Modified Accelerated Cost Recovery System

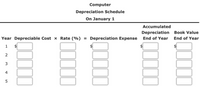

An example of a

| MODIFIED ACCELERATED COST RECOVERY SYSTEM | |||||||

|---|---|---|---|---|---|---|---|

Year |

Cost |

× |

Rate |

= |

Depreciation Expense |

Depreciation (End of Year) |

Book Value (End of Year) |

| 1 | $40,000 | 20.00% | $8,000 | $8,000 | $32,000 | ||

| 2 | 40,000 | 32.00% | 12,800 | 20,800 | 19,200 | ||

| 3 | 40,000 | 19.20% | 7,680 | 28,480 | 11,520 | ||

| 4 | 40,000 | 11.52% | 4,608 | 33,088 | 6,912 | ||

| 5 | 40,000 | 11.52% | 4,608 | 37,696 | 2,304 | ||

| 6 | 40,000 | 5.76% | 2,304 | 40,000 | 0 |

Prepare a depreciation schedule showing the depreciation expense, accumulated depreciation, and book value for each year under the Modified Accelerated Cost Recovery System for a small delivery truck purchased on January 1 at a cost of $30,000 and a salvage value of $6,000. For tax purposes, assume that the truck has a useful life of five years. Use the rates from the example provided. (The IRS schedule will spread depreciation over six years.)

Meaning of Modified Accelerated Cost Recovery System (MACRS)

The modified accelerated cost recovery system (MACRS) is a depreciation system used for tax purposes in the U.S. MACRS depreciation allows the capitalized cost of an asset to be recovered over a specified period via annual deductions. The MACRS system puts fixed assets into classes that have set depreciation periods.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Your company has purchased a large new trucktractor for over-the-road use (asset class 00.26). It has a cost basis of $179,000. With additional options costing $14,000, the cost basis for depreciation purposes is $193,000. Its MV at the end of six years is estimated as $36,000. Assume it will be depreciated under the GDS: a. What is the cumulative depreciation through the end of year two? b. What is the MACRS depreciation in the second year? c. What is the BV at the end of year one? Click the icon to view the partial listing of depreciable assets used in business. Click the icon to view the GDS Recovery Rates (rk). a. The cumulative depreciation through the end of year two is $ (Round to the nearest dollar.) b. The MACRS depreciation in the second year is $ (Round to the nearest dollar.) c. The BV at the end of year one is $ (Round to the nearest dollar.)arrow_forwardThe following information is available on a depreciable asset: Purchase date January 1, Year 1 Purchase price $96,000 Salvage value $10,000 Useful life 10 years Depreciation method straight-line The asset's book value is $78,800 on January 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during Year 3 would be: Multiple Choice $7,880.00 $9,225.00 $8,600.00 $7,380.00 $9,850.00arrow_forwardAn automated assembly robot that cost $352,000 has a depreciable life of 5 years with a $85,000 salvage value. The MACRS (Modified Accelerated Cost Recovery System) depreciation rates for years 1, 2, 3, and 6 are 20.00%, 32.00%, 19.20%, and 5.76%, respectively. What is the book value at the end of year 3? Year 5? Year 6? The book value at the end of year 3 is $ . The book value at the end of year 5 is $ . The book value at the end of year 6 is $ .arrow_forward

- Revision of depreciation. Equipment with a cost of $698,500 has an estimated residual value of $63,500, has an estimated useful life of 25 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. $ b. Determine the book value after 13 full years of use. c. Assuming that at the start of the year 14 the remaining life is estimated to be 18 years and the residual value is estimated to be $53,300, determine the depreciation expense for each of the remaining 18 years.arrow_forwardStraight-Line Depreciation A building acquired at the beginning of the year at a cost of $134,200 has an estimated residual value of $5,200 and an estimated useful life of 10 years. Determine the following: (a) The depreciable cost (b) The straight-line rate % (c) The annual straight-line depreciationarrow_forwardA piece of equipment is available for purchase for $ 16000 has an estimated useful life of 5 years, and has an estimated salvage value of $ 4000. Determine the depreciation and the book value for each of the 5 years using the straight-line method and the double declining-balance method? (Compare)arrow_forward

- A project requires $16,412 of equipment that is classified as a 7-year property. What is the depreciation expense in Year 5 given the following MACRS depreciation allowances, starting with year one: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent? Enter your answer rounded off to two decimal points. Do not enter $ or comma in the answer box.arrow_forwardStraight-Line Depreciation A building acquired at the beginning of the year at a cost of $134,200 has an estimated residual value of $5,200 and an estimated useful life of 10 years. Determine the following: (a) The depreciable cost (b) The straight-line rate % (c) The annual straight-line depreciationarrow_forwardCalculate depreciation and fill out the form 4562 for 2022 year based on the following information: Depreciable assets: Recovery Prior Description Placed in Service Cost Method Convention Period Depreciation $32,963 MACRS/ 01/01/2020 $85,000 HY 7 200DB 01/15/2021 $13,930 HY 7 $1,991 04/15/20XX $1,900 7 Tools Equipment Sprayer MACRS/ 200DB MACRS/ 200DB HY Prior AMT Depreciation $32,963 $1,492 The S corporation has elected not to take the Section 179 deduction for the full amount of the cost of the sprayer or bonus depreciation.arrow_forward

- For each of the following depreciable assets, determine the missing amount. Abbreviations for depreciation methods are SL for straight-line and DDB for double-declining-balance. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Asset A B C D E Cost 68,000 93,000 258,000 214,000 Residual Value $ 34,000 13,000 24,000 34,000 Service Life Depreciation (Years) Method 5 8 10 8 DDB SL SL DDB Depreciation (Year 2) $ 39,000 5,900 10,000 23,400arrow_forwardCalculate the depreciation expense for an asset with the following details: Initial Cost: $50,000 Salvage Value: $5,000 Useful Life: 5 yearsarrow_forwardModified Accelerated Cost Recovery System An example of a depreciation schedule under the Modified Accelerated Cost Recovery System of depreciation is shown. The Internal Revenue Service (IRS) classifies various assets according to useful life and sets depreciation rates for each year of the asset’s life. This asset has a five year life. The MACRS rates are shown in the schedule. This example is for an asset with a cost of $40,000 and a salvage value of $4,000. MODIFIED ACCELERATED COST RECOVERY SYSTEM Year Cost × Rate = DepreciationExpense AccumulatedDepreciation(End of Year) Book Value(End of Year) 1 $40,000 20.00% $8,000 $8,000 $32,000 2 40,000 32.00% 12,800 20,800 19,200 3 40,000 19.20% 7,680 28,480 11,520 4 40,000 11.52% 4,608 33,088 6,912 5 40,000 11.52% 4,608 37,696 2,304 6 40,000 5.76% 2,304 40,000 0 Prepare a depreciation schedule showing the depreciation…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education