ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

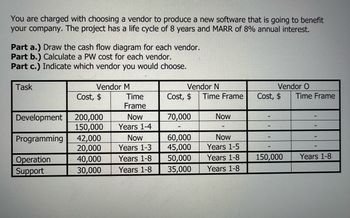

Transcribed Image Text:You are charged with choosing a vendor to produce a new software that is going to benefit

your company. The project has a life cycle of 8 years and MARR of 8% annual interest.

Part a.) Draw the cash flow diagram for each vendor.

Part b.) Calculate a PW cost for each vendor.

Part c.) Indicate which vendor you would choose.

Task

Development

Programming

Operation

Support

Vendor M

Cost, $

200,000

150,000

42,000

20,000

40,000

30,000

Time

Frame

Now

Years 1-4

Now

Years 1-3

Years 1-8

Years 1-8

Vendor N

Cost, $ Time Frame

70,000

60,000

45,000

50,000

35,000

Now

Now

Years 1-5

Years 1-8

Years 1-8

Vendor O

Cost, $

150,000

Time Frame

Years 1-8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- PW values of a project were calculated for several values of (i). The results were plotted as shown in the figure. a. What are the values of ROR (i*) for this project? Put 100 integer number followed immediately by% 75 1- 50 25 2- 10 20 30 40 50 b. If this project is a public sector project (i.e. its ROR is low). What value should we choose as the ROR for the 50 project? Put integer number followed immediately 75 by% 100 (O00TS x) Mdarrow_forwardA seasonal bus tour firm has 5 buses with a capacity of 60 people each. Each customer pays $25 for a one-day tour. Records show $360,000 in fixed costs per season, incremental costs of $5 per customer, and an average daily occupancy of 80%. The number of days of operation necessary each season to break even is closest to which value? (a) 50 days (b) 75 days (c) 100 days (d) 120 days?arrow_forwardWhat Term goes with what Conceptarrow_forward

- Please use the formulae and make the solution Project Month Month Month Month Status at the end of Month 3 Phases 1 2 3 4 Requirements Definition S-F Complete, spent $10,000 Architecture and Design SPF F Complete, spent $12000 Development and unit testing System testing and Operation S -PF 50% done, spent $9000 Not yet startedarrow_forwardWithout using excelarrow_forwardkuzukuzu12121@outlook.com just sent here I NEED EXCEL FİLE. Determine the NPW, AW, FW and IRR of the following engineering project. Initial Cost ($400,000) The Study Period 15 years Salvage (Market) Value of the project 15% of the initial cost Operating Costs in the first year($9,000) Cost Increase 3% per year Benefits in the first year $40,000 Benefit Increase 9% per year MARR 8% per year Is the Project acceptable? WHY?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education