FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

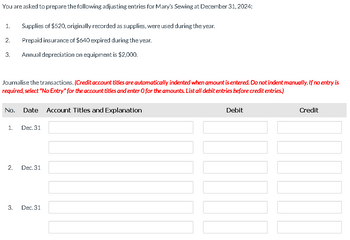

Transcribed Image Text:You are asked to prepare the following adjusting entries for Mary's Sewing at December 31, 2024:

1. Supplies of $520, originally recorded as supplies, were used during the year.

Prepaid insurance of $640 expired during the year.

Annual depreciation on equipment is $2,000.

2.

3.

Journalise the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

No. Date Account Titles and Explanation

1.

2.

3.

Dec. 31

Dec. 31

Dec. 31

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Reviewing insurance policies revealed that a single policy was purchased on August 1, for oneyear’s coverage, in the amount of $6,000. There was no previous balance in the Prepaid Insurance account atthat time. Based on the information provided:A. Make the December 31 adjusting journal entry to bring the balances to correct.B. Show the impact that these transactions had.arrow_forwardAt the end of the year, Dahir Incorporated’s balance of Allowance for Uncollectible Accounts is $1,500 (credit) before adjustment. The company estimates future uncollectible accounts to be $7,500. What adjusting entry would Dahir record for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardCarla Vista Corporation has the following selected transactions during the year ended December 31, 2024: Jan. 1 Purchased a copyright for $117.480 cash. The copyright has a useful life of six years and a remaining legal life of 30 years. Mar. 1 Sept. 1 Dec. 31 Acquired a franchise with a contract period of nine years for $500,850; the expiration date is March 1, 2033, Paid cash of $38,820 and borrowed the remainder from the bank. Purchased a trademark with an indefinite life for $73,190 cash. As the purchase was being finalized, spent $33.150 cash in legal fees to successfully defend the trademark in court. Purchased an advertising agency for $640,000 cash. The agency's only assets reported on its statement of financial position immediately before the purchase were accounts receivable of $58,000, furniture of $170,000, and leasehold improvements of $320,000. Carla Vista hired an independent appraiser who estimated that the fair value of these assets was accounts receivable $58,000,…arrow_forward

- The Yellow Canoe Company made year-end adjusting entries affecting each of the following accounts: InterestRevenue (credited); Depreciation Expense (debited); Unearned Rental Revenue (debited); and Prepaid Insurance(credited). Which account is likely to appear in Yellow Canoe’s reversing entries?a. Depreciation Expenseb. Interest Revenuec. Prepaid Insuranced. None of these answer choices is correct.arrow_forwardOn July 1, 2022, Blossom Company pays $18,000 to Sunland Company for a 2-year insurance contract. Both companies have fiscal years ending December 31. Journalize the entry on July 1 and the adjusting entry on December 31 for Sunland Company. Sunland uses the accounts Unearned Service Revenue and Service Revenue. (Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)arrow_forwardThe information necessary for preparing the 2021 year-end adjusting entries for Gamecock Advertising Agency appears below. Gamecock’s fiscal year-end is December 31. 1. On July 1, 2021, Gamecock receives $6,000 from a customer for advertising services to be given evenly over the next 10 months. Gamecock credits Deferred Revenue. 2. At the beginning of the year, Gamecock’s depreciable equipment has a cost of $28,000, a four-year life, and no salvage value. The equipment is depreciated evenly (straight-line depreciation method) over the four years. 3. On May 1, 2021, the company pays $4,800 for a two-year fire and liability insurance policy and debits Prepaid Insurance. 4. On September 1, 2021, the company borrows $20,000 from a local bank and signs a note. Principal and interest at 12% will be paid on August 31, 2022. 5. At year-end there is a $2,700 debit balance in the Supplies (asset) account. Only $1,000 of supplies remains on hand.Required: Record the necessary adjusting entries on…arrow_forward

- Pitman Company is a small editorial services company owned and operated by Jan Pitman. On October 31, 2019 the end of the current year, Pitman Company’s accounting clerk prepared the following unadjusted trial balance:Pitman CompanyUNADJUSTED TRIAL BALANCEOctober 31, 2019ACCOUNT TITLE DEBIT CREDIT1Cash7,710.002Accounts Receivable37,935.003Prepaid Insurance7,070.004Supplies2,125.005Land108,400.006Building145,300.007Accumulated Depreciation-Building85,610.008Equipment134,800.009Accumulated Depreciation-Equipment96,100.0010Accounts Payable12,625.0011Unearned Rent6,340.0012Jan Pitman, Capital219,690.0013Jan Pitman, Drawing15,120.0014Fees Earned323,700.0015Salaries and Wages Expense196,770.0016Utilities Expense42,265.0017Advertising Expense23,135.0018Repairs Expense17,195.0019Miscellaneous Expense6,240.0020Totals744,065.00744,065.00The data needed to determine year-end adjustments are as follows:a. Unexpired insurance at October 31, $6,105.b. Supplies on hand at October 31, $485.c.…arrow_forwardMarsteller Properties Inc. owns apartments that it rents to university students. At December 31,2019, the following unadjusted account balances were available: The following information is available for adjusting entries:a. An analysis of apartment rental contracts indicates that $3,800 of apartment rent is unbilledand unrecorded at year end.b. A physical count of supplies reveals that $1,400 of supplies are on hand at December 31, 2019.c. Annual depreciation on the buildings is $204,250.d. An examination of insurance policies indicates that $12,000 of the prepaid insurance applies to coverage for 2019.e. Six months’ interest at 9% is unrecorded and unpaid on the notes payable. f. Wages in the amount of $6,100 are unpaid and unrecorded at December 31.g. Utilities costs of $300 are unrecorded and unpaid at December 31.h. Income taxes of $5,738 are unrecorded…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education