ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Without using excel

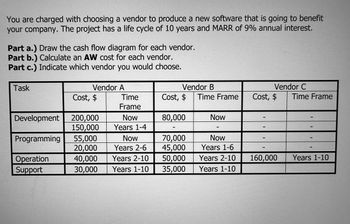

Transcribed Image Text:You are charged with choosing a vendor to produce a new software that is going to benefit

your company. The project has a life cycle of 10 years and MARR of 9% annual interest.

Part a.) Draw the cash flow diagram for each vendor.

Part b.) Calculate an AW cost for each vendor.

Part c.) Indicate which vendor you would choose.

Task

Vendor A

Cost, $

Development 200,000

150,000

Programming

Operation

Support

55,000

20,000

40,000

30,000

Time

Frame

Now

Years 1-4

Now

Years 2-6

Years 2-10

Years 1-10

Vendor B

Cost, $

80,000

70,000

45,000

50,000

35,000

Time Frame

Now

Now

Years 1-6

Years 2-10

Years 1-10

Vendor C

Cost, $ Time Frame

160,000

Years 1-10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- PLABOR МIC $7.00 -S $5.25 $4.50 MVP QLABOR 1000 1500arrow_forwardYou are charged with choosing a vendor to produce a new software that is going to benefit your company. The project has a life cycle of 8 years and MARR of 8% annual interest. Part a.) Draw the cash flow diagram for each vendor. Part b.) Calculate a PW cost for each vendor. Part c.) Indicate which vendor you would choose. Task Development Programming Operation Support Vendor M Cost, $ 200,000 150,000 42,000 20,000 40,000 30,000 Time Frame Now Years 1-4 Now Years 1-3 Years 1-8 Years 1-8 Vendor N Cost, $ Time Frame 70,000 60,000 45,000 50,000 35,000 Now Now Years 1-5 Years 1-8 Years 1-8 Vendor O Cost, $ 150,000 Time Frame Years 1-8arrow_forwardM2.arrow_forward

- Please do fast ASAParrow_forward21. Basics of Engineering Economy.arrow_forwardThe Pear company produces and sells pPhones. Their production costs are $290000 plus $180 for each pPhone they produce, but they can sell the pPhones for $250 each. How many pPhones should the Pear company produce and sell in order to break even? The break-even number of pPhones is Previewarrow_forward

- Required information Akash Uni-Safe in Chennai, India, makes Terminator fire extinguishers. The company needs replacement equipment to form the neck at the top of each extinguisher during production. Machine First cost, $ AOC, $ per year Salvage value, $ Life, years D E -70,000 -15,000 10,000 6 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. -60,000 -12,000 8,000 Select between two metal-constricting machines. Use the corporate MARR of 15% per year with future worth analysis using tabulated factors. The future worth of machine D is $- 8008 and the future worth of machine E is $- 20280 The machine selected based on the future worth analysis isarrow_forwardCosts and revenues (in thousands) 99 15 30 45 60 75 901052013550165 80195 Quantity per period (in thousands) Tools 1 O Aarrow_forward1) A company manufactures electrical metering devices that monitor power quality. The company's fixed cost is $68,000 per month. The variable cost is $80 per metering device. The selling price per device can be modeled by S = 170 – 0.05 Q where S is the selling price and Q is the number of metering devices sold. How many metering devices must the company sell per month in order to realize a maximum profit? Draw cash flow diagram.arrow_forward

- BVM manufactured and sold 25,000 small statues this past year. At that volume, the firm was exactly in a breakeven situation in terms of profitability. BVM’s unit costs are expected to increase by 30% next year. What additional information is needed to determine how much the production volume/sales would have to increase next year to just break even in terms of profitability? (a) Costs per unit (b) Sales price per unit and costs per unit (c) Total fixed costs, sales price per unit, and costs per unit (d) No data is needed, the volume increase is 25, 000 + 25, 000(0.30) = 32, 500 units.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardFill in the missing values: QP TC TB Tprofit MC MB Mprofit ATC AFC AVC 16 500-50 ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ 16 132 16 16 156 16 186 0 5 6 7 8 16 9 16 272 10 16 332 16 224arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education