Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

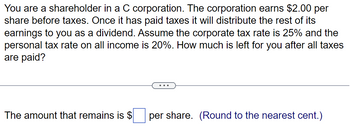

Transcribed Image Text:You are a shareholder in a C corporation. The corporation earns $2.00 per

share before taxes. Once it has paid taxes it will distribute the rest of its

earnings to you as a dividend. Assume the corporate tax rate is 25% and the

personal tax rate on all income is 20%. How much is left for you after all taxes

are paid?

The amount that remains is $ per share. (Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- d. Suppose the only owners of stock are corporations. Recall that corporations get at least a 50 percent exemption from taxation on the dividend income they receive, but they do not get such an exemption on capital gains. If the corporation's income and capital gains tax rates are both 33 percent, what does this model predict the ex- dividend share price will be? (Do not round intermediate calculations and round. your answer to 4 decimal places, e.g., 32.1616.)arrow_forwardYou are a shareholder at Babies R Us Co. the company is levered with debt outstanding of $50000. The company's EBIT is $100,000. The corporate tax rate is 40%. The weighted average cost of being unlevered is 12 percent.What is the value of being levered?arrow_forwardAssume that Provident Health System, a for-profit hospital, has $1 million in tax-able income for 2020, and its tax rate is 30 percent (combined federal and state tax rates). Given this information, what is the firm’s net income? Suppose the hospital pays out $300,000 in dividends. A shareholder, Carl Wu, receives $10,000. If Carl’s initially paid $100,000 for his shares and faces a tax rate on dividends of 15 percent, what is his after-tax dividend and after-tax rate of return on his investment. Suppose that Aditi Patel currently holds tax-exempt bonds of Good Samaritan Healthcare that pay 7 percent interest. She is in the 40 percent tax bracket. Her broker wants her to buy some Beverly Enterprises taxable bonds that will be issued next week. With all else the same, what rate must be set on the Beverly bonds to make Aditi interested in making a switch? Due date is midnight of day 7. Your submission can be made in WORD or EXCEL. Clearly show your work and provide a concise…arrow_forward

- From a corporation's point of view, does the tax treatment of dividends and interest paid favor the use of debt financing or equity financing? O Debt financing Equity financing You bought 1,000 shares of Tund Corp. stock for $60.59 per share and sold it for $82.35 per share after a few years. How will your gain or loss be treated when you file your taxes? will O As a capital gain taxed at the long-term tax rate O As a capital gain taxed at the current ordinary-income tax rate Depreciation expenses directly affect a company's taxable income. An increase in depreciation expense will lead to a tax deducted from a company's earnings, thus leading to a operating cash flow. According to a tax law established in 1969, taxpayers must pay the The applicable tax rate for S corporations is based on the: Stockholders' individual tax rates O Corporate tax rate taxable income. It of the Alternative Minimum Tax (AMT) or regular tax.arrow_forward8. What is the after-tax return to a corporation that buys a share of preferred stock at $45, sells it at year-end at $45, and receives a $5 year-end dividend? The firm is in the 20% tax bracket. Revenue = $5 For a company, taxable = $5 * 30% = $1.5 Tax = $1.5* 20% = $0.3 After tax income = $5 - $0.3= $4.7 Return $4.7/$45= 10.44%arrow_forwardThe tax rates are as shown below: Taxable Income $0 - 50,000 50,001 - 75,000 75,001 100,000 100,001 - 335,000 Tax Rate 15% 25% 34% 39% Your firm currently has taxable income of $80,700. How much additional tax will you owe if you increase your taxable income by $21,900?arrow_forward

- ↑ You are a shareholder in a C corporation. The corporation earns $2.05 per share before taxes. Once it has paid taxes it will distribute the rest of its earnings to you as a dividend Assume the corporate tax rate is 25% and the personal tax rate on all income is 20% How much is left for you after all taxes are paid? The amount that remains is $ per share. (Round to the nearest cent.)arrow_forward(Corporate income tax) Meyer Inc. has taxable income (earnings before taxes) of $300,000. Calculate Meyer's federal income tax liability using the tax table shown in the popup window: What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) Etext pages 2 W S mmand X Get more help # 3 80 F3 E D C $ 4 ODD 988 R F % 5 V FS T G 6 B MacBook Air F6 Y H & 7 F7 U N * 8 J PIL 1 M ( 9 K MOSISO DD F9 O ; FW1 { + [ option ? "1 1 Question Viewer 41 FYZ } delete returnarrow_forwardYou are a shareholder in a "S" corporation. This corporation earns $4 per share before taxes. After it has paid taxes, it will distribute the remainder of its earnings to you as a dividend. The dividend is income to you, so you will then pay taxes on these earnings. The corporate tax rate is 21% and your tax rate on dividend income is 15%. The effective tax rate on your share of the corporations' earnings is closest to: WHEELSTE • 15% O 21% О 28% O 33% • 36%arrow_forward

- Moncton Meats is a corporation that earned $3 per share before it paid any taxes. The firm retained $1 of after-tax earnings for reinvestment, and distributed what remained in dividend payments. You hold 20,000 shares of Moncton Meats in a tax-free savings account. If the corporate tax rate was 30% and dividend earnings were taxed at 20%, what was the value of your dividend earnings received after all taxes are paid?arrow_forward(MORNING) AC corporation earns $4.30 per share before taxes. The corporate tax rate is 35%, the personal tax rate on dividends is 20%, and the personal tax rate on non-dividend income is 39%. What is the total amount of taxes paid if the company pay $2.00 dividend? This questuon: 10 polniS) possibie O A. $2.29 O B. $2.67 OC. $1.91 O D. $1.52 O Time Remaining: 00:50:30 Next O tv MacBook Air DII DD 80 F12 F9 F10 F11 esc F5 F6 F7 F8 F1 F2 F3 F4 @ $ & delete %3D 1 2 4 7 { Y U P Q W E tab J K = - .. .. - *arrow_forwardYou are a shareholder in a C corporation. The corporation earns $4 per share before taxes. Once it has paid taxes, it will distribute the rest of its earnings to you as a dividend. The corporate tax rate is 21%, and the personal tax rate on dividend income is 20%. How much is left for you after all taxes are paid? The amount that remains is $ _ per share. (Round to 2 decimals.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education