FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

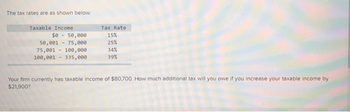

Transcribed Image Text:The tax rates are as shown below:

Taxable Income

$0 - 50,000

50,001 - 75,000

75,001 100,000

100,001 - 335,000

Tax Rate

15%

25%

34%

39%

Your firm currently has taxable income of $80,700. How much additional tax will you owe if you increase your taxable income by

$21,900?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Robert, the owner of a local poster shop, comes to you for help. "We've only been breaking even the past two years, and I'm getting very frustrated! I don't know what to do because I feel like I've already tried to improve our processes as much as possible, but we still haven't been able to generate a profit. Do you have any suggestions as to how we can turn things around? I just don't think we can even consider moving forward with this business unless we can earn $9,000 in operating income next year. Even then, we'll have to think long and hard about what the future holds." Robert shares the following information with you, as you ponder different scenarios to help your friend. Selling price Cost for paper, per unit Cost for printing, per unit Cost for film, per unit Staff salaries Other operating costs 1. 2. 3. $6.80 4. 0.75 After thinking about it for a while, you suggest the following possibilities to help him turn things around. 0.90 0.50 47,000 14,380 Lower the selling price by…arrow_forwardWhat is the effective tax rate that a company will end up paying if their year income is $16.7 million? The tax needs to be calculated based on the table shown below: From Below Tax + Marginal additional tax $0 $50,000 15% $50,000 $75,000 $7,500 + 25% over $50,000 $75,000 $100,000 $13,750 + 34% over $75,000 $100,000 $335,000 $22,250 + 39% over $100,000 $335,000 $10,000,000 $113,900 + 34% over $335,000 $10,000,000 $15,000,000 $3,400,000 + 35% over $10,000,000 $15,000,000 $18,333,333 $5,150,000 + 38% over $15,000,000 Group of answer choices 27.4483% 34.1007% 34.0000% 34.7066%arrow_forwardA company which started its operation in the year 8. The pannel set the MARR at 10% after-tax. CCA rate = 20% FOR EQUIPTMENT. a) What is the remaining Undepreciated Capital cost at the end of year 20 12? b) What is the equivalent annual worth of the tax savings associated with these transactions if the corporate tax rate is 40%?arrow_forward

- Franklin Corporation just paid taxes of $152,000 on taxable income of... Franklin Corporation just paid taxes of $152,000 on taxable income of $512,000. The marginal tax rate is 35% for the company. What is the average tax rate for the Franklin Corporation?arrow_forwardA company, based in the Midwest, requires an 8.000% after tax rate of return. The state tax rate is 5% and the company is in the 21% federal tax bracket.Using the combined incremental tax rate equation on p. 433 of the textbook and the after-tax rate of return equation on p. 439, what is the estimate of the before-tax rate ofreturn required.Give rate of return in percent to 3 decimal places like 10.134% or 9.765%arrow_forward8. What is the after-tax return to a corporation that buys a share of preferred stock at $45, sells it at year-end at $45, and receives a $5 year-end dividend? The firm is in the 20% tax bracket. Revenue = $5 For a company, taxable = $5 * 30% = $1.5 Tax = $1.5* 20% = $0.3 After tax income = $5 - $0.3= $4.7 Return $4.7/$45= 10.44%arrow_forward

- (Corporate income tax) Meyer Inc. has taxable income (earnings before taxes) of $300,000. Calculate Meyer's federal income tax liability using the tax table shown in the popup window: What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) Etext pages 2 W S mmand X Get more help # 3 80 F3 E D C $ 4 ODD 988 R F % 5 V FS T G 6 B MacBook Air F6 Y H & 7 F7 U N * 8 J PIL 1 M ( 9 K MOSISO DD F9 O ; FW1 { + [ option ? "1 1 Question Viewer 41 FYZ } delete returnarrow_forwardGiven the tax rates as shown, what is the marginal and average tax rates for a firm with taxable income of $102,000? Taxable Income Tax Rate $0-50,000 15% $50,001-75,000 25% $75,001-100,000 34% $100,001-335,000 39%arrow_forwardWhat was the firm's net income if the firm paid income taxes of $2,000 and the average tax rate was 25%, O A. $1,000 B. $6,000 O c. $8000 O D. $7,000arrow_forward

- a. What is the relative tax advantage of corporate debt if the corporate tax rate is TC=0.22, the personal tax rate on interest is TpD=0.37, but all equity income is received as capital gains and escapes tax entirely ( TpE=0 )? b. How does the relative tax advantage change if the company decides to pay out all equity income as cash dividends that are taxed at 10% ? Note: Do not round intermediate calculations. Round your answers to 4 decimal places.arrow_forwardPleas calculate the AVERAGE and MARGINAL TAX based on the tax bracket provided below. (Hint: every box in the table may NOT be used.) $0 $1,001 $3,001 Tax Bracket $10,001 $20,001 $40,001 $1,000 $3,000 $10,000 $20,000 $40,000 & Above Average Tax:__`17.729% Marginal Tax:__`25¹% Tax 5% 10% 15% 25% 30% 45% $ $ Taxable Income Amount Taxed type your ansv type your ansv type your ansv = type your ansv $16,500 $ $ $ $ Actual Tax Paid type your answe type your answe type your answe type your answe type your answe Amount Remaining $ $ $ $ type your answe type your answe type your answe type your answearrow_forwardAdjusted WACC. Lewis runs an outdoor adventure company and wants to know what effect a tax change will have on his company's WACC. Currently, Lewis has the following financing pattern: Equity: 36% and cost of 18.17% Preferred stock: 15% and cost of 11.88% Debt: 49% and cost of 10.8% before taxes What is the adjusted WACC for Lewis if the tax rate is a. 40%? b. 25%? с. 20%? d. 10%? е. 0%? ..... a. What is the adjusted WACC for Lewis if the tax rate is 40%? |% (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education