ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

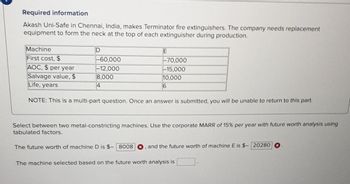

Transcribed Image Text:Required information

Akash Uni-Safe in Chennai, India, makes Terminator fire extinguishers. The company needs replacement

equipment to form the neck at the top of each extinguisher during production.

Machine

First cost, $

AOC, $ per year

Salvage value, $

Life, years

D

E

-70,000

-15,000

10,000

6

NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part.

-60,000

-12,000

8,000

Select between two metal-constricting machines. Use the corporate MARR of 15% per year with future worth analysis using

tabulated factors.

The future worth of machine D is $- 8008

and the future worth of machine E is $- 20280

The machine selected based on the future worth analysis is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Kk.7.arrow_forward5.24 For the cash flows below, use an annual worth comparison to determine which alternative is best at an interest rate of 1% per month. First cost, $ M&O costs, $/month Overhaul every 10 years, $ Salvage value, $ Life, years X -90,000 -400,000 -30,000 -20,000 - Y 7000 3 - 25,000 10 Z -900,000 -13,000 -80,000 200,000 8arrow_forwardA https://bbhosted.cuny.edu/webapps/assessment/take/launch.jsp?course_assessment_id%3_1840433_18&icourse_id=_1973374_1&content_id=_56338622_18is Remaining Time: 33 minutes, 41 seconds. v Question Completion Status: Figure Terice 10 1s 6. 6. 10 20 30 40 50 60 70 80 quantity Refer to Figure. A price floor of $ 8 in this market would result in O a. the quantity of the good demanded decreases by 10 units. O b. the quantity of the good demanded increases by 10 units. O c. the quantity of the good demanded decreases by 30 units. O d. the buyer's total expenditure to decrease by $20. QUESTION 2 Price controls O a. helps only buyers. O b. helps only sellers. O C. can help both buyers and sellers. O d. helps neither buyers or sellers.arrow_forward

- Marmara Processing Technologies Company wants to buy milling cutters in order to meet its increasing production needs. As a result of the studies, the data in the table below were found. According to these data, what will be the current cost of the annual operating expense parameter of alternative B? A Purchase Cost 10.000 12.000 Annual Operating Expense 1.500 1.700 Scrap Values 2.000 3.000 Economic Life 4 4 Capital Cost 10% 10%arrow_forwardEngineering Economy show complete solution pleasearrow_forwardAn industrial plant has hired a contractor to develop a solar farm nearby for the industrial plant's electricity consumption. During the 3-year construction period, the contractor will need to run a generator to power the construction. Cost analysis from previous projects indicates: Generator Brand Installed Cost Cost per Hour A $22M $500 B $23M $400 C $25M $250 D $30M $150 At the end of 3 years, the generator will have a salvage value equal to the cost of removing them. The generator will operate 6,000 hours per year. The lowest interest rate at which the contractor is willing to invest money is 7%. (The minimum required interest rate for invested money is called the minimum attractive rate of return, or MARR.) Select the alternative with the least present worth of cost. O Choice "C" with $29,872,900 O Choice "B" with $29,298,320 O Choice C with $28,936,450 O Choice "A" with $29,872,900arrow_forward

- Please answer by showing the HAND WRITTEN PROCESS!!arrow_forwardGive typing answer with explanation and conclusionarrow_forwardRequired information PEMEX, Mexico's petroleum corporation, has an estimated budget for oil and gas exploration that includes equipment for three offshore platforms as shown. Use PW analysis to select the best alternative at a MARR of 16% per year. Platform First cost, $ million Y Z -300 -450 -510 M&O, $ million per year -320 -290 -230 Salvage value, $ million 75 50 90 Estimated life, years 20 20 20 Select platform X, Y, or Z using tabulated factors. The present worth of platform X is $- 2298.4 worth of platform Z is $- 1944.14 million, the present worth of platform Y is $- 2262.15 million, and the present million. The platform selected based on the present worth is platform Zarrow_forward

- Show your complete solution.arrow_forwardPW values of a project were calculated for several values of (i). The results were plotted as shown in the figure. a. What are the values of ROR (i*) for this project? Put 100 integer number followed immediately by% 75 1- 50 25 2- 10 20 30 40 50 b. If this project is a public sector project (i.e. its ROR is low). What value should we choose as the ROR for the 50 project? Put integer number followed immediately 75 by% 100 (O00TS x) Mdarrow_forwardShow the correct answer to this problem. Please not that in excel type of calculation I need a detailed solution with formulas and computations on it. Thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education