FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

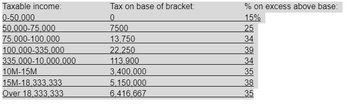

Last year, Martyn Company had $500,000 in taxable income from its operations, $50,000 in interest income, and $100,000 in dividend income. Using the corporate tax rate table given below, what was the company's tax liability for the year?

Transcribed Image Text:Taxable income:

0-50,000

50.000-75,000

75,000-100,000

100.000-335.000

335.000-10.000.000

10M-15M

15M-18.333.333

Over 18.333.333

Tax on base of bracket:

0

7500

13,750

22,250

113.900

3,400,000

5,150,000

6.416,667

% on excess above base:

15%

25

34

39

34

35

38

35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jackel, Inc. has the following information for the current tax year: Gross sales $350,000 Cost of goods sold 50,000 Dividends received from 10% owned domestic corporation 40,000 Operating expenses 30,000 Charitable contributions 45,000 What is Jackel's taxable income? Correct Answer should be $259,000arrow_forwardneed answer in step by steparrow_forwardWoods Company reports income before taxes in the amount of $925,000. The current tax expense is $365,375 and the effective tax rate is 27%. What is the conservatism ratio for Woods Company? Group of answer choices 0.45 0.19 0.40 0.68arrow_forward

- Franklin Corporation just paid taxes of $152,000 on taxable income of... Franklin Corporation just paid taxes of $152,000 on taxable income of $512,000. The marginal tax rate is 35% for the company. What is the average tax rate for the Franklin Corporation?arrow_forwardBasi Inc., a domestic corporation, reported the following: Determine the total gross income subject to regular income tax.arrow_forwardNonearrow_forward

- You have calculated the adjusted profit for the company to be $2,000,000. Capital Allowance was $20,000. The tax rate is 25%.Estimated tax paid during the year is $750,000. Employment Tax Credit available (which is nonrefundable)is $700,000. The tax refundable for this company is.a. $950,000b. $500,000c. $250,000d. $200,000arrow_forwardIn 2013, the Lenders collected $2,800,000 in taxable income. What was their total tax expense for that year?arrow_forwardG. R. Edwin Inc. had sales of $5.88 million during the past year. The cost of goods sold amounted to $2.8 million. Operating expenses totaled $2.57 million, and interest expense was $30,000. Use the corporate tax rates shown in the popup window, Taxable Income Marginal Tax Rate $0−$50,000 15% $50,001−$75,000 25% $75,001−$100,000 34% $100,001−$335,000 39% $335,001−$10,000,000 34% $10,000,001−$15,000,000 35% $15,000,001−$18,333,333 38% Over $18,333,333 35% , to determine the firm's tax liability. What are the firm's average and marginal tax rates?arrow_forward

- (Calculating corporate income tax) G. R. Edwin Inc. had sales of $6 million during the past year. The cost of goods sold amounted to $3 million. Operating expenses totaled $2.6 million, and interest expense was $30,000. Determine the firm's tax li- ability. What are the firm's average and marginal tax rates?arrow_forward(Corporate income tax) G. R Edwin Inc had sales of $6.01 million during the past year. The cost of goods sold amounted to $2.7 million. Operating expenses totaled $2.47 million, and interest expense was $29,000. Use the corporate tax rates shown in the popup window, to determine the firm's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is S (Round to the nearest dollar) The firm's average tax rate is % (Round to two decimal places) The firm's marginal tax rate is % (Round to the nearest integer.) Data table Taxable Income $0- $50,000 $50,001 - $75,000 $75,001 - $100,000 $100,001 - $335,000 Marginal Tax Rate 15% 25% 34% 39% $335,001-$10,000,000 $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38% Over $18,333,333 34% 35% (Cick on the icon in order fo copy its contents into a spreadsheel) Print Donearrow_forwardwhat is total tax paid by firm and owner, when corporation has$790 in profits and a 34.2% tax rate (individual tax rate is 12.13%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education