Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

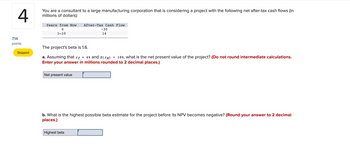

Transcribed Image Text:4

You are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in

millions of dollars):

7.14

points

Skipped

Years from Now After-Tax Cash Flow

0

1-10

The project's beta is 1.6.

a. Assuming that rƒ = 4% and E(™M) 18%, what is the net present value of the project? (Do not round intermediate calculations.

Enter your answer in millions rounded to 2 decimal places.)

Net present value

-30

14

b. What is the highest possible beta estimate for the project before its NPV becomes negative? (Round your answer to 2 decimal

places.)

Highest beta

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are a consultant to a large manufacturing corporation considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax CF 0 −$ 22 1 to 10 $ 10 The project's beta is 1.6. Assuming rf = 5% and E(rM) = 15% Required: a. What is the net present value of the project? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the highest possible beta estimate for the project before its NPV becomes negative? (Do not round intermediate calculations. Round your answer to 3 decimal places.)arrow_forwardSuppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project’s net present value (NPV). You don’t know the project’s initial cost, but you do know the project’s regular, or conventional, payback period is 2.50 years. Year Cash Flow Year 1 $375,000 Year 2 $450,000 Year 3 $475,000 Year 4 $425,000 If the project’s weighted average cost of capital (WACC) is 10%, the project’s NPV (rounded to the nearest dollar) is: $267,719 $312,338 $297,465 $282,592 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. The payback period does not take the time value of money into account. The payback period does not take the project’s entire life into account. The payback period is calculated using net income…arrow_forwardCan you show me how this is done? Emily Company has a minimum required rate of return of 9%. It is considering investing in a project that costs $90,671 and is expected to generate cash inflows of $23,576 at the end of each year for three years. The profitability index for this project is Round your answer to 2 decimal places. Selected Answer: 65 Correct Answer: 0.66 ± 0.05arrow_forward

- You have the opportunity to invest in a project with the following cash flows. Initial investment/Outlay today: $11,000. Cashflow back to you in 1 year $6000 Cashflow back to you in 2 years $5000 Scrap Value in 2 years $500 Assume interest rates are 5% in the 1 year and 7% in the 2 year. (tip: use the spreadsheet “NPV” from Moodle to helpin your calculations) a. Calculate the NPV of the project (show formula/workings)? b. Should you invest in this project? Why ?arrow_forwardWhat information does the payback period provide? Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project’s net present value (NPV). You don’t know the project’s initial cost, but you do know the project’s regular, or conventional, payback period is 2.50 years. Year Cash Flow Year 1 $350,000 Year 2 $500,000 Year 3 $450,000 Year 4 $425,000 If the project’s weighted average cost of capital (WACC) is 8%, the project’s NPV (rounded to the nearest dollar) is: $312,620 $295,253 $277,885 $347,356 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. The payback period is calculated using net income instead of cash flows. The payback period does not take the project’s entire life into account.…arrow_forwardBorder Mining, Inc., is trying to evaluate a project with the following cash flows: Year Cash Flow 0 −$ 39,300,000 1 63,300,000 2 − 12,300,000 a-1. What is the NPV for the project if the company requires a return of 12 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a-2. Should the firm accept this project?arrow_forward

- GTO Incorporated is considering an investment costing $214,720 that results in net cash flows of $32,000 annually for 10 years. (PV of $1. FV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided.) (a) What is the internal rate of return of this investment? (b) The hurdle rate is 8.5%. Should the company invest in this project on the basis of internal rate of return? a. Internal rate of return b. Should the company invest in this project on the basis of internal rate of return? %arrow_forwardA firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: Year 0 Cash Flow -$ 27,800 1 11,800 -23 3 14,800 10,800 If the required return is 18 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %arrow_forwardYou are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now 0 1-10 After-Tax Cash Flow -45 12 The project's beta is 1.4. Required: a. Assuming that ry=6% and E(M) = 14%, what is the net present value of the project? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. b. What is the highest possible beta estimate for the project before its NPV becomes negative? Note: Round your answer to 2 decimal places. a. Net present value b. Highest betaarrow_forward

- Giant Equipment Ltd. is considering two projects to invest next year. Both projects have the same start-up costs. Project A will produce annual cash flow of $42 000 at the beginning of each year for eight years. Project B will produce cash flow of $48 000 at the end of each year for seven years. The company requires a 12% return. Required:a. Whichprojectshouldthecompanyselectandwhy?b. Which project should the company select if the interest rate is 14% andthe cash flow in Project B is also at the beginning of each year?Please give me subheading answer.arrow_forwardWhat information does the payback period provide? Suppose Omni Consumer Products's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years. Year Year 1 Cash Flow $375,000 Year 2 $450,000 Year 3 $400,000 Year 4 $400,000 If the project's weighted average cost of capital (WACC) is 10%, what is its NPV? $261,541 $313,849 $287,695 $222,310 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply. ㅁㅁ The discounted payback period is calculated using net income instead of cash flows. The discounted payback period does not take the project's entire life into account. The discounted payback period does not take the time value of money into account.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education