FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

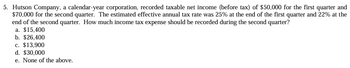

Transcribed Image Text:5. Hutson Company, a calendar-year corporation, recorded taxable net income (before tax) of $50,000 for the first quarter and

$70,000 for the second quarter. The estimated effective annual tax rate was 25% at the end of the first quarter and 22% at the

end of the second quarter. How much income tax expense should be recorded during the second quarter?

a. $15,400

b. $26,400

c. $13,900

d. $30,000

e. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 1. What is the tax due and payable amount in fiscal year 20x1? Fiscal year June 20, 20x1 (5th year) 20x2 Sales 80,000,000 75,000,000 Cost of Sales 50,000,000 46,875,000 Allowable Deductions excluding NOLCO 32,000,000 25,000,000 2. Using the information above, how much is tax due in fiscal year 20x2?arrow_forwardWhat is the income tax due using a 21 % federal income tax rate for a corporation with the following data: Gross income from sales: $40,000,000 Accumulated expenses for the year: $6,000,000 Depreciation charges for the year: $4,000,000arrow_forwardJosh Company, a calendar-year corporation has the following income before income tax provison and estimated effective annual income tax rates for the first three quarters of year 1: Income before income tax provision Estimated effective annual rate at end of quarter Quarter First P600,000 40% Second 700,000 40% Third 400,000 45% 1. Josh income tax provision in its interim income statement for the third quarter should be?arrow_forward

- (Corporate income tax) Boisjoly Productions had taxable income of $19.9 million. a. Calculate Boisjoly's federal income taxes by using the corporate tax rate structure in the popup window, b. Now calculate Boisjoly's average and marginal tax rates. c. What would Boisjoly's federal income taxes be if its taxable income was $29.3 million? d. Now calculate Boisjoly's average and marginal tax rates with taxable income of $29.3 million. a. Calculate Boisjoly's federal income taxes. The total tax due is $. (Round to the nearest dollar.)arrow_forwarddevarrow_forwardIn its first year of operations, Seagate Tech reported pretax accounting income of $780 million for the current year. Depreciation reported in the tax return in excess of depreciation in the income statement was $900 million. The excess tax will reverse itself evenly over the next three years. The current year's tax rate of 25% will be reduced under the current law to 30% next year and 35% for all subsequent years. At the end of the current year, the deferred tax liability related to the excess depreciation will be: Multiple Choice $315 million. $300 million. $270 million. $360 million.arrow_forward

- 1. If a company has a pre - tax accounting income of $1, 000, with interest revenue from municipal bonds totaling S500, and operates under a 20% tax rate, how would you record the journal entry?arrow_forwardNonearrow_forwardYou have calculated the adjusted profit for the company to be $2,000,000. Capital Allowance was $20,000. The tax rate is 25%.Estimated tax paid during the year is $750,000. Employment Tax Credit available (which is nonrefundable)is $700,000. The tax refundable for this company is.a. $950,000b. $500,000c. $250,000d. $200,000arrow_forward

- The pre-tax income statements for Moonstone Ltd. for two years (summarized) were as follows: 20X8 20X9 Revenues 266,000 S 330,000 Expenses 181,000 237,000 Pre-tax income s 85,000 $ 93,000 For tax purposes, the following income tax differences existed: a. Revenues on the 20X9 statement of profit and loss include $37,000 rent, which is taxable in 20X8 but was unearned at the end of 20X8 for accounting purposes. b. Expenses on the 20X9 statement of profit and loss include political contributions of $12,500, which are not deductible for income tax purposes. c. Expenses on the 20X8 statement of profit and loss include $20,900 of estimated warranty costs, which are not deductible for income tax purposes until 20X9. Required: 1. What was the accounting carrying value and tax basis for unearned revenue and the warranty liability at the end of 20X8 and 2OX9? 2. Compute (a) income tax payable, (b) deferred income tax, and (c) income tax expense for each period. Assume a tax rate of 30%. (Amounts…arrow_forwardG. R. Edwin Inc. had sales of $5.88 million during the past year. The cost of goods sold amounted to $2.8 million. Operating expenses totaled $2.57 million, and interest expense was $30,000. Use the corporate tax rates shown in the popup window, Taxable Income Marginal Tax Rate $0−$50,000 15% $50,001−$75,000 25% $75,001−$100,000 34% $100,001−$335,000 39% $335,001−$10,000,000 34% $10,000,001−$15,000,000 35% $15,000,001−$18,333,333 38% Over $18,333,333 35% , to determine the firm's tax liability. What are the firm's average and marginal tax rates?arrow_forwardNeed Help with this Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education