Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

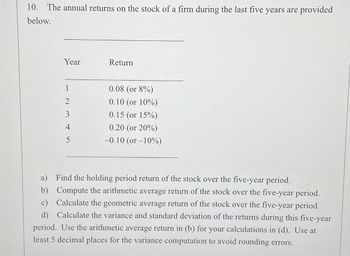

Transcribed Image Text:10. The annual returns on the stock of a firm during the last five years are provided

below.

Year

Return

12345

0.08 (or 8%)

0.10 (or 10%)

0.15 (or 15%)

0.20 (or 20%)

-0.10 (or -10%)

a) Find the holding period return of the stock over the five-year period.

b) Compute the arithmetic average return of the stock over the five-year period.

c) Calculate the geometric average return of the stock over the five-year period.

d) Calculate the variance and standard deviation of the returns during this five-year

period. Use the arithmetic average return in (b) for your calculations in (d). Use at

least 5 decimal places for the variance computation to avoid rounding errors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Stephen has just purchased a home for $154,000. A mortgage company has approved his loan application for a 30-year fixed-rate loan at 4.75%. Stephen has agreed to pay 25% of the purchase price as a down payment. Find the down payment, amount of mortgage, and monthly payment. Click the icon to view the table of the monthly payment of principal and interest per $1,000 of the amount financed. The down payment is about S 38500 . (Round to the nearest cent as needed.) The mortgage amount is about $ (Round to the nearest cent as needed.)arrow_forwardNeed Aarrow_forwardQuestion 7: For the cash flows below, find the value of x that makes the equivalent annual worth in years 1 through 7 equal to $300 per year. Use an interest rate of 10% per year. Year 0 1 2 3 Answer: $619.88 Cash Flow,$ 200 200 200 200 Year 4 5 6 7 Cash Flow, $ X 200 200 200arrow_forward

- Present Value $ 400 2,091 33,105 32,800 Years Interest Rate 12 % 10 % 15% 22 % Future Value $ 1,255 3,850 388,620 202,748arrow_forwardStephen has just purchased a home for $136,000. A mortgage company has approved his loan application for a 30-year fixed-rate loan at 5.00%. Stephen has agreed to pay 30% of the purchase price as a down payment. Find the down payment, amount of mortgage, and monthly payment. Click the icon to view the table of the monthly payment of principal and interest per $1,000 of the amount financed. (Round to the nearest cent as needed.) (Round to the nearest cent as needed.) The down payment is about S The mortgage amount is about $ The monthly mortgage payment is about S CODE (Round to the nearest cent as needed.)arrow_forwardSolve using Rate of Return Methodarrow_forward

- plan A plan B plan C Down payment 1,789.91 2,309.65 3,764.51 Annual payments 5,097.70 7,450.16 9,845.78 Years 20 20 20 Discount rate 12% 12% 12% What is the present value of plan B?arrow_forwardWhat is the PV?arrow_forwardJanine is 40 and has a good job at a biotechnology company. Janine estimates that she will need $953,000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $25,500 a year. (She expects that Social Security will pay her an additional $18,500 a year.) She currently has $5,000 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 8 percent, and she plans to leave it untouched until she retires at age 65. How much will Janine's IRA be worth when she needs to start withdrawing money from it when she retires? Use Exhibit 1-A. (Round time value factor to 3 decimal places and answer to 2 decimal places.) Future value of IRAarrow_forward

- Complete the following using compound future value. (Use the Table provided.) Time 6 months Principal $ 15,000 Rate Compounded 6% Semiannually Amount Interestarrow_forwardQuestion 7 Consider the two investments shown in the table. Find the present value of each at Year 0 assuming an interest rate of 5%. What is the percentage difference in the present values (with Investment 1 as the base of the percentage)? Year 0 1 2 3 Investment #1 Investment #2 $0 $100. $100 $1,100 $0 $100 $1,100 $0arrow_forwardAccountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education