Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

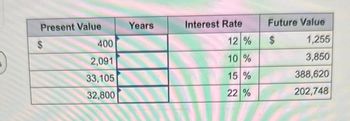

Transcribed Image Text:Present Value

$

400

2,091

33,105

32,800

Years

Interest Rate

12 %

10 %

15%

22 %

Future Value

$

1,255

3,850

388,620

202,748

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 42 Compute the missing variable for each of the following alternatives of investments to accumulate $1,000,000. for 30 years @ 6% annual interest rate: Following are appropriate factors from tables: Table % / n Present Value of annuity due $1 6%/30 12.15812 $33,3333.33 O $72,648.92 Present Value of ordinary annuity of $1 13.76483 Present value of $1 .17411 $????????? invested annually at the end of the year. Required Computations: O $12,648.91 O $11,927.43 Future Value of ordinary annuity of $1 79.05819arrow_forwardTerm in years: Rate: 2 OA $74.862 OB $02.385 OC. $57,339 OD $40.000 10 35% 30 43755 3.125% The table above shows the interest rates available from investing in msk free US Treasury securbes with different investment ferms. If an investment offers a risk-free cash flow of $85,000 in ten years' time, what is the present value (PV) of that cash flow?arrow_forwardInternal Rate of Return A project is estimated to cost $244,296 and provide annual net cash flows of $58,000 for five years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine the internal rate of return for this project, using the Present Value of an Annuity of $1 at Compound Interest table shown above.fill in the blank 1 %arrow_forward

- Future values. Fill in the future values for the following table, a. Use the future value formula, FV=PVX (1+r)^. b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. using one of the three methods below:arrow_forwardChapter 10 Discussion Q1 A property is sold for $200,000. Typical financing terms are an 85 percent loan with a 10 percent interest rate over 15 years. If the gross income per year is $30,000, what is the overall capitalization rate?arrow_forwardNonearrow_forward

- ces Year 0 1 Cash Flow (A) -$430,000 41,500 2 64,500 3 81,500 4 545,000 Cash Flow (B). -$ 42,500 20,900 12,800 21,100 17,900 The required return on these investments is 10 percent. a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. What is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. c. What is the IRR for each project? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. d. What is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. e. Based on your answers in (a) through (d), which project will you finally choose? a. Project A Project B b. Project A Project B years years Q Search < Prev 5 of 5 Next Larrow_forwardQUESTION 42 Compute the missing variable for each of the following alternatives of investments to accumulate $1,000,000. for 30 years @ 6% annual interest rate: Following are appropriate factors from tables: Table % / n Present Value of annuity due $1 Present Value of ordinary annuity of $1 Present value of $1 Future Value of ordinary annuity of $1 6%/30 12.15812 13.76483 .17411 79.05819 $????????? invested annually at the end of the year. Required Computations: $12,648.91 $72,648.92 $33,3333.33 $11,927.43arrow_forwardQUESTION 41 Compute the missing variable for each of the following alternatives of investments to accumulate $1,000,000. for 30 years @ 6% annual interest rate: Following are appropriate factors from tables: Table % / n Present Value of annuity due $1 Present Value of ordinary annuity of $1 Present value of $1 Future Value of ordinary annuity of $1 6%/30 12.15812 13.76483 .17411 79.05819 One single deposit of $???????? for 30 years. Required Computations: $166,666.66 $174,110 $175,933.83 $126,489arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education