Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

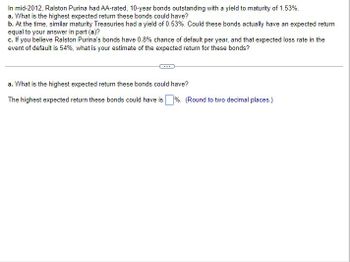

Transcribed Image Text:In mid-2012, Ralston Purina had AA-rated, 10-year bonds outstanding with a yield to maturity of 1.53%.

a. What is the highest expected return these bonds could have?

b. At the time, similar maturity Treasuries had a yield of 0.53%. Could these bonds actually have an expected return

equal to your answer in part (a)?

c. If you believe Ralston Purina's bonds have 0.8% chance of default per year, and that expected loss rate in the

event of default is 54%, what is your estimate of the expected return for these bonds?

a. What is the highest expected return these bonds could have?

The highest expected return these bonds could have is%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Squire Inc.'s 5-year bonds yield 12.50%, and 5-year T-bonds yield 4.80%. The real risk-free rate is r* = 2.75%, the inflation premium for 5-year bonds is IP = 1.65%, the default risk premium for Squire's bonds is DRP = 1.20% versus zero for T-bonds, and the maturity risk premium for all bonds is found with the formula MRP = (t − 1) × 0.1%, where t = number of years to maturity. What is the liquidity premium (LP) on Squire's bonds?arrow_forwardPlease correct answer and step by step solutionarrow_forwardA company's 5-year bonds are yielding 8.35% per year. Treasury bonds with the same maturity are yielding 7.15% per year, and the real risk-free rate (r*) is 2.90%. The average inflation premium is 3.85%, and the maturity risk premium is estimated to be 0.1 x (t - 1)%, where t = number of years to maturity. If the liquidity premium is 0.9%, what is the default risk premium on the corporate bonds? Round your answer to two decimal places.arrow_forward

- need answer in step by steparrow_forwardKatle Pairy Fruits Incorporated has a $2,400 16-year bond outstanding with a nominal yield of 17 percent (coupon equals 17% × $2,400 = $408 per year). Assume that the current market required interest rate on similar bonds is now only 12 percent. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the current price of the bond. Note: Do not round Intermediate calculations. Round your final answer to 2 decimal places. Assume Interest payments are annual. Current price of the bond b. Find the present value of 5 percent × $2,400 (or $120) for 16 years at 12 percent. The $120 is assumed to be an annual payment. Add this value to $2,400. Note: Do not round Intermediate calculations. Round your final answer to 2 decimal places. Assume Interest payments are annual. Present valuearrow_forward(Related to Checkpoint 9.3) (Bond valuation) Doisneau 18-year bonds have an annual coupon interest of 11 percent, make interest payments on a semiannual basis, and have a $1,000 par value. If the bonds are trading with a market's required yield to maturity of 12 percent, are these premium or discount bonds? Explain your answer. What is the price of the bonds? a. If the bonds are trading with a yield to maturity of 12%, then (Select the best choice below.) C O A. the bonds should be selling at par because the bond's coupon rate is equal to the yield to maturity of similar bonds. O B. the bonds should be selling at a premium because the bond's coupon rate is greater than the yield to maturity of similar bonds. O C. there is not enough information to judge the value of the bonds. O D. the bonds should be selling at a discount because the bond's coupon rate is less than the yield to maturity of similar bonds.arrow_forward

- ‘An investor purchased the following five bonds. Each bond had a par value of $1,000 and a 11% yield to maturity on the purchase day. Immediately after the investor purchased them, interest rates fell, and each then had a new YTM of 7%, What is thepercentage change in price for each bond after the decline in interest rates? Fill in the following table. Enter all amounts as positive numbers. Do not round intermediate calculations. Round your monetary answers to the nearest cent and percentage answers totwo decimal places. Price @ 11% Price @ 7% Percentage Change10-year, 10% annual coupon $ $ %10-year zeroS-year zero 30-year zero$100 perpetuityarrow_forwardIn 2016, AT&T issued 10-year bonds with a coupon that pays $93.75 annually. At the time of issue, the bonds sold at par. Today, bonds of similar risk and maturity must pay an annual coupon of 7.25% to sell at par value. Assuming semi-annual payments and a 7.25% yield to maturity, what is the current price of the firm’s bonds?arrow_forwardA 30 year, par value $1,000, floating rate bond was issued in 2008 with a coupon rate of 8%. By the year 2013 rates on bonds with similar risk are down to 6%. What is your best guess as to the value of the bond?arrow_forward

- Keys Corporation's 5-year bonds yield 6.20% and 5-year T-bonds yield 4.40%. The real risk-free rate is r* = 2.5%, the inflation premium for 5-year bonds is IP = 1.50%, the liquidity premium for Keys' bonds is LP = 0.5% versus zero for T- bonds, and the maturity risk premium for all bonds is found with the formula MRP =(t-1) x 0.1%; where t = number of years to maturity. What is the default risk premium (DRP) on Keys' bonds? 1.17% 1.30% 1.43% 1.57% 1.73%arrow_forwardWhich of the following statements is CORRECT? O The yield on á 5-year Treasury bond cannot exceed the yield on a 20-year Treasury bond. O The following represents a "possibly reasonable" formula for the maturity risk premium on bonds: MRP = -0.1% (t), where t is the years to maturity. O The yield on a 10-year AAA-rated corporate bond should always exceed the yield on a 5- year AAA-rated corporate bond. O The yield on a 3-year corporate bond should always exceed the yield on a 2-year corporate bond. O The yield on a 10-year corporate bond should always exceed the yield on a 10-year Treasury bond.arrow_forwardI need a step by step solution on how to solve these types of problems: Lee Corp.'s 5-year bonds yield 7.50% and 5-year T-bonds yield 4.40%. The real risk-free rate is r* = 2.5%, the inflation premium for 5-year bonds isIP = 1.50%, the default risk premium for Kay's bonds is DRP = 1.40% versus zero for T-bonds, and the maturity risk premium for all bonds is found with the formula MRP = (t –1)×0.1%, where t = number of years to maturity. What is the liquidity premium (LP) on Kay's bonds?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education