FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

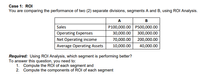

Transcribed Image Text:Case 1: ROI

You are comparing the performance of two (2) separate divisions, segments A and B, using ROI Analysis.

A

в

P100,000.00 P500,000.00

30,000.00

Sales

Operating Expenses

300,000.00

Net Operating income

70,000.00

200,000.00

Average Operating Assets

10,000.00

40,000.00

Required: Using ROI Analysis, which segment is performing better?

To answer this question, you need to:

1. Compute the ROi of each segment and

2. Compute the components of ROI of each segment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject - account Please help me. Thankyou.arrow_forwardA. Compute the divisional ROI for the Campus Division. B. Compute the divisional RI for the Campus Division.arrow_forwardROI is effective because it takes into consideration the three factors under the control of an investment center manager: revenues, costs, and investments. ROI measures the income (or return) earned on each dollar of investment. APPLY THE CONCEPTS: Calculating return on investment The divisional income statements for three divisions of the McLaren Company are shown. McLaren Company Divisional Income Statements For the Year Ending December 31, 2012 Division A Division B Division C Sales Revenue $1,947,000 $1,197,000 $594,000 Operating expenses (1,148,730) (897,750) (314,820) Operating income before service department charges $798,270 $299,250 $279,180 Service department charges (467,280) (177,156) (166,320) Operating income $330,990 $122,094 $112,860 Additional financial data from the three divisions of the McLaren Company are shown. Division A Division B Division C Invested assets $1,100,000 $665,000 $450,000 Calculate the return on investment for each division. If required, round the…arrow_forward

- Exercise 10-12 Evaluating New Investments Using Return on Investment (ROI) and Residual Income (LO10-1, LO10-2] Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Division A $ 6,300,000 $ 1,260,000 340,200 Division B $ 10,300,000 $ 5,150,000 968,200 18.80% Division C $ 9,400,000 $ 1,880,000 24 Sales Average operating assets Net operating income Minimum required rate of return 2$ 249,100 20.00% 17.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 20% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or…arrow_forwardMeiji Isetan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income Average operating assets Required 1 Required 2 Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 16%. Compute the residual income for each division. 3. Is Yokohama's greater amount of residual income an indication that it is better managed? Osaka $ 10,600,000 $ 742,000 $ 2,650,000 Complete this question by entering your answers in the tabs below. ROI % Division Required 3 For each division, compute the return on investment (ROI) in terms of margin and turnover. Osaka Yokohama Yokohama $ 36,000,000 $ 3,240,000 $ 18,000,000 %arrow_forwardEacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales Net operating income Average operating assets The company's minimum required rate of return $14,720,000 $1,000,960 $4,000,000 14% Required: a. What is the division's margin? b. What is the division's turnover? c. What is the division's return on investment (ROI)? d. What is the division's residual income?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education