FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

The answer is project B but please answer why that is the correct answer.

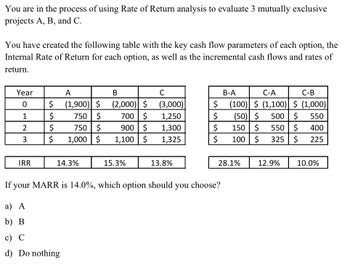

Transcribed Image Text:**Rate of Return Analysis for Projects A, B, and C**

You are in the process of using Rate of Return analysis to evaluate three mutually exclusive projects: A, B, and C.

Below is a table with the key cash flow parameters for each option, the Internal Rate of Return (IRR) for each option, as well as the incremental cash flows and rates of return.

| Year | A | B | C |

|------|--------|--------|--------|

| 0 | $(1,900) | $(2,000) | $(3,000) |

| 1 | $750 | $700 | $1,250 |

| 2 | $750 | $900 | $1,300 |

| 3 | $1,000 | $1,100 | $1,325 |

**IRR:**

- A: 14.3%

- B: 15.3%

- C: 13.8%

**Incremental Cash Flows:**

| | B-A | C-A | C-B |

|------|--------|--------|--------|

| 0 | $(100) | $(1,100) | $(1,000) |

| 1 | $(50) | $500 | $550 |

| 2 | $150 | $550 | $400 |

| 3 | $100 | $325 | $225 |

**Incremental IRR:**

- B-A: 28.1%

- C-A: 12.9%

- C-B: 10.0%

**Decision Criteria:**

If your Minimum Acceptable Rate of Return (MARR) is 14.0%, which option should you choose?

a) A

b) B

c) C

d) Do nothing

**Analysis:**

To make a decision, compare each project's IRR and incremental IRR with the MARR. The ideal project should have an IRR greater than the MARR, and any incremental investment should generate additional returns above the MARR.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is Fintech? Describe the drivers of fintech innovation.arrow_forwardNonearrow_forwardUtility refers to the: Question 55 options: usefulness of a product extent to which a product can be used as a capital resource relative scarcity of a product opportunity cost of a product satisfaction that a customer derives from a good or servicearrow_forward

- What are some of the difficulties that might occur with the application of an IRR approach in project analysis. Why do they occur? What can you do to avoid the IRR problems. Explain fully.arrow_forwardHaving an issue with this problem. Thank youarrow_forwardWhich of the following is a facility-level activity? O Engineering changes O Product design O Property taxes ○ Inspectionarrow_forward

- Why should the total costs of the machine be viewed as an asset and allocated against the future revenue that the machine will generate?arrow_forwardWhat happens when "pet" projects do not have the requisite NPV or IRR? Do pet projects seem to be approved over other more viable projects? Why does this happen?arrow_forwardWhat is a sunk cost, and if included in a project how should they be treated?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education