FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

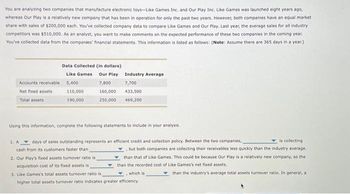

Transcribed Image Text:You are analyzing two companies that manufacture electronic toys-Like Games Inc. and Our Play Inc. Like Games was launched eight years ago,

whereas Our Play is a relatively new company that has been in operation for only the past two years. However, both companies have an equal market

share with sales of $200,000 each. You've collected company data to compare Like Games and Our Play. Last year, the average sales for all industry

competitors was $510,000. As an analyst, you want to make comments on the expected performance of these two companies in the coming year.

You've collected data from the companies' financial statements. This information is listed as follows: (Note: Assume there are 365 days in a year.)

Accounts receivable

Net fixed assets

Total assets

Data Collected (in dollars)

Like Games Our Play

5,400

110,000

190,000

Industry Average

7,800 7,700

160,000

250,000

2. Our Play's fixed assets turnover ratio is

acquisition cost of its fixed assets is

433,500

469,200

Using this information, complete the following statements to include in your analysis.

1. A days of sales outstanding represents an efficient credit and collection policy. Between the two companies,

cash from its customers faster than

is collecting

but both companies are collecting their receivables less quickly than the industry average.

than that of Like Games. This could be because Our Play is a relatively new company, so the

than the recorded cost of Like Games's net fixed assets.

3. Like Games's total assets turnover ratio is

which is

than the industry's average total assets turnover ratio. In general, a

higher total assets turnover ratio indicates greater efficiency.

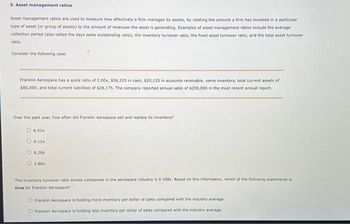

Transcribed Image Text:3. Asset management ratios

Asset management ratios are used to measure how effectively a firm manages its assets, by relating the amount a firm has invested in a particular

type of asset (or group of assets) to the amount of revenues the asset is generating. Examples of asset management ratios include the average

collection period (also called the days sales outstanding ratio), the inventory turnover ratio, the fixed asset turnover ratio, and the total asset turnover

ratio.

Consider the following case:

Franklin Aerospace has a quick ratio of 2.00x, $36,225 in cash, $20,125 in accounts receivable, some inventory, total current assets of

$80,500, and total current liabilities of $28,175. The company reported annual sales of $200,000 in the most recent annual report.

Over the past year, how often did Franklin Aerospace sell and replace its inventory?

8.01x

9.11x

O8.28x

O 2.86x

The inventory turnover ratio across companies in the aerospace Industry is 9.108x. Based on this information, which of the following statements is

true for Franklin Aerospace?

Franklin Aerospace is holding more inventory per dollar of sales compared with the industry average.

O Franklin Aerospace is holding less inventory per dollar of sales compared with the industry average.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Get Answerarrow_forwardConn Man’s Shops, a national clothing chain, had sales of $390 million last year. The business has a steady net profit margin of 8 percent and a dividend payout ratio of 35 percent. The balance sheet for the end of last year is shown. The firm's marketing staff has told the president that in the coming year there will be a large increase in the demand for overcoats and wool slacks. A sales increase of 20 percent is forecast for the company. All balance sheet items are expected to maintain the same percent-of-sales relationships as last year,* except for common stock and retained earnings. No change is scheduled in the number of common stock shares outstanding, and retained earnings will change as dictated by the profits and dividend policy of the firm. (Remember, the net profit margin is 8 percent.) *This includes fixed assets, since the firm is at full capacity.arrow_forwardS. Liang Inc. is a new concept on-line store that has proven to be very popular in the past year. Mrs. Liang and her team worked very hard in the past year in developing the brand and she indicated that she spent approximately $5,000,000 in a large marketing and customer service initiative. In an article published in December 2016, the business journal has indicated that their brand name is estimated to be worth $12,000,000 based on an analysis they performed. On their balance sheet for December 31, 2016, Liang Inc should record: a) An intangible asset worth $5,000,000 b) An intangible asset worth $7,000,000 c) An intangible asset worth $12,000,000 d) No intangible asset should be recorded at December 31, 2016.arrow_forward

