FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

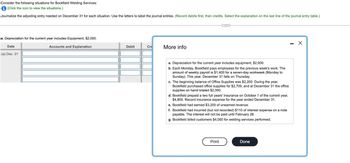

Transcribed Image Text:Consider the following situations for Bookfield Welding Services:

(Click the icon to view the situations.)

Journalize

the adjusting entry needed on December 31 for each situation. Use the letters to label the journal entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

C

a. Depreciation for the current year includes Equipment, $2,000.

X

Accounts and Explanation

Debit

Cre

More info

Date

(a) Dec. 31

a. Depreciation for the current year includes equipment, $2,000.

b. Each Monday, Bookfield pays employees for the previous week's work. The

amount of weekly payroll is $1,400 for a seven-day workweek (Monday to

Sunday). This year, December 31 falls on Thursday.

c. The beginning balance of Office Supplies was $2,200. During the year,

Bookfield purchased office supplies for $2,700, and at December 31 the office

supplies on hand totaled $2,000.

d. Bookfield prepaid a two full years' insurance on October 1 of the current year,

$4,800. Record insurance expense for the year ended December 31.

e. Bookfield had earned $3,200 of unearned revenue.

f. Bookfield had incurred (but not recorded) $110 of interest expense on a note

payable. The interest will not be paid until February 28.

g. Bookfield billed customers $4,000 for welding services performed.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the following: a. Carder & Company purchased equipment for $24,000 with a useful life of eight years and no expected salvage value. Prepare the adjusting entry for the first year using the straightline depreciation method. Omit explanations. If an amount box does not require, leave it blank. Page: 1 DATE DESCRIPTION POST.REF. DEBIT CREDIT 1 a. fill in the blank a56629fe4031fb0_2 fill in the blank a56629fe4031fb0_3 1 2 fill in the blank a56629fe4031fb0_5 fill in the blank a56629fe4031fb0_6 2 a. Carder & Company purchased equipment for $24,000 with a useful life of eight years and no expected salvage value. Compute the book value at the end of the second year of the equipment's life. Book Value $fill in the blank bd8c2300bf8af95_1 b. DAC Company pays its employees every Friday. On January 2, 20--, the Company paid $6,000 for the 5 days beginning the previous December 29. Prepare the adjusting entry on December 31. Omit…arrow_forwardView History Bookmarks Window Help ezto.mheducation.com Educo Content Framework Consider a company that.. Lesson 9.2 Practice Mod.. uiz A Saved Help Save & Exit MC Qu. 8-45 Assume Zap Industries reported the following... Assume Zap Industries reported the following adjusted account balances at year-end. 2019 $2,496,320 $1,937,472 (126,400) $2,369,920 $1,834,112 2018 Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net (103,360) Assume the company recorded no write-offs or recoveries during 2019. What was the amount of Bad Debt Expense reported in 2019? Multiple Choice $103,360 APR 25 étv S MacBook 000 DD 80 F7 F8 F9 F10 F3 F4 F5 F6 * %24 4. 6 7 8.arrow_forwardPrepare journal entries for each of the following transactions entered into by the City of Loveland. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar.)arrow_forward

- Wolfpack Corp. has determined it should record depreciation expense of $40,000 for the year ending 12/31/X7. Required: In the general journal below, complete the year-end entry to record depreciation. Debit Credit Dec 31 ? 40,000 ? 40,000arrow_forwardCould some one help me fill in the rest of the eleven column journal? Need help as soon as possible Instructions: Post the amounts from entries in the accounts receivable and accounts payable special amount columns in the journal to the appropriate subsidiary ledgers.arrow_forwardA moodle.jamessprunt.edu/mod/quiz/attempt.php?attempt3D473287&cmid%3D605671&page%3D10 CC JSCC Homepage - Tech Support Student Toolbox JSCC Bookstore English (United States) (en_us) - For each account below, indicate the normal balance of the account. Notes Payable (due in 5 years) =21 Choose. tion Advertising Expense Choose., Cash Choose. J. Smith, Capital Choose. Accumulated Depreciation Choose. J. Smith, Drawing Choose. Rent Revenue Choose. Land Choose. Sales Choose. Mortgage Payable Choose. Interest Expense Choose. Merchandise Inventory Choose. Depreciation Expense - Office Building Choose. Accounts Payable Choose. Depreciation Expense - Store Choose. Customer Refunds Payable Choose. Freight Out Choose. Accounts Receivable Choose. Office Supplies Expense Choose. Unearned Rent Choose. : Prepaid Insurance Choose.. Type here to search hp 立arrow_forward

- attacinhed in the screneh sto thankas for help appreicatei ti 4 p626pi24j6 pi2j4 62ip 62jp64ip 26j4i64p ji 2ji 4pij4p hji barrow_forward2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=... A ems a < Print Item Transactions and T Accounts The following selected transactions were completed during August of the current year: 1. Billed customers for fees earned, $73,900. 2. Purchased supplies on account, $1,960. 3. Received cash from customers on account, $62,770. 4. Paid creditors on account, $820. a. Journalize these transactions in a two-column journal. If an amount box does not require an entry, leave it blank. (1) Accounts Receivable ✓ 73,900 ✓ Fees Earned (2) Supplies - ✓ Accounts Payable (3) Cash Accounts Receivable (4) Accounts Payable Cash ✓ ✓ 1,960 62,770 820 ✓ ✓ ✓ 73,900 1,960 62,770 820 ✓ b. Post the entries prepared in (a) to the following T accounts: Cash, Supplies, Accounts Receivable, Accounts Payable, Fees Earned. To the left of each amount posted in the accounts, select the appropriate number to identify the transactions. FA 00 7:33 PM 8/23/2022…arrow_forwardOrion Flour Mills purchased a new machine and made the following expenditures: Purchase price Sales tax $74,000 5,950 Shipment of machine Insurance on the machine for the first year Installation of machine 990 690 1,980 The machine, including sales tax, was purchased on account, with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Record the above expenditures for the new machine. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet re to search ASUSarrow_forward

- 1/1 8/10 8/12 8/25 11/10 (a) Led shows the following entries in its Equipment account for 2023. All amounts are based on historical cost. Balance (b) Purchases of equipment Freight on equipment purchased Installation costs Repairs Your answer is correct Account Titles and Explanation Repairs and Maintenarios Expense Equipment eTextbook and Media List of Accounts Your answer is partially correct Equipment 115.000 Prepare any necessary correcting entries (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no enby is required, select "No Entry for the account titles and enter O for the amounts. List debit entry before credit entry) 1.Straight-line 27.000 600 2.300 425 Cost of equipment sold (purchased prior to 6/30 2023) 2. Declining balance (assume twice the straight-line rate) Debit 425 Assuming that depreciation is to be charged for a full year based on the ending balance in the asset account no matter when acquired, calculate the…arrow_forwardSubject: acountingarrow_forwardhelp please answer in text form with proper working and explanation for each and every part and steps with concept and introduction no ai no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education