Concept explainers

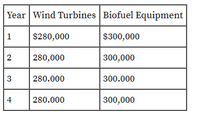

The management of Advanced Alternative Power Inc. is considering two

capital investment projects. The estimated net

project are as follows:

The wind turbines require an investment of $887,600, while the biofuel

equipment requires an investment of $911,100. No residual value is

expected from either project.

Instructions

1. Compute the following for each project:

a. The net present value. Use a rate of 6% and the present value of an

annuity of $1 table appearing in this chapter (Exhibit 5).

b. A present value index. Round to two decimal places.

2. Determine the internal rate of return for each projectby (a)

computing a present value factor for an annuity of $1 and (b) using the

present value of an annuity of $1 table appearing in this chapter (Exhibit 5).

3. What advantage does the internal rate of return method have over then

net present value method in comparing projects ?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- Carmen, Inc. is considering three different independent investment opportunities. The present value of future cash flows, initial investment, net present value, and profitability index for each of the projects are as follows: Project A Project B Project C Present value of future cash flows $450,100 $313,100 $405,000 Initial investment 200,000 155,000 190, еее Net present value $250, 100 $158,100 $215,000 Profitability index 2.25 2.02 2.13 In what order should Carmen prioritize investment in the projects? Multiple Cholce С, В, А O A, B, C А, С, В C, A, Barrow_forwardGardial Fisheries is considering two mutually exclusive investments. The projects' expected net cash flows are as follows: d. What is the crossover rate, and what is its significance? Crossover rate = The crossover rate represents the cost of capital at which the two projects value, at a cost of capital of 13.14% is:arrow_forwardSolve this onearrow_forward

- 4arrow_forward"Consider the following two mutually-exclusive altematives: Project Alternatives n Project A1 Cash Flows Project A2 Cash Flows 0-514,000 1+$4,000 - $17,000 $21,000 2- 54,000 3-$12,000 If MARR=15% and assuming indefinite required service and repeatability, use the incremental NPV and IRR analyses in parts (a) and (b) of the problem, respectively, to choose the project in part (c). Please note that project alternatives A7 and A2 have different lives, namely three years for A1 and one year for A2. The alternatives should be compared over the same period, so project A2 will have to be repeated twice." axThe Net Present Value of the incremental investment is: YbrThe rternal Rate of Retun of the incremental investment is: (oWe shoulo choose project alternative: Note: Please enrer your onswvers to two decimal places. If using the interest factor method, apply the value of the factor os presented in the table or spreocsheet (with all four decimal places).arrow_forwardThe answer is project B but please answer why that is the correct answer. Engineering economic questionarrow_forward

- ZLIK Inc is considering methods by which to evaluate a multi-year project that requires a large $55 million investment. Assuming the project has conventional cash flows, under which conditions would the project be an acceptable investment for ZLIK? Select all that apply. A) NPV < 0 B) NPV > 0 C) IRR > firm's required return D) IRR < firm's required return E) Profitability Index > 1.0 F) Profitability Index < 1.0arrow_forwardThe management of Revco Products is exploring four different investment opportunities. Information on the four projects under study follows: Project Number 1 2 3 4 Investment required $ (270,000) $ (450,000) S (360,000) $ (480,000) Present value of cash inflows 336, 140 522,970 433, 400 567, 270 Net present value $ 66, 140 $ 72,970 $ 73,400 $ 87,270 Life of the project 6 years 3 years 12 years 6 years Internal rate of return 18% 19% 14% 16% The net present values above have been computed using a 10% discount rate. Limited funds are available for investment, so the company can't accept all of the available projects. Required: Compute the profitability index for each investment project. Rank the four projects according to preference, in terms of net present value, profitability index, and internal rate of return.arrow_forwardNet present value method, internal rate of return method, and analysis for a service company The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: Year Wind Turbines Biofuel Equipment 1 $230,000 $410,000 2 230,000 410,000 3 230,000 410,000 4 230,000 410,000 The wind turbines require an investment of $698,510, while the biofuel equipment requires an investment of $1,170,550. No residual value is expected from either project. Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Required: 1a. Compute the net present value for each project. Use a rate of…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education