Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

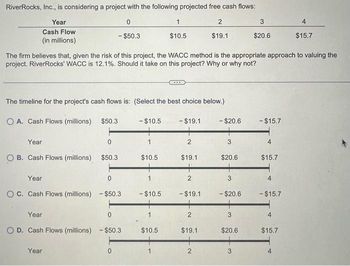

Transcribed Image Text:RiverRocks, Inc., is considering a project with the following projected free cash flows:

Year

Cash Flow

(in millions)

O A. Cash Flows (millions) $50.3

Year

O B. Cash Flows (millions) $50.3

0

- $50.3

The timeline for the project's cash flows is: (Select the best choice below.)

Year

OC. Cash Flows (millions) - $50.3

Year

The firm believes that, given the risk of this project, the WACC method is the appropriate approach to valuing the

project. RiverRocks' WACC is 12.1%. Should it take on this project? Why or why not?

0

0

Year

D. Cash Flows (millions) - $50.3

0

- $10.5

$10.5

1

-$10.5

1

$10.5

$10.5

1

- $19.1

2

$19.1

+

2

- $19.1

+

2

2

$19.1

$19.1

2

- $20.6

3

$20.6

3

- $20.6

+

3

3

$20.6

$20.6

+

3

- $15.7

$15.7

- $15.7

4

4

$15.7

$15.7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 2.0 and 3.0 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: -$7,300 $1,160 $2,360 $1,560 $1,560 $1,360 $1,160 Use the Pl decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) PI 0.94 Should it be accepted or rejected? O rejected O acceptedarrow_forwardKiley Electronics is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the WACC (and even negative), in which case it will be rejected. Year 0 1 2 3 Cash Flows -$1,100 $450 $270 $490arrow_forwardA project has the following cash flows: as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward

- Barry Company is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's projected NPV can be negative, in which case it will be rejected. WACC: Year Cash flows a. $34.27 b. $39.24 c. -$284.96 d. $222.55 e. $390.72 14.50% 0 -$1,225 1 $390 2 $380 3 $370 4 $360 $350arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 11 percent, and that the maximum allowable payback and discounted payback statistics for your company are 3.0 and 3.5 years, respectively. Time: Cash flow: 0 1 2 -$241,000 $66,400 $84,600 Payback Use the payback decision rule to evaluate this project. Note: Round your answer to 2 decimal places. years 4 3 $141,600 $122,600 Should the project be accepted or rejected? (Click to select) 5 $81,800arrow_forwardRiverRocks, Inc., is considering a project with the following projected free cash flows: Year 0 Cash Flow - $50.8 (in millions) O A. Cash Flows (millions) - $50.8 The timeline for the project's cash flows is: (Select the best choice below.) Year B. Cash Flows (millions) The firm believes that, given the risk of this project, the WACC method is the appropriate approach to valuing the project. RiverRocks' WACC is 12.8%. Should it take on this project? Why or why not? Year O C. Cash Flows (millions) Year D. Cash Flows (millions) Year 0 - $50.8 0 $50.8 0 $50.8 0 - $10.8 + 1 $10.8 1 - $10.8 1 1 $10.8 $10.8 1 - $20.7 2 $20.7 2 - $20.7 2 2 $20.7 $20.7 2 - $19.5 3 $19.5 + 3 - $19.5 3 $19.5 3 $19.5 3 - $15.4 4 $15.4 4 - $15.4 4 $15.4 4 $15.4 4arrow_forward

- A project has the following cash flows: Year 0: 74000 Year 1: -49000 Year 2: -41000 What is the IRR for this project? If the required return is 12%, should the firm accept the project? What is the NPV of this project? What is the NPV of the project if the required return is 0%? 24%? What is going on here? Explain your answerarrow_forwardA firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: Year Cash Flow 0 -$27,400 1 11,400 23 3 14,400 10,400 If the required return is 16 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR % Should the firm accept the project? ○ Yes ○ Noarrow_forwardFB Company is considering investing in two construction projects, and he developed the following estimates of the cash flows. His required return is 10% and views these projects as equally risky. Year Project 1 cash flow project 2 cash flow 0 -550000 -700000 1 150000 200000 2 200000 150000 3 150000 250000 4 150000 150000 5 100000 150000 Required: a) Calculate the net present value (NPV) of each project, assess its acceptability, and indicate which project is best using NPV. b) Calculate the profitability index (PI) of each project, assess its acceptability, and indicate which project is best using PI. c) If both the projects have recorded a positive NPV value and the projects are mutually exclusive, which projects would you recommend for FB Company to undertake? Why?arrow_forward

- Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: -$4,900 $1,260 $2,460 $1,660 $1,660 $ 1,460 $1,260 Use the NPV decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistics for your company are 2.5 and 3.0 years, respectively. Time: 0 1 2 3 4 5 Cash flow -$228,000 $65, 100 $83,300 $140, 300 $121,300 $80, 500 Use the discounted payback decision rule to evaluate this project. (Do not round intermediate…arrow_forwardWarr Company is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. Year 0 1 2 3 4 5 CF -1,415 400 400 400 400 400 Need to know how to compute using CF function on calculator.arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Time: Cash flow: 0 -$15, 200 MIRR 1 $3,000 3 2 $4,200 $3,400 Use the MIRR decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) % 5 $3,400 $3,200 6 $3,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education