

Annual labor costs would increase $6,000 using the gang punch, but annual raw

material costs would decrease $12,000. MARR is 5.5% /year.

What is the present worth of this investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Most likely estimates for a project are as follows MARR Useful life Initial investment Receipts Expenses (R-E) Determine whether the statement "An initial investment of $3,450 is profitable." is true or false Click the icon to view the relationship between the PW and the percent change in parameter Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. Choose the correct choice below. False O True 10% per year 6 years $3,000 $1,000/year BIODarrow_forwardQuestion 5 The second, Van Y, has a useful life of 10 years and will cost you $33,000 in Year 0. You expect it to earn the same additional $8,000 per year in profit, and have a salvage value of $5,000 at the end of Year 10. Using the coterminated assumptions and a study period of 15 years, what is the Future Worth of Van Y? Assume that you reinvest all cash flows at the MARR after the end of the useful life of the van. Typed numeric answer will be automatically saved.arrow_forwardGalvanized Products is considering the purchase of a new computer system for their enterprise data management system. The vendor has quoted a purchase price of $80,000. Galvanized Products is planning to borrow 1/4th of the purchase price from a bank at 19% compounded annually. The loan is to be repaid using equal annual payments over a 3-year period. The computer system is expected to last 5 years and has a salvage value of $7,000 at that time. Over the 5-year period, Galvanized Products expects to pay a technician $29,000 per year to maintain the system but will save $58,000 per year through increased efficiencies. Galvanized Products uses a MARR of 17%/year to evaluate investments. What is the external rate of return of this investment?arrow_forward

- A new highway is to be constructed. Design A calls for a concrete pavement costing $80 per foot with a 20-year life; four paved ditches costing $3 per foot each; and four box culverts every mile, each costing $10,000 and having a 20-year life. Annual maintenance will cost $1,600 per mile; the culverts must be cleaned every five years at a cost of $400 each per mile. Design B calls for a bituminous pavement costing $55 per foot with a 10-year life; four sodded ditches costing $1.40 per foot each; and four pipe culverts every mile, each costing $2,100 and having a 10-year life. The replacement culverts will cost $2,450 each. Annual maintenance will cost $2,600 per mile; the culverts must be cleaned yearly at a cost of $225 each per mile; and the annual ditch maintenance will cost $1.55 per foot per ditch. Compare the two designs on the basis of equivalent worth per mile for a 20-year period. Find the most economical design on the basis of AW and PW if the MARR is 12% per year. Click the…arrow_forwardPlease use a financial calculator to solve. Be sure to list your steps. You are evaluating two different silicon wafer milling machines. The Techron I costs $237,000, has a three-year life, and has pretax operating costs of $62, 000 per year. The Techron II costs $ 415,000, has a five - year life, and has pretax operating costs of $ 35,000 per year. For both milling machines, use straight - line depreciation to zero over the project's life and assume a salvage value of $39, 000. If your tax rate is 21 percent and your discount rate is 8 percent, compute the EAC for both machines. (Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardA deep water port for imported liquefied natural gas (LNG) is needed for three years. At the end of the third year, it will cost more to dismantle the LNG facility than it produces in revenues. The cash flows are estimated as follows: The IRR for this LNG facility is closest to which choice below? Choose the closest answer below. A. The IRR for the LNG facility is 9.5% per year. B. The IRR for the LNG facility is 4.7% per year. C. The IRR for the LNG facility is 12.2% per year. D. The IRR for the LNG facility is 14.6% per year. EOY 0 1 2 3 Net Cash Flow - $54 million 44 million 40 million - 24 millionarrow_forward

- 5.15arrow_forwardWhat would be the annual worth on this investment?arrow_forwardAn equipment costing $57,500 is being considered for a production process at Dewey Chemicals. The expected benefits per year is $4,500 and estimated salvage value is $10,000. Determine the rate of return the company can get in this equipment proposal. Equipment life = 15 years.arrow_forward

- earch 1 Bailey, Inc., is considering buying a new gang punch that would allow them to produce circuit boards more efficiently. The punch has a first cost of $120,000 and a useful life of 15 years. At the end of its useful life, the punch has no salvage value. Annual labor costs would increase $2,000 using the gang punch, but annual raw material costs would decrease $15,000. MARR is 4.0%/year. Part a Q Ft A What is the present worth of this investment? $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +5. eTextbook and Media Z Save for Later Part b The parts of this question must be completed in order. This part will be available when you complete the part above. @ 2 F2 E 3 S W WE D x $ 4 R F FB % 5 FG 6 TY G F7 & 7 H n FB U * 8 F9 Attempts: 0 of 3 used I 02 ( 9 F10 J K X CV BN M O - ) F11 0 L < Alt Submit Answer *+ P F12 11 : 85°F Mostly cloud Prisc ( + 11 [ ? Inse Aarrow_forwardIf you could write out the equation once for me to see where the values should go, that would be helpful. Thank you!arrow_forwardIf the Savings function is S = -$300 + 0.75Y %3D Then the breakeven level of income is $1200. O True O Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education