FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

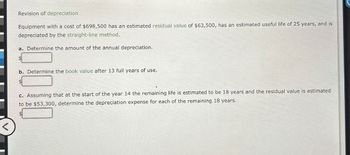

Transcribed Image Text:Revision of depreciation.

Equipment with a cost of $698,500 has an estimated residual value of $63,500, has an estimated useful life of 25 years, and is

depreciated by the straight-line method.

a. Determine the amount of the annual depreciation.

$

b. Determine the book value after 13 full years of use.

c. Assuming that at the start of the year 14 the remaining life is estimated to be 18 years and the residual value is estimated

to be $53,300, determine the depreciation expense for each of the remaining 18 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Revision of Depreciation A truck with a cost of $123,000 has an estimated residual value of $24,000, has an estimated useful life of 12 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation.$8250 b. Determine the book value at the end of the seventh year of use.$65250 c. Assuming that at the start of the eighth year the remaining life is estimated to be five years and the residual value is estimated to be $15,000, determine the depreciation expense for each of the remaining five years.$arrow_forwardStraight-Line, Declining-Balance, Sum-Of-The-Years'-Digits, and MACRS Methods A machine is purchased January 1 at a cost of $59,000. It is expected to serve for eight years and have a salvage value of $3,000. Required: 1. Prepare a schedule showing depreciation for each year and the book value at the end of each year using the following methods a. Straight-linearrow_forwardRevision of Depreciation A building with a cost of $630,000 has an estimated residual value of $126,000, has an estimated useful life of 36 years, and is depreciated by the straight-line method. a. What is the amount of the annual depreciation? b. What is the book value at the end of the twentieth year of use? c. If at the start of the twenty-first year it is estimated that the remaining life is 20 years and that the residual value is $30,000, what is the depreciation expense for each of the remaining 20 years?arrow_forward

- Disposal of fixed asset Equipment acquired on January 6 at a cost of $386,400 has an estimated useful life of 10 years and an estimated residual value of $50,400. a. What was the annual amount of depreciation for Years 1-3 using the straight-line method of depreciation? Year Depreciation Expense Year 1 Year 2 Year 3 b. What was the book value of the equipment on January 1 of Year 4? c. Assuming that the equipment was sold on January 3 of Year 4 for $271,300, journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. January 3 d. Assuming that the equipment had been sold on January 3 of Year 4 for $291,300 instead of $271,300, journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. January 3arrow_forwardA piece of equipment is purchased for $40,000 and has an estimated salvage value of $1,000 at the end of the recovery period. Prepare a depreciation schedule for the piece of equipment using the straight-line method, the sum-of-the-years method, and the 200% declining-balance method with a recovery period of five years. Compare these depreciation methods in a graph.arrow_forwardUnits-of-activity Depreciation A truck acquired at a cost of $250,000 has an estimated residual value of $15,500, has an estimated useful life of 35,000 miles, and was driven 3,200 miles during the year. Determine the following. If required, round your answer for the depreciation rate to two decimal places. (a) The depreciable cost (b) The depreciation rate %24 per mile (c) The units-of-activity depreciation for the yeararrow_forward

- A truck with a cost of $123,000 has an estimated residual value of $24,000, has an estimated useful life of 12 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation.$ b. Determine the book value at the end of the seventh year of use.$ c. Assuming that at the start of the eighth year the remaining life is estimated to be six years and the residual value is estimated to be $15,000, determine the depreciation expense for each of the remaining five years.$arrow_forwardStraight-Line Depreciation A building acquired at the beginning of the year at a cost of $2,200,000 has an estimated residual value of $400,000 and an estimated useful life of 20 years. Determine the following: (a) The depreciable cost (b) The straight-line rate (c) The annual straight-line depreciation $ %arrow_forwardK Depreciation Norton Systems acquired two new assets. Asset A was research equipment costing $19,000 and having a 3-year recovery period. Asset B was duplicating equipment having an installed cost of $56,000 and a 5-year recovery period. Using the MACRS depreciation percentages, prepare a depreciation schedule for each of these assets. Complete the depreciation schedule for asset A below: Recovery Year 1 ... Depreciation (Round to the nearest dollar.) edit: 0 Qu Quarrow_forward

- Straight-Line Depreciation A building acquired at the beginning of the year at a cost of $134,200 has an estimated residual value of $5,200 and an estimated useful life of 10 years. Determine the following: (a) The depreciable cost (b) The straight-line rate % (c) The annual straight-line depreciationarrow_forwardEquipment acquired on January 8, 20Y1, at a cost of $675,000, has an estimated useful life of 17 years and an estimated residual value of $135,000. What was the annual amount of depreciation for the years 20Y1, 20Y2, and 20Y3, using the straight-line method of depreciation? Round annual depreciation to the nearest dollar and use this amount in your follow-on calculations. Depreciation expense 20Y1$ 20Y2$ 20Y3$arrow_forwardStraight-Line Depreciation A building acquired at the beginning of the year at a cost of $134,200 has an estimated residual value of $5,200 and an estimated useful life of 10 years. Determine the following: (a) The depreciable cost (b) The straight-line rate % (c) The annual straight-line depreciationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education