Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

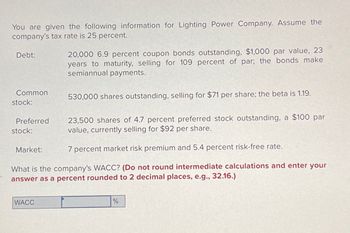

Transcribed Image Text:You are given the following information for Lighting Power Company. Assume the

company's tax rate is 25 percent.

Debt:

Common

stock:

Preferred

stock:

23,500 shares of 4.7 percent preferred stock outstanding, a $100 par

value, currently selling for $92 per share.

7 percent market risk premium and 5.4 percent risk-free rate.

What is the company's WACC? (Do not round intermediate calculations and enter your

answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Market:

20,000 6.9 percent coupon bonds outstanding, $1,000 par value, 23

years to maturity, selling for 109 percent of par; the bonds make

semiannual payments.

WACC

530,000 shares outstanding, selling for $71 per share; the beta is 1.19.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nikularrow_forwarda. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 10.2 percent. Interest payments are $51.00 and are paid semiannually. The bonds have a current market value of $1,123 and will mature in 10 years. The firm's marginal tax rate is 34 percet. b. A new common stock issue that paid a $1.79 dividend last year. The firm's dividends are expected to continue to grow at 7.3 percent per year, forever. The price of the firm's common stock is now $27.87. c. A preferred stock that sells for $132, pays a dividend of 8.7 percent, and has a $100 par value. d. A bond selling to yield 11.3 percent where the firm's tax rate is 34 percent. Question content area bottom Part 1 a. The after-tax cost of debt is_____%arrow_forwardNonearrow_forward

- The IPO Investment Bank has the following financing outstanding. Debt: 20,000 bonds with a coupon rate of 12 percent and a current price quote of 110; the bonds have 20 years to maturity. 190, 000 zero coupon bonds with a price quote of 20.5 and 30 years until maturity. Both bonds have a par value of $1,000 and semiannual coupons. Preferred stock: 110,000 shares of 10 percent preferred stock with a current price of $85, and a par value of $100. Common stock: 2,200, 000 shares of common stock; the current price is $71, and the beta of the stock is 1.45. Market: The corporate tax rate is 21 percent, the market risk premium is 5 percent, and the risk - free rate is 2 percent. What is the WACC for the company? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardPhillips Equipment Inc. has 72,000 bonds outstanding that are each selling at $1,066 in the market. Each bond has 8 years left to maturity, a $1000 face value and a coupon rate of 5%. Coupons are paid semiannually. The company also has 1.9 million shares of common stock outstanding. The common stock has a beta of 1.35 and sells for $44 a share. The U.S. Treasury bill is yielding 3.1 percent and the return on the market is 9.5 percent. The corporate tax rate is 35 percent. (a) Determine the firms market value weight for debt (Enter answers as a % to 2 decimal places) 8.41 % (b) Determine the firms market value weight for equity (Enter answers as a % to 2 decimal places) 91.59 % (c) What is the firms after tax cost of debt? (Enter answers as a % to 2 decimal places) 2.81% (d) What is the firms cost of equity? (Enter answers as a % to 2 decimal places) 11.74 % (e) Using the information you have found in the earlier parts, determine the Cost of Capital for Phillips Equipment Inc. (Enter…arrow_forwardSuppose Westerfield Co. has the following financial information: Debt: 900, 000 bonds outstanding with a face value of $1,000. The bonds currently trade at 85% of par and have 12 years to maturity. The coupon rate equals 7%, and the bonds make semiannual interest payments. Preferred stock: 600,000 shares of preferred stock outstanding; currently trading for $108 per share, paying a dividend of $9 annually. Common stock: 25,000,000 shares of common stock outstanding; currently trading for $185 per share. Beta equals 1.22. Market and firm information: The expected return on the market is 9%, the risk - free rate is 5%, and the tax rate is 21 %. Calculate the weight of debt in the capital structure. (Enter percentages as decimals and round to 4 decimals)arrow_forward

- Charter Corp. has issued 1,554 debentures with a total principal value of $1,554,000. The bonds have a coupon interest rate of 9%. a. What dollar amount of interest per bond can an investor expect to receive each year from Charter? b. What is Charter's total interest expense per year associated with this bond issue? c. Assuming that Charter is in a 39% corporate tax bracket, what is the company's net after-tax interest cost associated with this bond issue?arrow_forwardThe $1,000 face value bonds of ABC Inc have coupon of 6.45 percent and pay interest semiannually. Currently, the bonds are quoted at 103.4 percent of par and mature in 10 years. What is the before tax cost of debt? 5.49 percent 6.02 percent 5.99 percent 7.18 percent 6.79 percentarrow_forwardRaghubhaiarrow_forward

- You are given the following information for Lightning Power Company. Assume the company's tax rate is 23 percent. 23,000 7.2 percent coupon bonds outstanding, $1,000 par value, 19 years to maturity, selling for 106 percent of par; the bonds make semiannual payments. 560,000 shares outstanding, selling for $74 per share; beta is 1.17. 25,000 shares of 5 percent preferred stock outstanding, a $100 par value, selling for $95 per share. 7 percent market risk premium and 5.1 percent risk-free rate. Debt: Common stock: Preferred stock: Market: What is the company's WACC? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. WACC %arrow_forwardThe New Dance LLC. has 10,000 perpetual bonds outstanding, a par value of $1000. Also, The bonds have a coupon rate of 5% paid annually. The nomial interest rate on these bonds is 8%. This LLC. also has 2 million shares of stock outstanding with a market price of $30/share. What is this LLC.'s market value debt equity ratio?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education