- Last year, Company A reported profits of about $47 billion on sales of $282 billion. For that same period, Company B posted a profit of about $22 billion on sales of $113 billion. So Company A is a better marketer, right? Sales and profits provide information to compare the profitability of these two competitors, but between these numbers is information regarding the efficiency of marketing efforts in creating those sales and profits. Using the following information from the companies' income statements (all numbers are in thousands), calculate profit margin, net marketing contribution, marketing return on sales (or marketing ROS), and marketing return on investment (or marketing ROI) for each company. Hint: See the Marketing Profitability Metrics section of Appendix 3: Marketing By The Numbers in your textbook. Sales Gross Profit Company A $281,822,000 $66,558,000 $8,264,050 $46,962,000 Profit Margin Marketing Expenses Net Income (Profit) Fill in the table below. (Round the NMC to the…arrow_forwardJill Barksalot owns Jill's Jams, a condiment conglomerate focused on world dominance. She sells a variety of jellies and jams that are just to die for mwhahaha. Using the provided data on her last several years of sales, prepare a statement of trend percentages using 2017 as the base year. (in millions) 2017 2018 2019 2020 Sales 13,241 14,122 11,957 13,244 Cost of goods sold 8,987 9,534 8,272 9,101 Gross margin 4,254 4,588 3,685 4,143 2017 2018 2019 2020 Sales Cost of Goods Sold Gross Marginarrow_forwardCharle's Furniture Store has been In business for several years. The firm's owners have described the store as a "high-price, high- service" operatlon that provides lots of assistance to Its customers. Margin has averaged a relatively high 29% per year for several years, but turnover has been a relatively low 0.6 based on average total assets of $800,000. A discount furniture Store is about to open in the area served by Charlie's, and management Is considering lowering prices to compete effectively. Required: a. Calculate current sales and ROI for Charlie's Furniture Store. b. Assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same ROl as Charlie's currently earns. c. Suppose you presented the results of your analysis in parts a and b of this problem to Charle, and he replied, "What are you telling me? If I reduce my prices as planned, then I have to Increase my…arrow_forward

- You are trying to prepare financial statements for Bartlett Pickle Company, but seem to be missing its balance sheet. You have Bartlett's income statement, which shows sales last year were $300 million with a gross profit margin of 30 percent. You also know that credit sales equaled three-quarters of Bartlett's total revenues last year. In adlon, Bartlett had a collection period of 40 days, a payables period of 30 days, and an inventory turnover of 7 times based on cost of oods sold. Calculate Bartlett's year-ending balance for accounts receivable, inventory, and accounts payable. Note: Round your answers to 1 decimal place. Bartlett's year-ending balance (million) Accounts receivable Inventory Accounts payable BV3arrow_forward[The following information applies to the questions displayed below.] Mears and Company has been operating for five years as an electronics component manufacturer specializing in cellular phone components. During this period, it has experienced rapid growth in sales revenue and in inventory. Mr. Mears and his associates have hired you as Mears's first corporate controller. You have put into place new purchasing and manufacturing procedures that are expected to reduce inventories by approximately one-third by year-end. You have gathered the following data related to the changes: Inventory (dollars in thousands) Beginning of Year $585,700 End of Year (projected) $392,310 Current Year Cost of goods sold P7-7 Part 1 (projected) $7,018,984 Required: 1. Compute the inventory turnover ratio based on two different assumptions: Note: Round your answers to 1 decimal place. a. Those presented in the above table (a decrease in the balance in inventory). b. No change from the beginning-of-the-year…arrow_forwardTreynor Pie Company is a food company specializing in high-calorie snack foods. It is seeking to diversify its food business and lower its risks. It is examining three companies—a gourmet restaurant chain, a baby food company, and a nutritional products firm. Each of these companies can be bought at the same multiple of earnings. The following represents information about all the companies. Company Correlation withTreynor PieCompany Sales($ millions) Expected Earnings($ millions) Standard Deviationin Earnings($ millions) Treynor Pie Company +1.0 $ 151 $ 8 $4.0 Gourmet restaurant +0.6 63 7 1.2 Baby food company +0.3 59 3 1.9 Nutritional products company −0.8 75 5 3.4 a-1. Compute the coefficient of variation for each of the four companies. (Enter your answers in millions (e.g., $100,000 should be entered as ".10"). Round your answers to 3 decimal places.) a-2. Which company is the least risky?…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education