Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

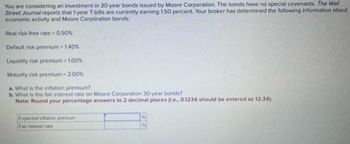

Transcribed Image Text:You are considering an investment in 30-year bonds issued by Moore Corporation. The bonds have no special covenants. The Wall

Street Journal reports that 1-year T-bills are currently earning 1.50 percent. Your broker has determined the following information about

economic activity and Moore Corporation bonds:

Real risk-free rate = 0.50%

Default risk premium = 1.40%

Liquidity risk premium = 1.00%

Maturity risk premium = 2.00%

a. What is the inflation premium?

b. What is the fair interest rate on Moore Corporation 30-year bonds?

Note: Round your percentage answers to 2 decimal places (ie., 0.1234 should be entered as 12.34).

Expected inflation premium

Fair interest rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the current one-year rate (one-year spot rate) and expected one-year government bonds over years 2, 3 and 4 are as follows: 1R₁ = 4.80%, E(2r₁) = 5.45%, E(3r₁) = 5.95%, E(41) = 6.10% Assume that there are no liquidity premiums. To the nearest basis point, what is the current rate for the four-year-maturity government bond? A. 5.57% B. 5.62% C. 5.83% D. 6.10%arrow_forwardHelparrow_forwardThe prices of several bonds with face values of $1,000 are summarized in the following table: state whether it trades at a discount, at par, or at a premium. Bond A is selling at (Select from the drop-down menu.) . For each bond,arrow_forward

- A company issues a bond with a par value of $500,000 and a contract rate of 5%. Explain the concept of market rate. Why would a company issue a bond at a discount or a premium? How is bond price impacted? If the bond is issued at a discount or a premium, does it impact the interest or principal paid? Why or why not? (Answer in 5-10 sentences)arrow_forwardAn insurance company is analyzing two bonds and is using duration as the measure of interest rate risk. Both the bonds trade at a yield to maturity of 8 percent, have $10,000 par values, and have five years to maturity. The bonds differ only in the amount of annual coupon interest that they pay: 5 and 7 percent. What is the duration for each five-year bond?arrow_forwardKatle Pairy Fruits Incorporated has a $2,400 16-year bond outstanding with a nominal yield of 17 percent (coupon equals 17% × $2,400 = $408 per year). Assume that the current market required interest rate on similar bonds is now only 12 percent. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the current price of the bond. Note: Do not round Intermediate calculations. Round your final answer to 2 decimal places. Assume Interest payments are annual. Current price of the bond b. Find the present value of 5 percent × $2,400 (or $120) for 16 years at 12 percent. The $120 is assumed to be an annual payment. Add this value to $2,400. Note: Do not round Intermediate calculations. Round your final answer to 2 decimal places. Assume Interest payments are annual. Present valuearrow_forward

- In mid-2012, Ralston Purina had AA-rated, 10-year bonds outstanding with a yield to maturity of 1.53%. a. What is the highest expected return these bonds could have? b. At the time, similar maturity Treasuries had a yield of 0.53%. Could these bonds actually have an expected return equal to your answer in part (a)? c. If you believe Ralston Purina's bonds have 0.8% chance of default per year, and that expected loss rate in the event of default is 54%, what is your estimate of the expected return for these bonds? a. What is the highest expected return these bonds could have? The highest expected return these bonds could have is%. (Round to two decimal places.)arrow_forwardSan Miguel Company's 18-year, $1,000 par value bonds pay 6.5 percent interest annually. The market price of the bond is $1,105, and your required rate of return is 8.5 percent. a. Compute the bond's expected rate of return. b. Determine the value of the bond to you given your required rate or return. c. Should you purchase the bond? Why or why not? (*You must show your calculation process as well.)arrow_forwardWhich of the following are short-term financial instruments? Select one: a. A banker's acceptance.b. A bond with five years maturity c.Share of Raysut cement d.None of thesearrow_forward

- (Related to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000 bonds pay 7 percent interest annually and have 14 years until maturity. You can purchase the bond for $915. a. What is the yield to maturity on this bond? b. Should you purchase the bond if the yield to maturity on a comparable-risk bond is 7 percent? a. The yield to maturity on the Saleemi bonds is %. (Round to two decimal places.)arrow_forwardSuppose that the current one-year rate (one-year spot rate) and expected one-year government bonds over years 2, 3 and 4 are as follows: 1R1 = 4.80%, E(201) = 5.45%, E(3r1) = 5.95%, E(41) = 6.10% Assume that there are no liquidity premiums. To the nearest basis point, what is the current rate for the four-year-maturity government bond? < A. 5.57% B. 5.62% C. 5.83% D. 6.10%arrow_forwardAn investor is considering between purchasing a Treasury Bond and a bond from a large corporation. Both bonds have a face value of $1,000. The Treasury Bond has no risk, while the corporate bond has a 10% change of not repaying (a default). Both bonds are 2-year bonds and don't pay any coupons, only the final payment at maturity. a) Assuming that the interest rate in year 1 is 10% and in year 2 is expected to be 5%, what is the current price of each bond? Why are the values different? b) Now assume that the investor purchased the Treasury Bond a year has passed. How much can this bond be sold for if the interest rate is confirmed at 5%? c) Continue assuming that the investor purchased the Treasury Bond a year has passed. If the investor is offered the corporate bond for $800, should it be purchased? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education